Question: Prepare a Ratio Analysis which are useful in understanding a Company. Ratio Analysis is used in conjunction with the other types of analysis discussed in

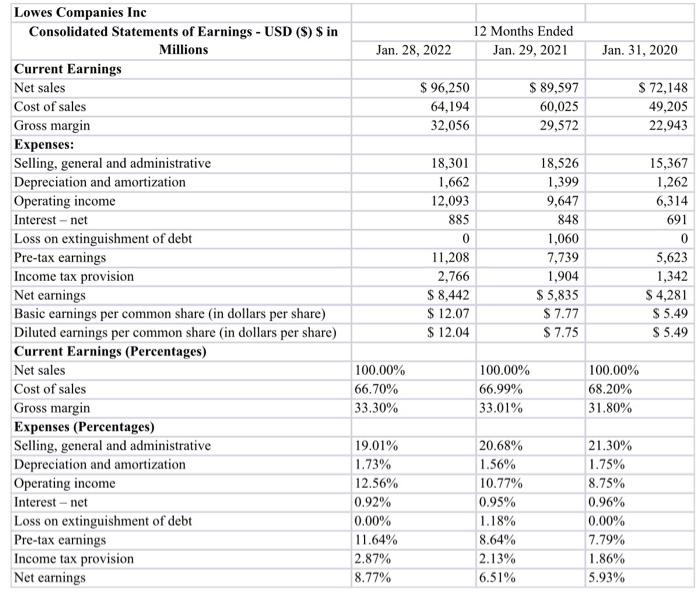

Prepare a Ratio Analysis which are useful in understanding a Company. Ratio Analysis is used in conjunction with the other types of analysis discussed in this module. The ratios include four categories: Liquidity, Solvency, Profitability and Market Prospects.

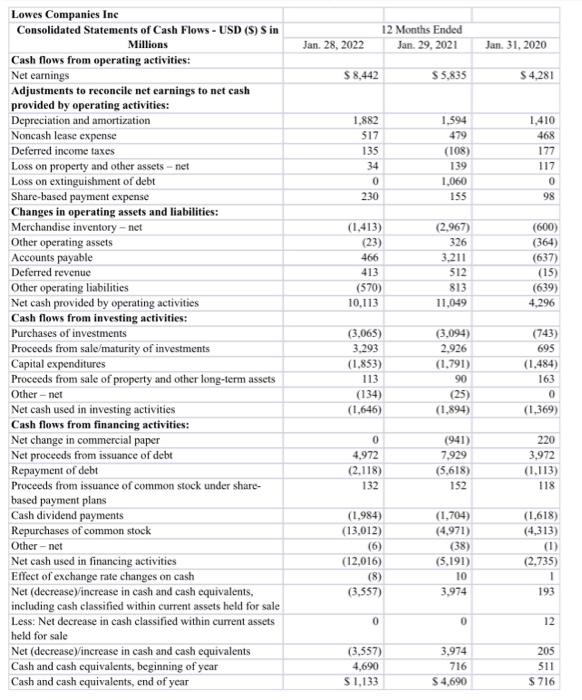

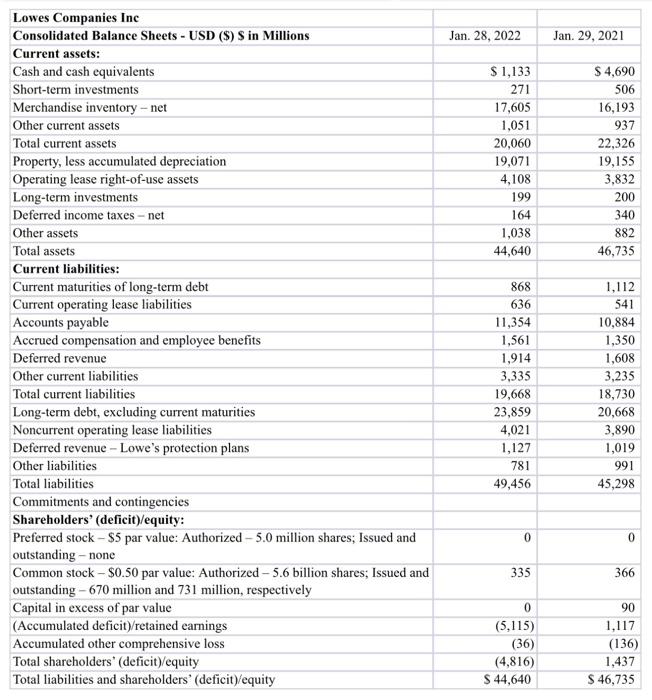

Lowes Companies Ine Lowes Companies Inc Consolidated Balance Sheets - USD (\$) S in Millions Current assets: Cash and cash equivalents Short-term investments Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes - net Other assets Total assets \begin{tabular}{l|l} Jan. 28,2022 & Jan. 29,2021 \end{tabular} Current liabilities: Current maturities of long-term debt Current operating lease liabilities Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Noncurrent operating lease liabilities Deferred revenue - Lowe's protection plans Other liabilities Total liabilities \begin{tabular}{|r|r|} \hline$1,133 & $4,690 \\ \hline 271 & 506 \\ \hline 17,605 & 16,193 \\ \hline 1,051 & 937 \\ \hline 20,060 & 22,326 \\ \hline 19,071 & 19,155 \\ \hline 4,108 & 3,832 \\ \hline 199 & 200 \\ \hline 164 & 340 \\ \hline 1,038 & 882 \\ \hline 44,640 & 46,735 \\ \hline \end{tabular} Commitments and contingencies Shareholders' (deficit)/equity: Preferred stock - \$5 par value: Authorized - 5.0 million shares; Issued and outstanding - none Common stock $0.50 par value: Authorized 5.6 billion shares; Issued and outstanding - 670 million and 731 million, respectively Capital in excess of par value (Accumulated deficit)/retained earnings Accumulated other comprehensive loss Total shareholders' (deficit)/equity Total liabilities and shareholders' (deficit)/equity \begin{tabular}{|r|r|} \hline 868 & 1,112 \\ \hline 636 & 541 \\ \hline 11,354 & 10,884 \\ \hline 1,561 & 1,350 \\ \hline 1,914 & 1,608 \\ \hline 3,335 & 3,235 \\ \hline 19,668 & 18,730 \\ \hline 23,859 & 20,668 \\ \hline 4,021 & 3,890 \\ \hline 1,127 & 1,019 \\ \hline 781 & 991 \\ \hline 49,456 & 45,298 \\ \hline \end{tabular} Lowes Companies Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts