Question: prepare a revised comprehensive income statement and single step income statement Question 1 Amos Corporation was incorporated and began business on January 1, 2020. It

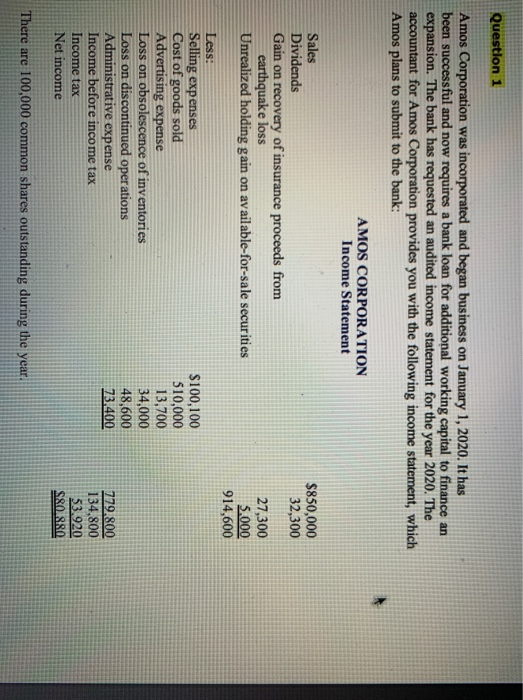

Question 1 Amos Corporation was incorporated and began business on January 1, 2020. It has been successful and now requires a bank loan for additional working capital to finance an expansion. The bank has requested an audited income statement for the year 2020. The accountant for Amos Corporation provides you with the following income statement, which Amos plans to submit to the bank: AMOS CORPORATION Income Statement $850,000 32,300 Sales Dividends Gain on recovery of insurance proceeds from earthquake loss Unrealized holding gain on available-for-sale securities 27,300 5.000 914,600 Less: Selling expenses Cost of goods sold Advertising expense Loss on obsolescence of inventories Loss on discontinued operations Administrative expense Income before income tax Income tax Net income $100,100 510,000 13,700 34,000 48,600 73.400 779.800 134,800 53.920 S&0.880 There are 100,000 common shares outstanding during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts