Question: Prepare a retained earnings statement. (List items that increase retained earnings first.) Prepare the closing entries. (Credit account titles are automatically indented when amount is

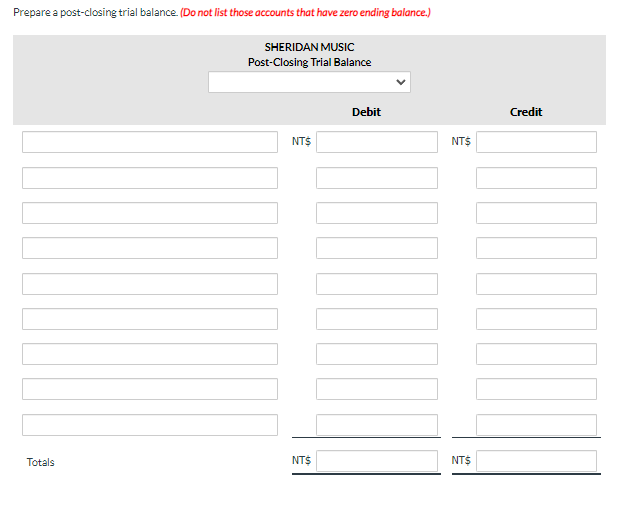

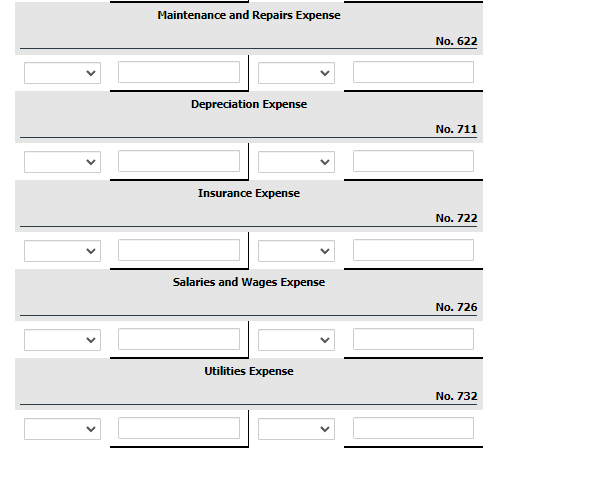

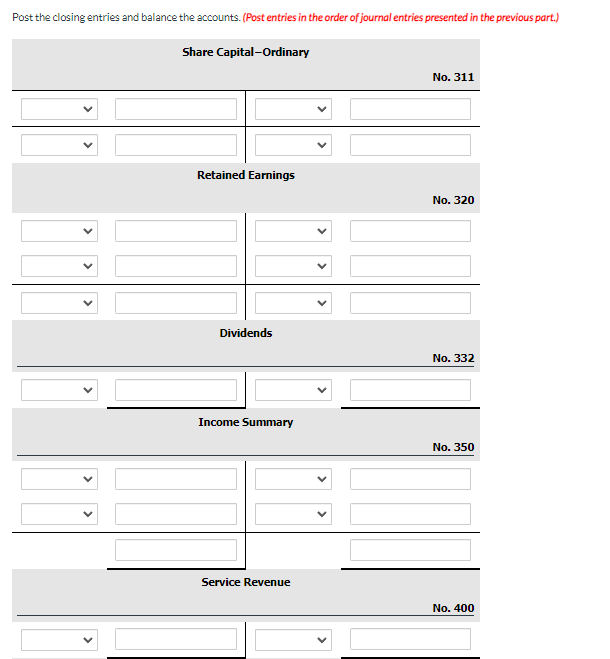

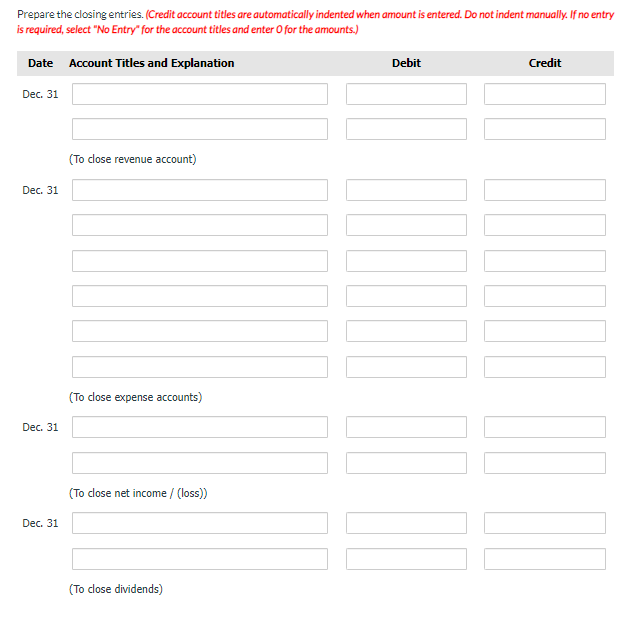

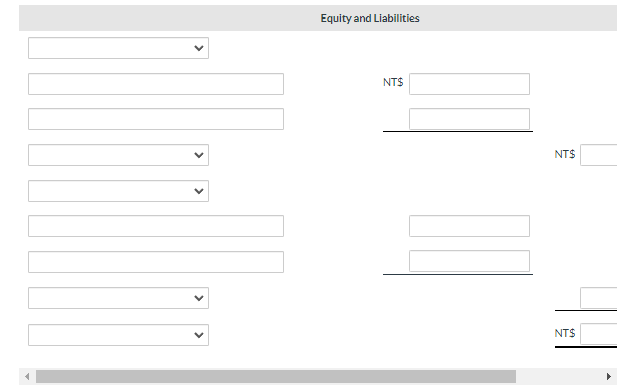

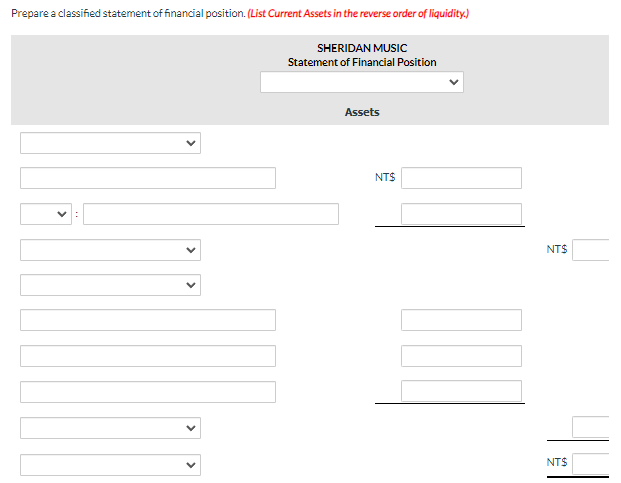

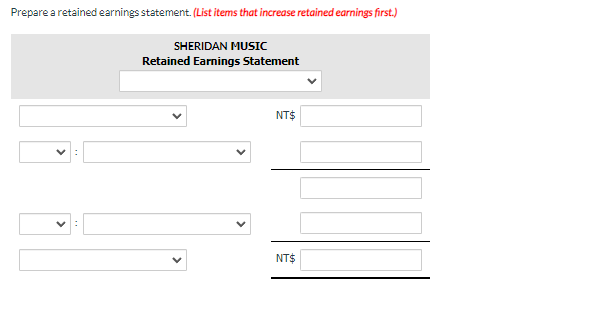

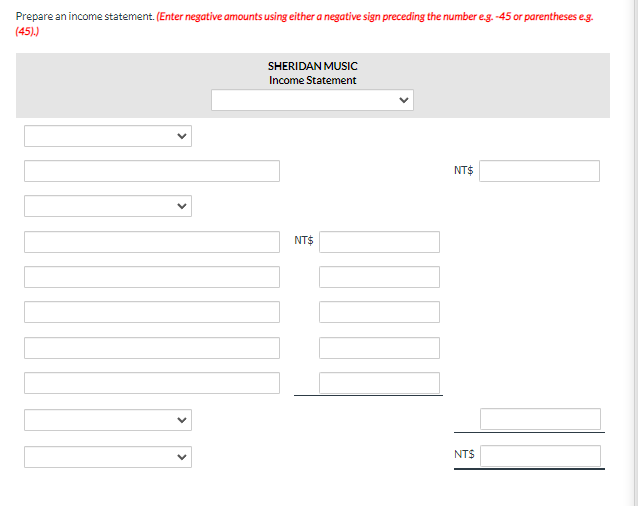

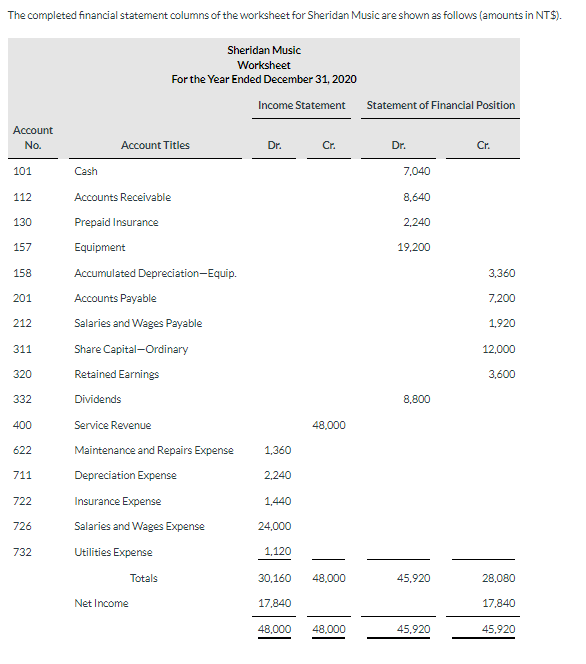

Prepare a retained earnings statement. (List items that increase retained earnings first.) Prepare the closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry Prepare a post-closing trial balance. (Do not list those accounts that have zero ending balance.) he previous part.) Prepare an income statement. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. Maintenance and Repairs Expense No. 622 Depreciation Expense No. 711 Insurance Expense No. 722 Salaries and Wages Expense No. 726 Utilities Expense No. 732 Equity and Liabilities NTS NT\$ Prepare a classified statement of financial position. (List Current Assets in the reverse order of liquidity.) The completed financial statement columns of the worksheet for Sheridan Music are shown as follows (amounts in NT\$). \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{3}{*}{AccountNo.} & \multirow{2}{*}{\multicolumn{3}{|c|}{SheridanMusicWorksheetFortheYearEndedDecember31,2020}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Statement of Financial Position }} \\ \hline & & & & & \\ \hline & Account Titles & Dr. & Cr & Dr. & Cr. \\ \hline 101 & Cash & & & 7,040 & \\ \hline 112 & Accounts Receivable & & & 8,640 & \\ \hline 130 & Prepaid Insurance & & & 2,240 & \\ \hline 157 & Equipment & & & 19,200 & \\ \hline 158 & Accumulated Depreciation-Equip. & & & & 3,360 \\ \hline 201 & Accounts Payable & & & & 7,200 \\ \hline 212 & Salaries and Wages Payable & & & & 1,920 \\ \hline 311 & Share Capital-Ordinary & & & & 12,000 \\ \hline 320 & Retained Earnings & & & & 3,600 \\ \hline 332 & Dividends & & & 8,800 & \\ \hline 400 & Service Revenue & & 48,000 & & \\ \hline 622 & Maintenance and Repairs Expense & 1,360 & & & \\ \hline 711 & Depreciation Expense & 2,240 & & & \\ \hline 722 & Insurance Expense & 1,440 & & & \\ \hline 726 & Salaries and Wages Expense & 24,000 & & & \\ \hline \multirow[t]{4}{*}{732} & Utilities Expense & 1,120 & & & \\ \hline & Totals & 30,160 & 48,000 & 45,920 & 28,080 \\ \hline & Net Income & 17,840 & & & 17,840 \\ \hline & & 48,000 & 48,000 & 45,920 & 45,920 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts