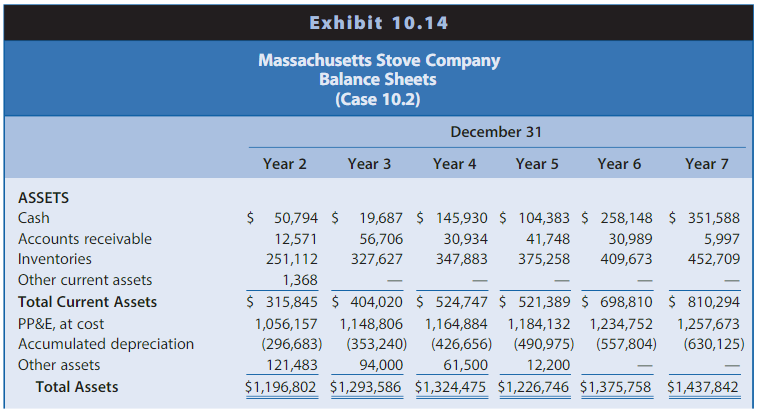

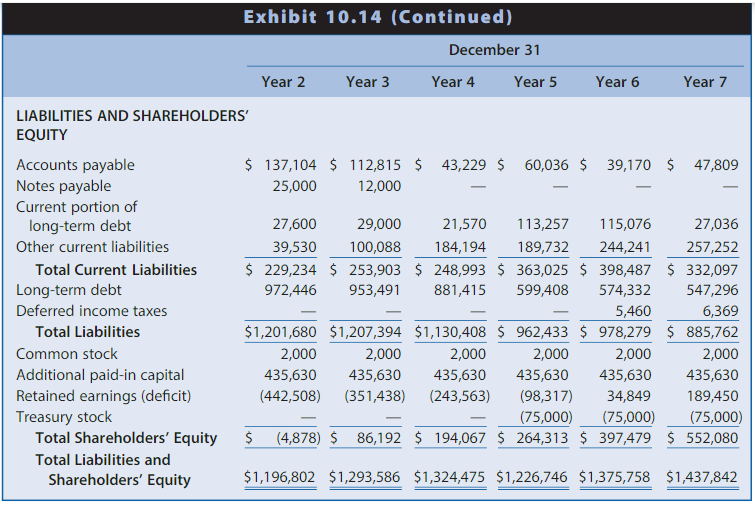

Question: Prepare a projected balance sheets for MSC for Year 8Year 12. Development Costs MSC plans to develop two gas stove models, but not concurrently. It

Prepare a projected balance sheets for MSC for Year 8Year 12.

Development Costs MSC plans to develop two gas stove models, but not concurrently. It will develop the rst gas model during Year 8 and begin selling it during Year 9. It will develop the second gas model during Year 9 and begin selling it during Year 10. MSC will capitalize the development costs in the year incurred (Year 8 and Year 9) and amortize them straight-line over ve years, beginning with the year the stove is initially sold (Year 9 and Year 10). Estimated development cost for each stove are as follows:

Best Case: $100,000

Most Likely Case: $120,000

Worst Case: $160,000

Capital Expenditures Capital expenditures, other than development costs, will be as follows: Year 8, $20,000; Year 9, $30,000; Year 10, $30,000; Year 11, $25,000; Year 12, $25,000. Assume a six-year depreciable life, straight-line depreciation, and a full year of depreciation in the year of acquisition

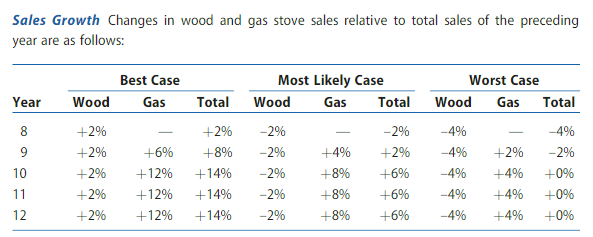

Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows:

Because sales of gas stoves will start at zero, the projections of sales should use the preceding growth rates in total sales. The growth rates shown for woodstove sales and gas stove sales simply indicate the components of the total sales increase. Cost of Goods Sold Manufacturing costs of the gas stoves will equal 50% of sales, the same as for woodstoves.

Depreciation will increase for the amortization of the product development costs on the gas stoves and depreciation of additional capital expenditures.

Facilities Rental Income and Facilities Costs Facilities rental income will decrease by 50%beginning in Year 9 when MSC takes over 5,000 square feet of its building now rented to another company and will remain at that reduced level for Year 10Year 12. Facilities costs will increase by $30,000 beginning in Year 9 for facilities costs now paid by a tenant and for additional facilities costs required by gas stove manufacturing. These costs will remain at that increased level for Year 10Year 12

Administrative Expenses Administrative expenses will increase by $30,000 in Year 8, $30,000in Year 9, and $20,000 in Year 10, and then will remain at the Year 10 level in Years 11 and 12.

Interest Income MSC will earn 5% interest on the average balance in cash each year.

Interest Expense The interest rate on interest-bearing debt will be 6.8% on the average amount of debt outstanding each year.

Income Tax Expense MSC is subject to an income tax rate of 28%.

Accounts Receivable and Inventories Accounts receivable and inventories will increase at the growth rate in sales.

Property, Plant, and Equipment Property, plant, and equipment at cost will increase each year by the amounts of capital expenditures and expenditures on development costs. Accumulated depreciation will increase each year by the amount of depreciation and amortization expense.

Accounts Payable and Other Current Liabilities Accounts payable will increase with the growth rate in inventories. Other current liabilities include primarily advances by customers for stoves manufactured soon after the year-end. Other current liabilities will increase with the growth rate in sales.

Current Portion of Long-Term Debt Scheduled repayments of long-term debt are as follows: Year 8, $27,036; Year 9, $29,200; Year 10, $31,400; Year 11, $33,900; Year 12, $36,600; Year 13, $39,500.

Deferred Income Taxes Deferred income taxes relate to the use of accelerated depreciation for tax purposes and the straight-line method for nancial reporting. Assume that deferred income taxes will not change.

Shareholders Equity Assume that there will be no changes in the contributed capital of MSC. Retained earnings will change each year in the amount of net income.

PLEASE DO NOT USE ANY DATA THAT HAS ALREADY BEEN SUBMITTED FOR THIS QUESTION PREVIOUSLY. ONLY NEW & ORIGINAL WORK. THANK YOU!

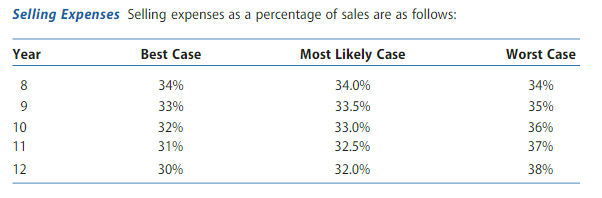

Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows: Selling Expenses Selling expenses as a percentage of sales are as follows: Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows: Selling Expenses Selling expenses as a percentage of sales are as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts