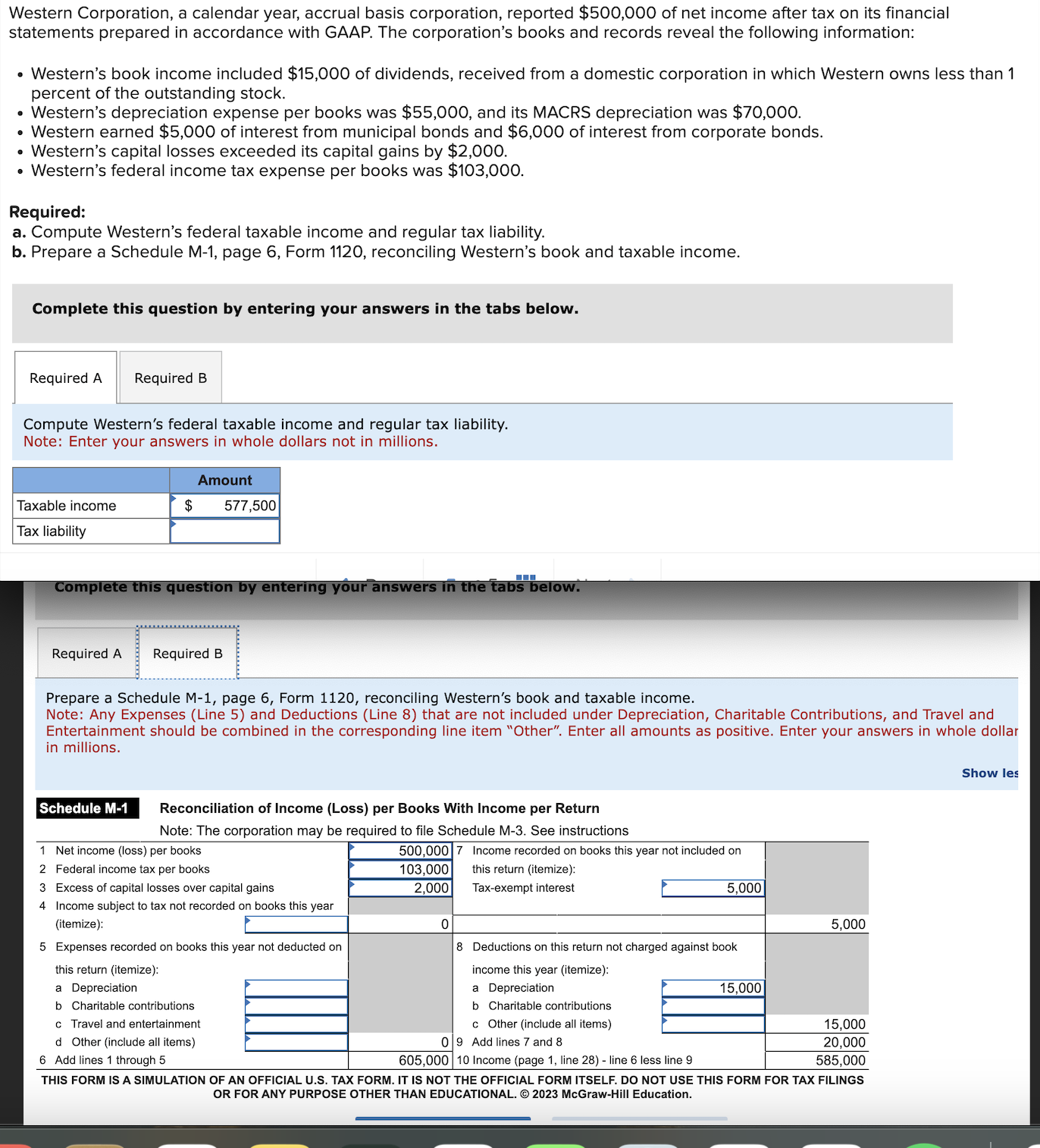

Question: Prepare a Schedule M - 1 , page 6 , Form 1 1 2 0 , reconciling Western's book and taxable income. Note: Any Expenses

Prepare a Schedule M page Form reconciling Western's book and taxable income.

Note: Any Expenses Line and Deductions Line that are not included under Depreciation, Charitable Contributions, and Travel and

Entertainment should be combined in the corresponding line item "Other". Enter all amounts as positive. Enter your answers in whole dollar

in millions.

Schedule M Reconciliation of Income Loss per Books With Income per Return

Note: The corporation may be required to file Schedule M See instructions

THIS FORM IS A SIMULATION OF AN OFFICIAL US TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS

OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. McGrawHill Education.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock