Question: Prepare a production budget for Raikkonen Manufacturing, Inc. Budget should be for the indidual three months of the first quarter of 2016. Include a quartley

Prepare a production budget for Raikkonen Manufacturing, Inc. Budget should be for the indidual three months of the first quarter of 2016. Include a quartley total cloumn on the right side.

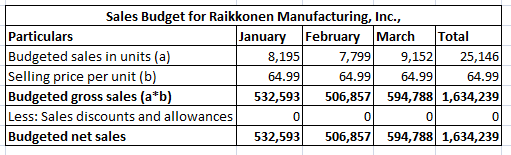

Facts: (attached is the sales budget)

| RIKKNEN MANUFACTURING, INC. | |||||

| BALANCE SHEET | |||||

| DECEMBER 31, 2015 | |||||

| ASSETS | |||||

| Cash | $30,853.00 | ||||

| Marketable Securities | 20,000.00 | ||||

| Accounts Receivable | 689,217.00 | ||||

| Interest Receivable | - | ||||

| Inventories: | |||||

| Raw Materials | $6,121.28 | ||||

| Work in Process | - | ||||

| Finished Goods | 97,163.67 | 103,284.95 | |||

| Total Current Assets | 843,354.95 | ||||

| Property, Plant and Equipment | 801,990.00 | ||||

| Less: Accumulated Depreciation | (302,670.00) | ||||

| Total Property, Plant and Equipment | 499,320.00 | ||||

| Total Assets | $1,342,674.95 | ||||

| LIABILITIES AND STOCKHOLDERS EQUITY | |||||

| Accounts Payable | $7,715.24 | ||||

| Interest Payable | - | ||||

| Income Tax Payable | - | ||||

| Short Term Borrowings | - | ||||

| Total Current Liabilities | 7,715.24 | ||||

| Long-Term Notes Payable | 436,000.00 | ||||

| Total Liabilities | 443,715.24 | ||||

| Common Stock ($5.00 Par) | $100,000.00 | ||||

| Paid in Capital in Excess of Par | 475,000.00 | ||||

| Retained Earnings | 323,959.71 | ||||

| Total Stockholders Equity | 898,959.71 | ||||

| Total Liabilities and Stockholders Equity | $1,342,674.95 | ||||

| 1. Sales | |||||||

| 2015 Actual Sales | 2016 Estimated Sales | ||||||

| Nov | Dec | Jan | Feb | Mar | Apr | May | |

| Units | 8,618 | 8,767 | 8,195 | 7,799 | 9,152 | 9,977 | 11,132 |

| The selling price per unit has remained constant for the past year and is expected to | |||||||

| remain unchanged throughout the first quarter of 2016 at an amount of $64.99 | |||||||

| 2. Cash Collection Policy | |||||||

| Total sales consist of the following: | |||||||

| Cash sales: | 10% | ||||||

| Credit sales: | 90% | ||||||

| Credit collections are as follows: | |||||||

| In the month following the month of sale: | 65% | ||||||

| In the second month following the month of sale: | 35% | ||||||

| The Company does not have any bad debts. | |||||||

| 3. Production Policy | |||||||

| The Company's policy is to produce during each month, enough units to meet the current | |||||||

| month's sales as well as a desired inventory at the end of the month which should be | |||||||

| equal to 22% of next month's estimated sales. On December 31, 2015, the finished | |||||||

| goods inventory consisted of 1,803 units at a cost of $53.89. | |||||||

| 4. Raw Materials Purchasing Policy | |||||||

| Each month the Company purchases enough raw materials to meet that month's | |||||||

| production requirements and an amount equal to 20% of the next month's estimated | |||||||

| production requirements. Each unit of finished product requires 2.55 pounds of raw | |||||||

| materials at a cost of $1.48 per pound. On December 31, 2015, the raw materials | |||||||

| inventory consisted of 4,136 lbs. at a cost of $1.48. | |||||||

| Payments are made as follows: | |||||||

| In the month of purchase: | 75% | ||||||

| In the following month the balance: | 25% | ||||||

| The accounts payable balance of $7,715.24 as of December 31, 2015, represents 20% of | |||||||

| purchases made in December 2015 to be paid in January 2016. | |||||||

| 5. Direct Labor Costs | |||||||

| Direct labor hours required per unit of finished product: 1.7 | |||||||

| Average rate per direct labor hour: | $11.25 | ||||||

| 6. Manufacturing Overhead | |||||||

| The Company applies variable manufacturing overhead cost at the rate of 125% of direct | |||||||

| labor cost and fixed factory overhead on the basis of the number of direct labor hours. | |||||||

| The company has the following fixed overhead expenses per month: | |||||||

| Factory supervisor's salary | $61,000.00 | ||||||

| Factory rent | 7,500.00 | ||||||

| Factory insurance | 5,500.00 | ||||||

| Depreciation of factory equipment | 750.00 | ||||||

| All manufacturing overhead costs, except depreciation, are paid for in cash during the | |||||||

| month in which they are incurred. | |||||||

| 7. Selling and Administrative Expenses | |||||||

| Variable selling expenses are: | |||||||

| Freight out | $0.75 | per unit | |||||

| Sales commissions | 2% | of sales dollars | |||||

| Fixed selling and administrative expenses per month are: | |||||||

| Salaries | $8,800.00 | ||||||

| Rent | 2,000.00 | ||||||

| Advertising | 175.00 | ||||||

| Insurance | 265.00 | ||||||

| Depreciation (excluding depreciation of | |||||||

| computer to be purchased at the end | |||||||

| of January 2016 | 10,050.00 | ||||||

| 8. Income Taxes | |||||||

| Combined tax rate is 30% of Income before taxes computed at the end of the | |||||||

| quarter ending March 31, 2016 , payable in the second quarter. | |||||||

| 9. Capital Expenditures | |||||||

| The Company expects to buy a new computer on January 31, 2016, for use in the sales and | |||||||

| administrative offices at a cost of $80,000.00, which will be paid in cash. Monthly | |||||||

| depreciation expense will be an additional $1,500.00 . | |||||||

| 10. Financing Policy | |||||||

| On February 29, 2016, the Company is scheduled to pay $250,000.00 , of the long-term notes | |||||||

| payable plus interest expense for the first quarter at a rate of 12% | |||||||

| With respect to short-term borrowing, the Company's policy is to borrow at the beginning | |||||||

| of a month with an anticipated cash deficiency. A minimum cash balance of $25,000.00 is | |||||||

| required of the end of each month. The Company repays the principal of such short-term | |||||||

| borrowing at the end of the first following month to the extent of anticipated excess cash. | |||||||

| Interest must be paid at the beginning of the following month at a rate of 12%. Borrowing | |||||||

| and principal repayments are made in multiples of $1,000.00 . | |||||||

| 11. Investing Policy | |||||||

| The Company invests any cash balance in excess of minimum requirements in marketable | |||||||

| securities at the beginning of any month where such surplus is anticipated. Investments | |||||||

| earn interest of the rate of 6% per annum which is credited to our account by the bank at | |||||||

| the beginning of the following month. You may assume that the balance of Marketable | |||||||

| Securities at December 31, 2015, was outstanding throughout the entire month. | |||||||

| 12. General Information | |||||||

| Use proper rounding and show two (2) decimal places of accuracy on dollar amounts. | |||||||

| Round up and show whole amounts on all other figures. | |||||||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts