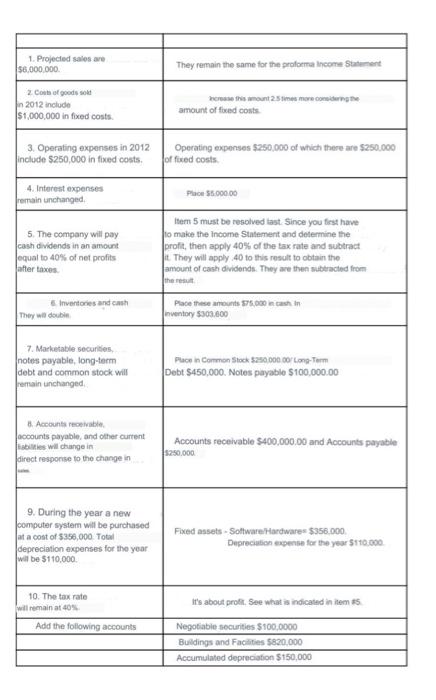

Question: PREPARE a PRO FORMA INCOME STATEMENT TABLE for the year ending December 31, 2013, using the fixed cost data provided to improve the accuracy of

\begin{tabular}{|c|c|} \hline \begin{tabular}{l} 1. Projected sales are \\ $6,000,000. \end{tabular} & They remain the same for the proforma income Statement \\ \hline \begin{tabular}{l} 2 Cons of goods sole \\ - 2012 include \\ $1,000,000 in fixed costs. \end{tabular} & \\ \hline \begin{tabular}{l} 3. Operating expenses in 2012 \\ include $250,000 in fixed costs. \end{tabular} & \begin{tabular}{l} Operating expenses $250,000 of which there are $250,000 \\ of fixed costs. \end{tabular} \\ \hline \begin{tabular}{l} 4. Interest expenses \\ remain unchanged. \end{tabular} & Pace $500000 \\ \hline \begin{tabular}{l} 5. The company will pay \\ cash dividends in an amount \\ equal to 40% of net profits \\ after taxes. \end{tabular} & \begin{tabular}{l} Item 5 must be resolved last. Since you first have \\ 1o make the income Statement and determine the \\ profit, then apply 40% of the tax rate and subtract \\ it. They will apply 40 to this result to obtain the \\ amount of cash dividends. They ave then subtracted from \\ the result. \end{tabular} \\ \hline \begin{tabular}{l} E Invertories and cash \\ They wil doubin. \end{tabular} & \\ \hline \begin{tabular}{l} 7. Marketabie securities, \\ notes payabie, long-term \\ debt and common stock will \\ remain unchanged. \end{tabular} & \\ \hline & \begin{tabular}{l} Accounts receivable $400,000,00 and Accounts payable \\ saso.000. \end{tabular} \\ \hline \begin{tabular}{l} 9. During the year a new \\ computer system will be purchased \\ at a cost of $356,000. Total \\ depreciation expenses for the yoar \\ wil be $110,000. \end{tabular} & \begin{aligned} Fixed assets - Soltware/Hardwares $356,000 Depreciation expense for the year \( \$ 110.000\end{aligned} \). \\ \hline \begin{tabular}{l} 10. The tax rate \\ will remain at 40s. \end{tabular} & It's about prolic. See what is indicated in ilem 15 . \\ \hline Add the following accounts & Negotiable securities $100,0000 \\ \hline & Buldings and Faclifies $8820,000 \\ \hline & Accumulated depreciation $150,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts