Question: Prepare a report covering the following: a) Using the figures provided and based on the given cost of capital of 5%, you are required to

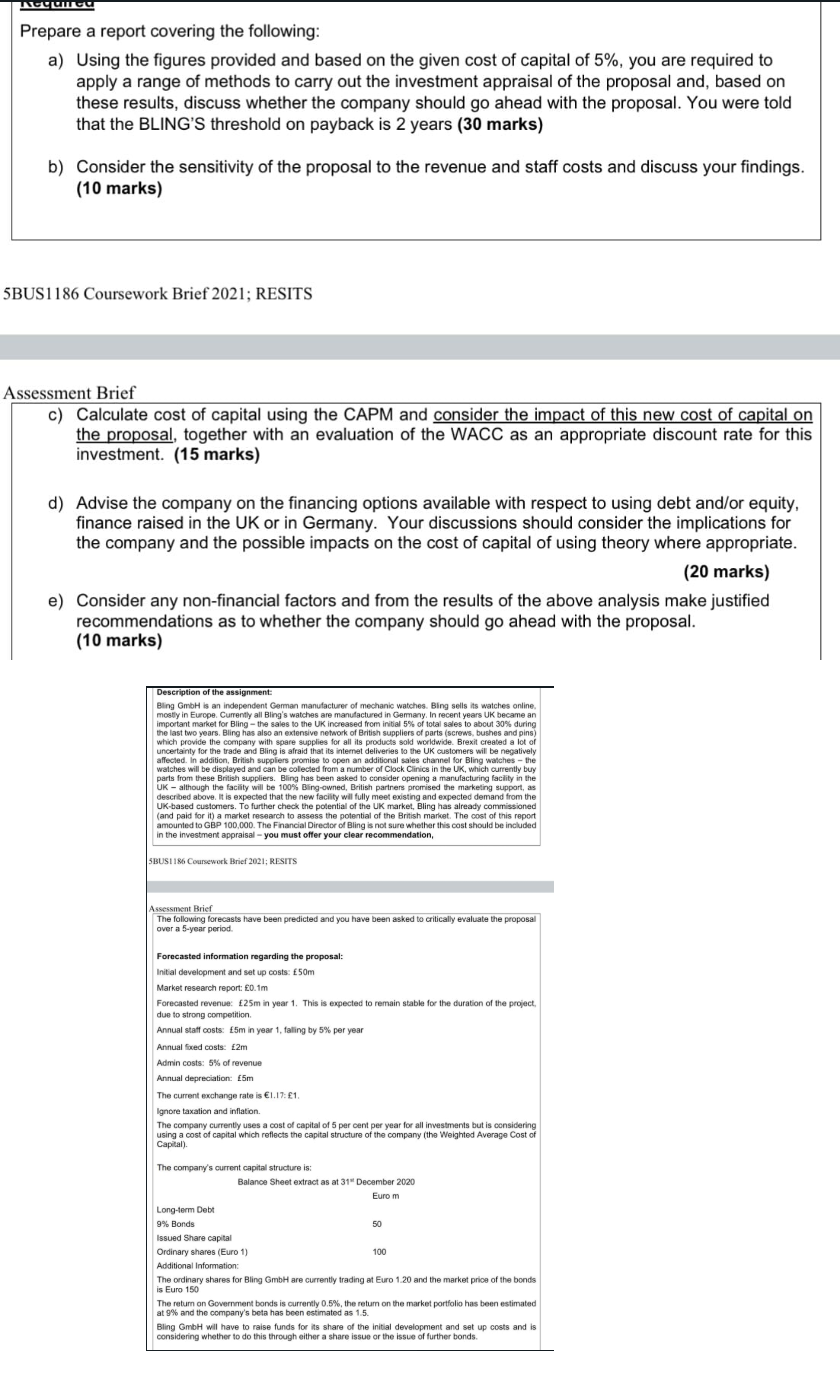

Prepare a report covering the following: a) Using the figures provided and based on the given cost of capital of 5%, you are required to apply a range of methods to carry out the investment appraisal of the proposal and, based on these results, discuss whether the company should go ahead with the proposal. You were told that the BLING'S threshold on payback is 2 years (30 marks) b) Consider the sensitivity of the proposal to the revenue and staff costs and discuss your findings. (10 marks) 5BUS1186 Coursework Brief 2021; RESITS Assessment Brief c) Calculate cost of capital using the CAPM and consider the impact of this new cost of capital on the proposal, together with an evaluation of the WACC as an appropriate discount rate for this investment. (15 marks) d) Advise the company on the financing options available with respect to using debt and/or equity, finance raised in the UK or in Germany. Your discussions should consider the implications for the company and the possible impacts on the cost of capital of using theory where appropriate. (20 marks) e) Consider any non-financial factors and from the results of the above analysis make justified recommendations as to whether the company should go ahead with the proposal. (10 marks) Description of the assignment: Bling GmbH is an independent German manufacturer of mechanic watches. Bing sells its watches online mostly in Europe. Currently all Bling's watches are manufactured in Germany. In recent years UK became an important market for Bling the sales to the UK increased from initial 5% of total sales to about 30% during , which provide the company with spare supplies for all its products sold worldwide. Brexit created a lot of uncertainty for the trade and Bling is afraid that its internet deliveries to the UK customers will be negatively affected. In addition, British suppliers promise to open an additional sales channel for Bling watches - the watches will be displayed and can be collected from a number of Clock Clinics in the UK, which currently buy parts from these British suppliers. Bling has been asked to consider opening a manufacturing facility in the UK - although the facility will be 100% Bling-owned, British partners promised the marketing support, as described above. It is expected that the new facility will fully lly meet existing and expected demand from the UK-based customers. To further check the potential of the UK market, Bling has already commissioned (and paid for it) a market research to assess the potential of the British market. The cost of this report amounted to GBP 100,000. The Financial Director of Bling is not sure whether this cost should be included in the investment appraisal - you must offer your clear recommendation, 5BUS1186 Coursework Brief 2021; RESITS Assessment Brief The following forecasts have been predicted and you have been asked to critically evaluate the proposal over a 5-year period Forecasted information regarding the proposal: Initial development and set up costs: 50m Market research report: 0.1m remain stable for the duration of the project, Forecasted revenue: 25m in year 1. This is expected due to strong competition Annual staff costs: 5m in year 1, falling by 5% per year Annual fixed costs: 2m Admin costs: 5% of revenue Annual depreciation: 5m preciation om The current exchange rate is 1.17:21 Ignore taxation and inflation. The company currently uses a cost of capital of 5 per cent per year for all investments but is considering using a cost of capital which reflects the capital structure of the company (the Weighted Average Cost of Capital). The company's current capital structure is: Balance Sheet extract as at 31" December 2020 Eurom Long-term Debt 9% Bonds 50 Issued Share capital Ordinary shares (Euro 1) 100 Additional Information: The ordinary shares for Bling GmbH are currently trading at Euro 1.20 and the market price of the bonds is Euro 150 The return on Government bonds is currently 0.5%, the retum on the market portfolio has been estimated at 9% and the company's beta has been estimated as 1.5. Bling GmbH will have to raise funds for its share of the initial development and set up costs and is considering whether to do this through either a share issue or the issue of further bonds. Prepare a report covering the following: a) Using the figures provided and based on the given cost of capital of 5%, you are required to apply a range of methods to carry out the investment appraisal of the proposal and, based on these results, discuss whether the company should go ahead with the proposal. You were told that the BLING'S threshold on payback is 2 years (30 marks) b) Consider the sensitivity of the proposal to the revenue and staff costs and discuss your findings. (10 marks) 5BUS1186 Coursework Brief 2021; RESITS Assessment Brief c) Calculate cost of capital using the CAPM and consider the impact of this new cost of capital on the proposal, together with an evaluation of the WACC as an appropriate discount rate for this investment. (15 marks) d) Advise the company on the financing options available with respect to using debt and/or equity, finance raised in the UK or in Germany. Your discussions should consider the implications for the company and the possible impacts on the cost of capital of using theory where appropriate. (20 marks) e) Consider any non-financial factors and from the results of the above analysis make justified recommendations as to whether the company should go ahead with the proposal. (10 marks) Description of the assignment: Bling GmbH is an independent German manufacturer of mechanic watches. Bing sells its watches online mostly in Europe. Currently all Bling's watches are manufactured in Germany. In recent years UK became an important market for Bling the sales to the UK increased from initial 5% of total sales to about 30% during , which provide the company with spare supplies for all its products sold worldwide. Brexit created a lot of uncertainty for the trade and Bling is afraid that its internet deliveries to the UK customers will be negatively affected. In addition, British suppliers promise to open an additional sales channel for Bling watches - the watches will be displayed and can be collected from a number of Clock Clinics in the UK, which currently buy parts from these British suppliers. Bling has been asked to consider opening a manufacturing facility in the UK - although the facility will be 100% Bling-owned, British partners promised the marketing support, as described above. It is expected that the new facility will fully lly meet existing and expected demand from the UK-based customers. To further check the potential of the UK market, Bling has already commissioned (and paid for it) a market research to assess the potential of the British market. The cost of this report amounted to GBP 100,000. The Financial Director of Bling is not sure whether this cost should be included in the investment appraisal - you must offer your clear recommendation, 5BUS1186 Coursework Brief 2021; RESITS Assessment Brief The following forecasts have been predicted and you have been asked to critically evaluate the proposal over a 5-year period Forecasted information regarding the proposal: Initial development and set up costs: 50m Market research report: 0.1m remain stable for the duration of the project, Forecasted revenue: 25m in year 1. This is expected due to strong competition Annual staff costs: 5m in year 1, falling by 5% per year Annual fixed costs: 2m Admin costs: 5% of revenue Annual depreciation: 5m preciation om The current exchange rate is 1.17:21 Ignore taxation and inflation. The company currently uses a cost of capital of 5 per cent per year for all investments but is considering using a cost of capital which reflects the capital structure of the company (the Weighted Average Cost of Capital). The company's current capital structure is: Balance Sheet extract as at 31" December 2020 Eurom Long-term Debt 9% Bonds 50 Issued Share capital Ordinary shares (Euro 1) 100 Additional Information: The ordinary shares for Bling GmbH are currently trading at Euro 1.20 and the market price of the bonds is Euro 150 The return on Government bonds is currently 0.5%, the retum on the market portfolio has been estimated at 9% and the company's beta has been estimated as 1.5. Bling GmbH will have to raise funds for its share of the initial development and set up costs and is considering whether to do this through either a share issue or the issue of further bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts