Question: Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of

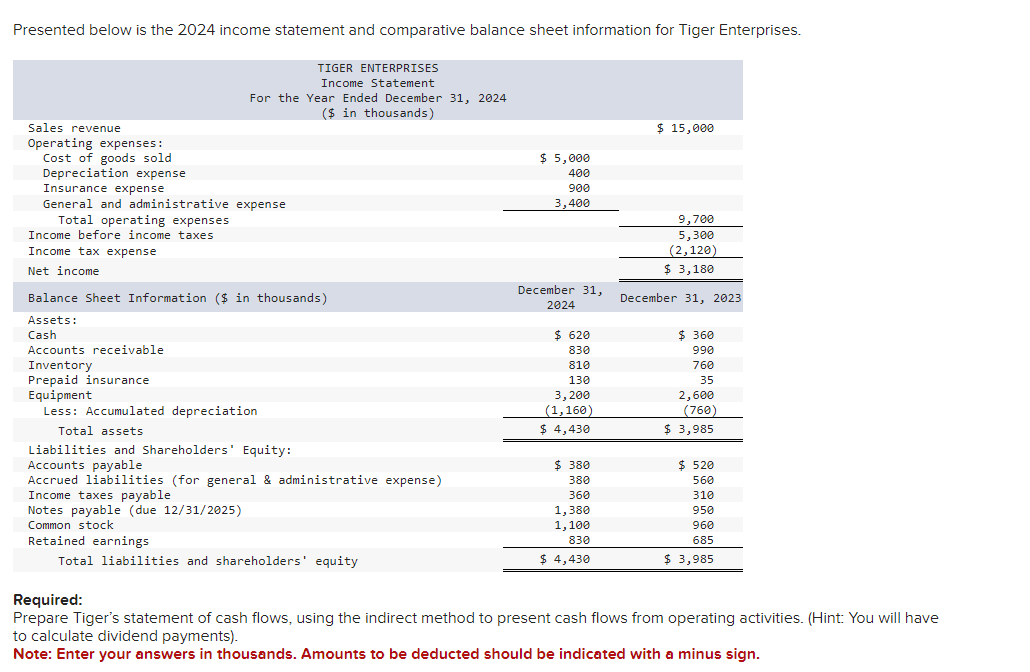

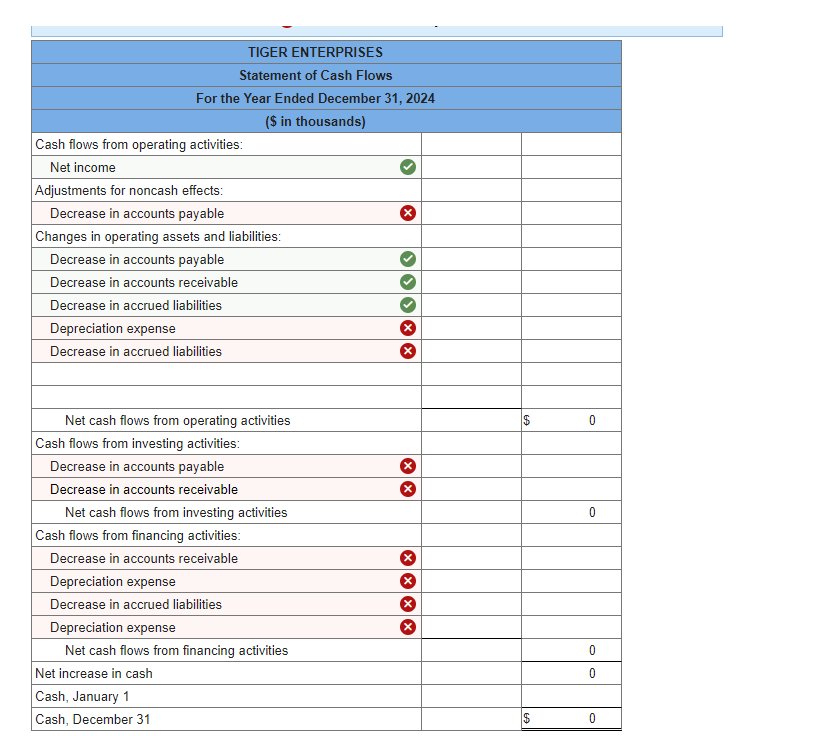

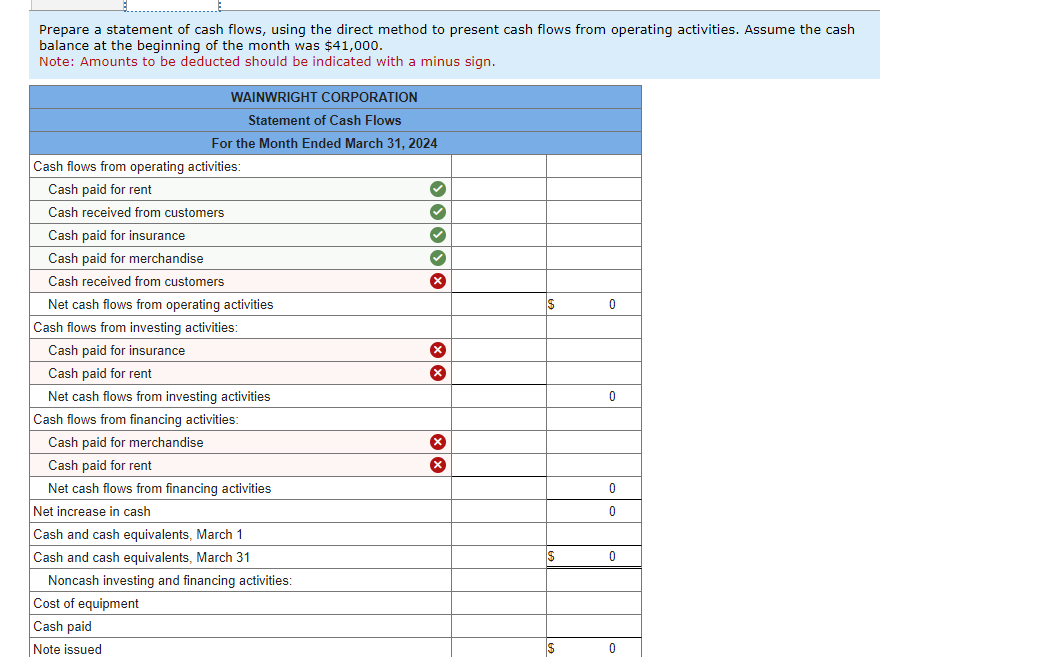

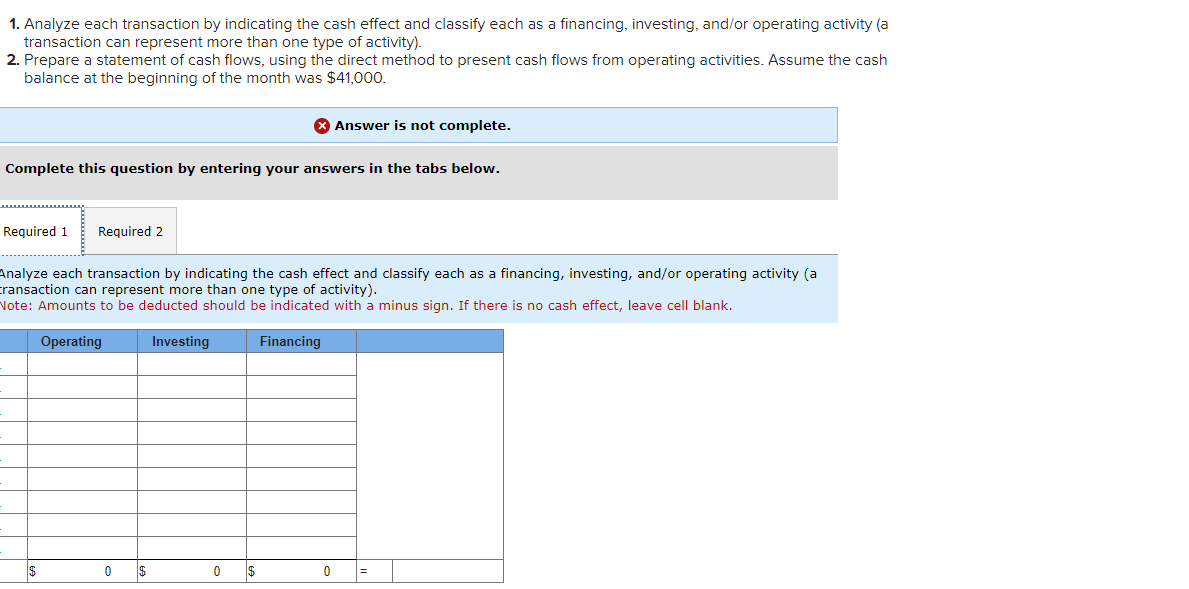

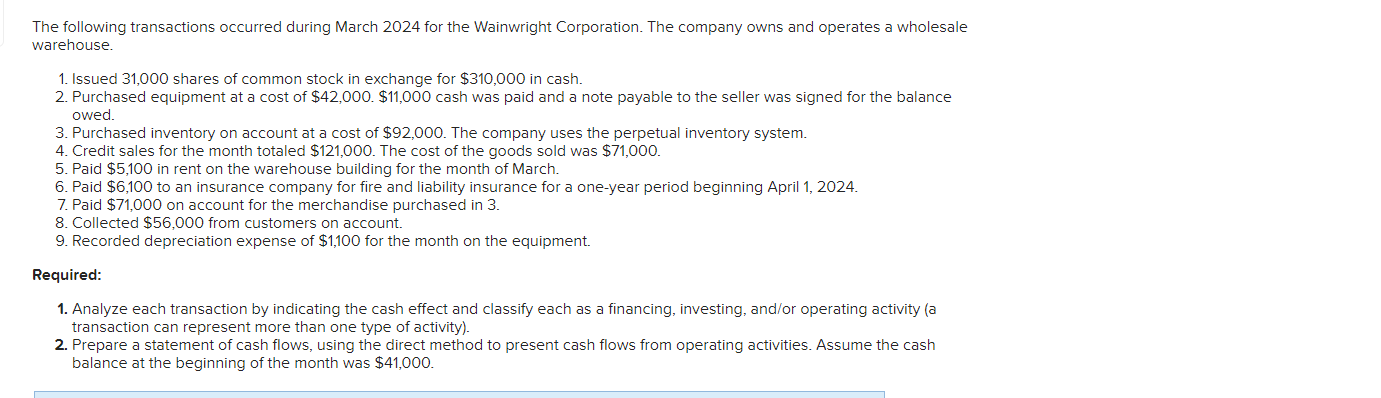

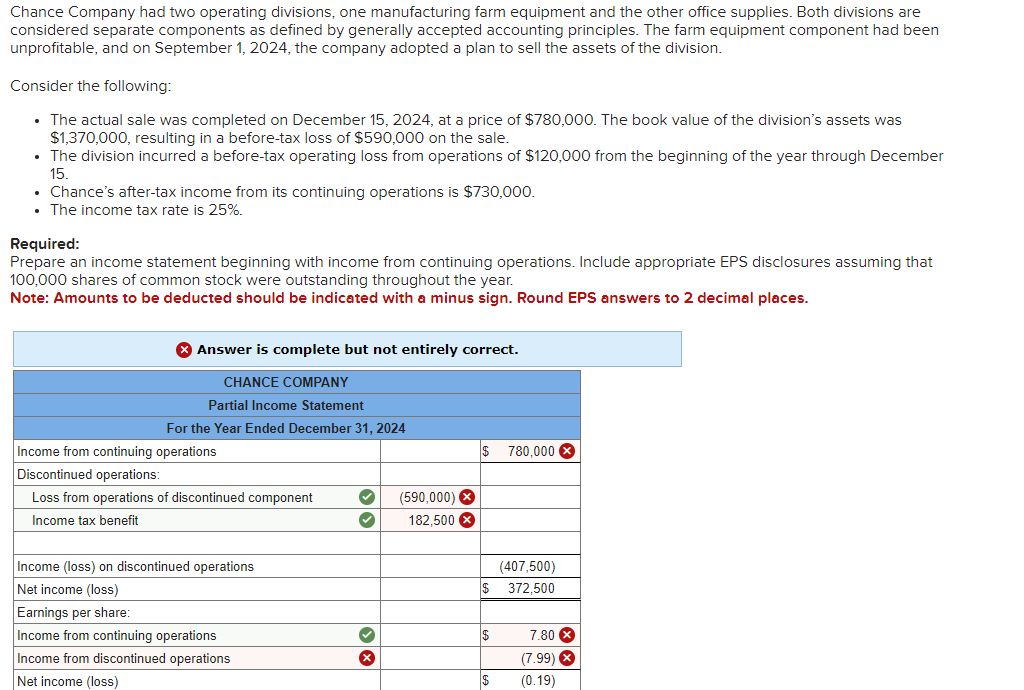

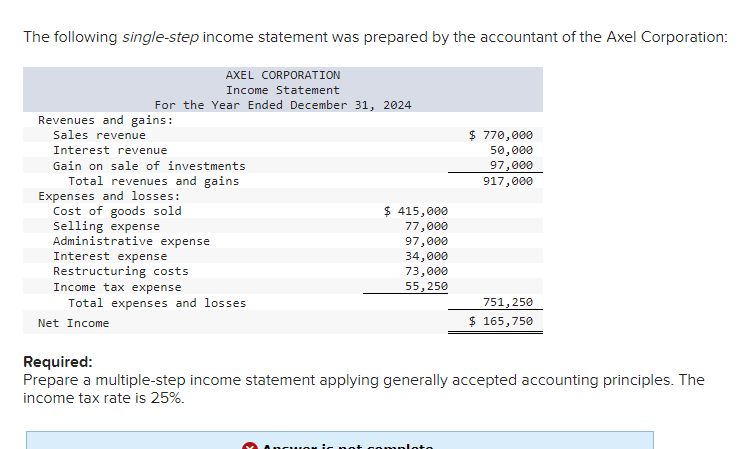

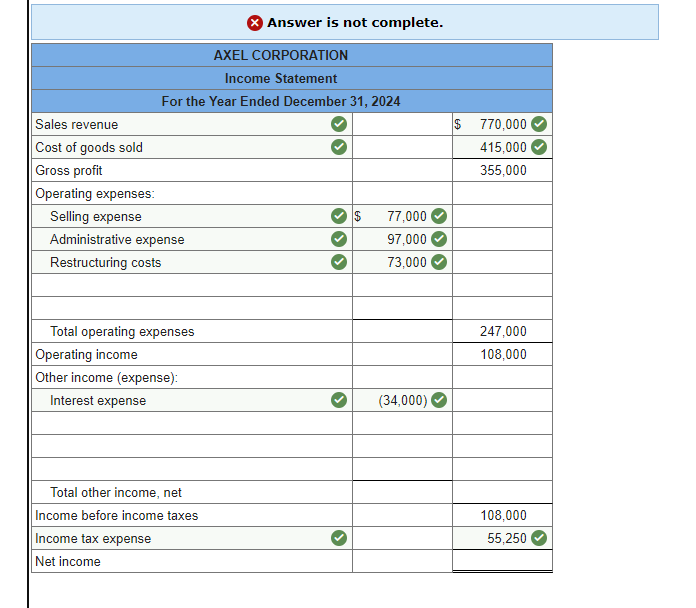

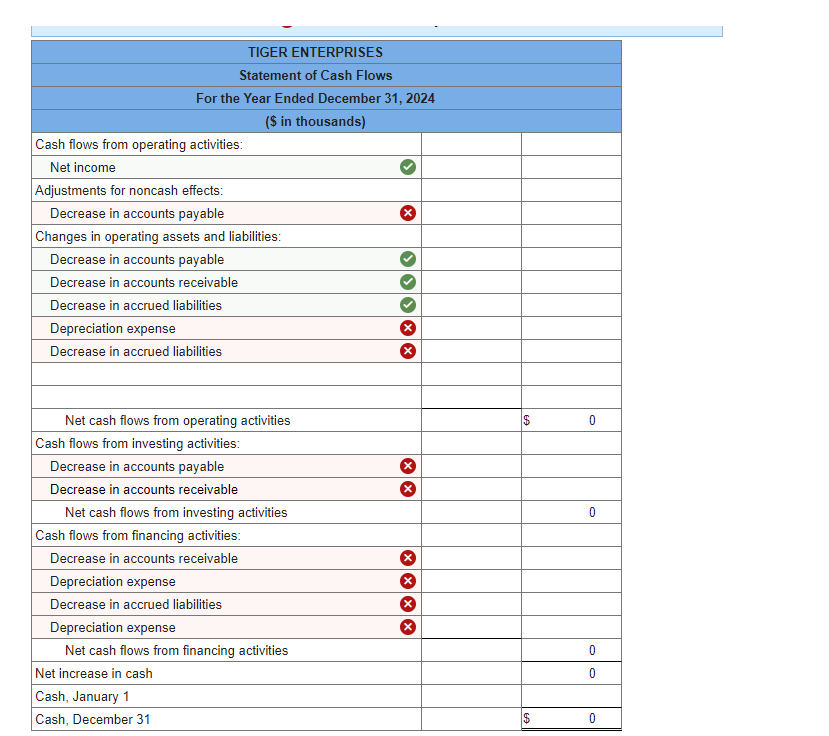

Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $41,000. Note: Amounts to be deducted should be indicated with a minus sign. Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Prepare Tiger's statement of cash flows, using the indirect method to present cash flows from operating activities. (Hint: You will have to calculate dividend payments). Note: Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. The following transactions occurred during March 2024 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 31,000 shares of common stock in exchange for $310,000 in cash. 2. Purchased equipment at a cost of $42,000. $11,000 cash was paid and a note payable to the seller was signed for the balance owed. 3. Purchased inventory on account at a cost of $92,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $121,000. The cost of the goods sold was $71,000. 5 . Paid $5,100 in rent on the warehouse building for the month of March. 6. Paid $6,100 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2024. 7. Paid $71,000 on account for the merchandise purchased in 3. 8. Collected $56,000 from customers on account. 9. Recorded depreciation expense of $1,100 for the month on the equipment. Required: 1. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a transaction can represent more than one type of activity). 2. Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $41,000. The following single-step income statement was prepared by the accountant of the Axel Corporation: Required: Prepare a multiple-step income statement applying generally accepted accounting principles. The income tax rate is 25%. 1. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a transaction can represent more than one type of activity). 2. Prepare a statement of cash flows, using the direct method to present cash flows from operating activities. Assume the cash balance at the beginning of the month was $41,000. Answer is not complete. Complete this question by entering your answers in the tabs below. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or operating activity (a ransaction can represent more than one type of activity). Note: Amounts to be deducted should be indicated with a minus sign. If there is no cash effect, leave cell blank. Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2024, the company adopted a plan to sell the assets of the division. Consider the following: - The actual sale was completed on December 15,2024 , at a price of $780,000. The book value of the division's assets was $1,370,000, resulting in a before-tax loss of $590,000 on the sale. - The division incurred a before-tax operating loss from operations of $120,000 from the beginning of the year through December 15. - Chance's after-tax income from its continuing operations is $730,000. - The income tax rate is 25%. Required: Prepare an income statement beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. Note: Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts