Question: Prepare a statement of Cash Flows Using the given data/information. Excel File Edit View Insert Format Tools Data Window Help Thu Apr 7 1:31 PM

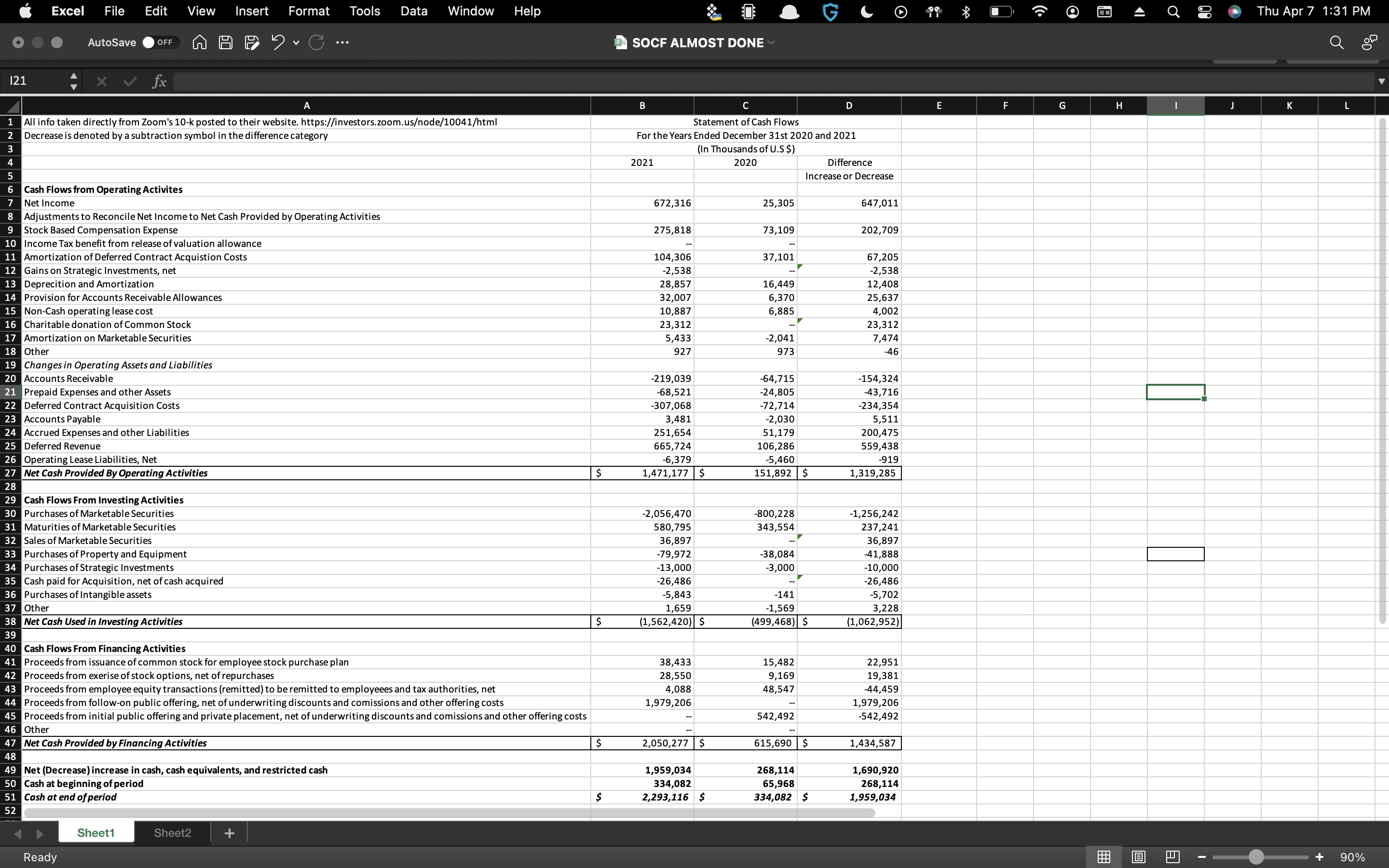

Prepare a statement of Cash Flows Using the given data/information.

Excel File Edit View Insert Format Tools Data Window Help Thu Apr 7 1:31 PM AutoSave OFF Doc ** SOCF ALMOST DONE 121 fx A B C D E F G I J L Statement of Cash Flows For the Years Ended December 31st 2020 and 2021 (In Thousands of U.S $) 2021 2020 Difference Increase or Decrease 672,316 25,305 647,011 275,818 73,109 202,709 37,101 104,306 -2,538 28,857 32,007 10,887 23,312 5,433 927 16,449 6,370 6,885 67,205 -2,538 12,408 25,637 4,002 23,312 7,474 -46 -2,041 973 1 All info taken directly from Zoom's 10-k posted to their website. https://investors.zoom.usode/10041/html 2 Decrease is denoted by a subtraction symbol in the difference category 3 4 5 6 Cash Flows from Operating Activites 7 Net Income 8 Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities 9 Stock Based Compensation Expense 10 Income Tax benefit from release of valuation allowance 11 Amortization of Deferred Contract Acquistion Costs 12 Gains on Strategic Investments, net 13 Deprecition and Amortization 14 Provision for Accounts Receivable Allowances 15 Non-Cash operating lease cost 16 Charitable donation of Common Stock 17 Amortization on Marketable Securities 18 Other 19 Changes in Operating Assets and Liabilities 20 Accounts Receivable 21 Prepaid Expenses and other Assets 22 Deferred Contract Acquisition Costs 23 Accounts Payable 24 Accrued Expenses and other Liabilities 25 Deferred Revenue 26 Operating Lease Liabilities, Net 27 Net Cash Provided By Operating Activities 28 29 Cash Flows From Investing Activities 30 Purchases of Marketable Securities 31 Maturities of Marketable Securities 32 Sales of Marketable Securities 33 Purchases of Property and Equipment 34 Purchases of Strategic Investments 35 Cash paid for Acquisition, net of cash acquired 36 Purchases of Intangible assets 37 Other 38 Net Cash Used in Investing Activities 39 40 Cash Flows From Financing Activities 41 Proceeds from issuance of common stock for employee stock purchase plan 42 Proceeds from exerise of stock options, net of repurchases 43 Proceeds from employee equity transactions (remitted) to be remitted to employeees and tax authorities, net 44 Proceeds from follow-on public offering, net of underwriting discounts and comissions and other offering costs 45 Proceeds from initial public offering and private placement, net of underwriting discounts and comissions and other offering costs 46 Other 47 Net Cash Provided by Financing Activities 48 49 Net (Decrease) increase in cash, cash equivalents, and restricted cash 50 Cash at beginning of period 51 Cash at end of period 52 -219,039 -68,521 -307,068 3,481 251,654 665,724 -6,379 1,471,177 $ -64,715 -24,805 -72,714 -2,030 51,179 106,286 -5,460 151,892 $ -154,324 -43,716 -234,354 5,511 200,475 559,438 -919 1,319,285 $ -800,228 343,554 -2,056,470 580,795 36,897 -79,972 -13,000 -26,486 -5,843 1,659 (1,562,420) $ -38,084 -3,000 -1,256,242 237,241 36,897 -41,888 -10,000 -26,486 -5,702 3,228 (1,062,952) -141 -1,569 (499,468) $ $ 38,433 28,550 4,088 1,979,206 15,482 9,169 48,547 22,951 19,381 -44,459 1,979,206 -542,492 542,492 $ 2,050,277 $ 615,690 $ 1,434,587 1,959,034 334,082 2,293,116 $ 268,114 65,968 334,082 $ 1,690,920 268,114 1,959,034 $ Sheet1 Sheet2 + Ready m E + 90% Excel File Edit View Insert Format Tools Data Window Help Thu Apr 7 1:31 PM AutoSave OFF Doc ** SOCF ALMOST DONE 121 fx A B C D E F G I J L Statement of Cash Flows For the Years Ended December 31st 2020 and 2021 (In Thousands of U.S $) 2021 2020 Difference Increase or Decrease 672,316 25,305 647,011 275,818 73,109 202,709 37,101 104,306 -2,538 28,857 32,007 10,887 23,312 5,433 927 16,449 6,370 6,885 67,205 -2,538 12,408 25,637 4,002 23,312 7,474 -46 -2,041 973 1 All info taken directly from Zoom's 10-k posted to their website. https://investors.zoom.usode/10041/html 2 Decrease is denoted by a subtraction symbol in the difference category 3 4 5 6 Cash Flows from Operating Activites 7 Net Income 8 Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities 9 Stock Based Compensation Expense 10 Income Tax benefit from release of valuation allowance 11 Amortization of Deferred Contract Acquistion Costs 12 Gains on Strategic Investments, net 13 Deprecition and Amortization 14 Provision for Accounts Receivable Allowances 15 Non-Cash operating lease cost 16 Charitable donation of Common Stock 17 Amortization on Marketable Securities 18 Other 19 Changes in Operating Assets and Liabilities 20 Accounts Receivable 21 Prepaid Expenses and other Assets 22 Deferred Contract Acquisition Costs 23 Accounts Payable 24 Accrued Expenses and other Liabilities 25 Deferred Revenue 26 Operating Lease Liabilities, Net 27 Net Cash Provided By Operating Activities 28 29 Cash Flows From Investing Activities 30 Purchases of Marketable Securities 31 Maturities of Marketable Securities 32 Sales of Marketable Securities 33 Purchases of Property and Equipment 34 Purchases of Strategic Investments 35 Cash paid for Acquisition, net of cash acquired 36 Purchases of Intangible assets 37 Other 38 Net Cash Used in Investing Activities 39 40 Cash Flows From Financing Activities 41 Proceeds from issuance of common stock for employee stock purchase plan 42 Proceeds from exerise of stock options, net of repurchases 43 Proceeds from employee equity transactions (remitted) to be remitted to employeees and tax authorities, net 44 Proceeds from follow-on public offering, net of underwriting discounts and comissions and other offering costs 45 Proceeds from initial public offering and private placement, net of underwriting discounts and comissions and other offering costs 46 Other 47 Net Cash Provided by Financing Activities 48 49 Net (Decrease) increase in cash, cash equivalents, and restricted cash 50 Cash at beginning of period 51 Cash at end of period 52 -219,039 -68,521 -307,068 3,481 251,654 665,724 -6,379 1,471,177 $ -64,715 -24,805 -72,714 -2,030 51,179 106,286 -5,460 151,892 $ -154,324 -43,716 -234,354 5,511 200,475 559,438 -919 1,319,285 $ -800,228 343,554 -2,056,470 580,795 36,897 -79,972 -13,000 -26,486 -5,843 1,659 (1,562,420) $ -38,084 -3,000 -1,256,242 237,241 36,897 -41,888 -10,000 -26,486 -5,702 3,228 (1,062,952) -141 -1,569 (499,468) $ $ 38,433 28,550 4,088 1,979,206 15,482 9,169 48,547 22,951 19,381 -44,459 1,979,206 -542,492 542,492 $ 2,050,277 $ 615,690 $ 1,434,587 1,959,034 334,082 2,293,116 $ 268,114 65,968 334,082 $ 1,690,920 268,114 1,959,034 $ Sheet1 Sheet2 + Ready m E + 90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts