Question: Prepare a statement of cash flows for 2020 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000

Prepare a statement of cash flows for 2020 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

Prepare a statement of cash flows for 2020 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

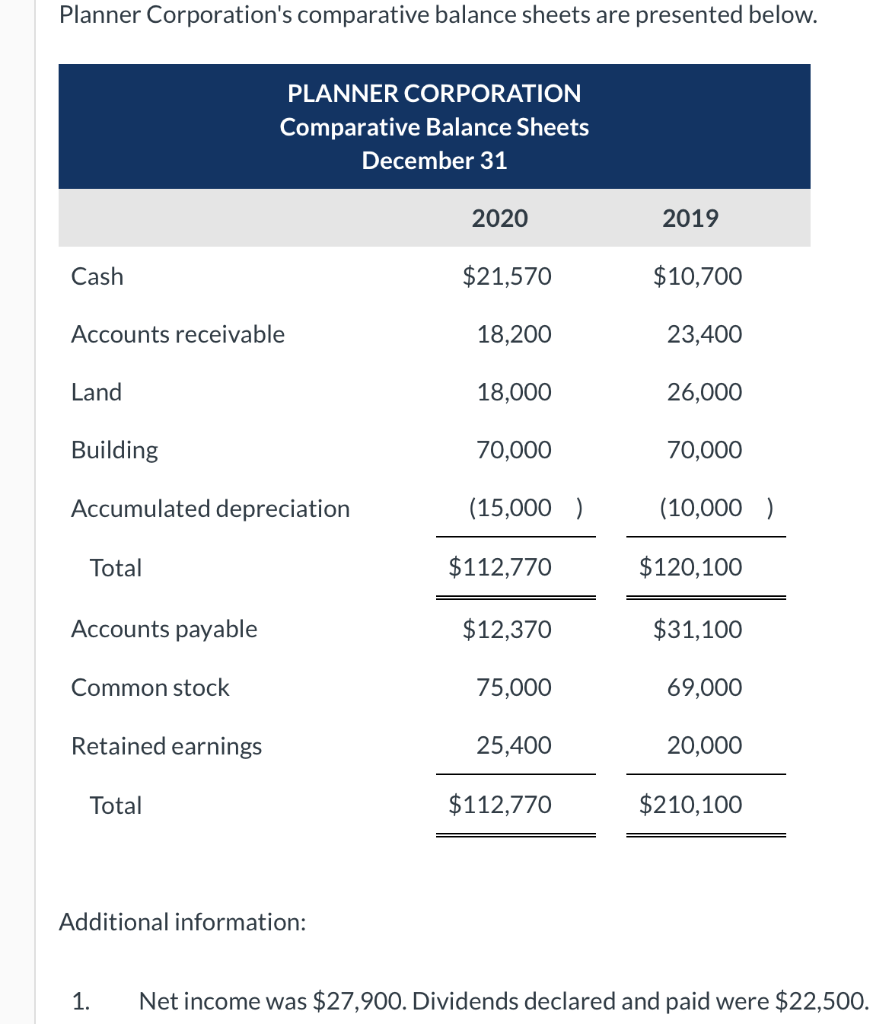

Planner Corporation's comparative balance sheets are presented below. PLANNER CORPORATION Comparative Balance Sheets December 31 2020 2019 Cash $21,570 $10,700 Accounts receivable 18,200 23,400 Land 18,000 26,000 Building 70,000 70,000 Accumulated depreciation (15,000) (10,000) Total $112,770 $120,100 Accounts payable $12,370 $31,100 Common stock 75,000 69,000 Retained earnings 25,400 20,000 Total $112,770 $210,100 Additional information: 1. Net income was $27,900. Dividends declared and paid were $22,500. Additional information: 1. Net income was $27,900. Dividends declared and paid were $22,500. 2. All other changes in noncurrent account balances had a direct effect on cash flows, except the change in accumulated depreciation. The land was sold for $5,900. (a) Prepare a statement of cash flows for 2020 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) PLANNER CORPORATION Statement of Cash Flows $ Adjustments to reconcile net income to PLANNER CORPORATION Statement of Cash Flows $ Adjustments to reconcile net income to $ 4 A A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts