Question: prepare a statement of cash flows using the indirect method of presenting cash flows from operating activities Statement of Cash Flows-Indirect Method The comparative balance

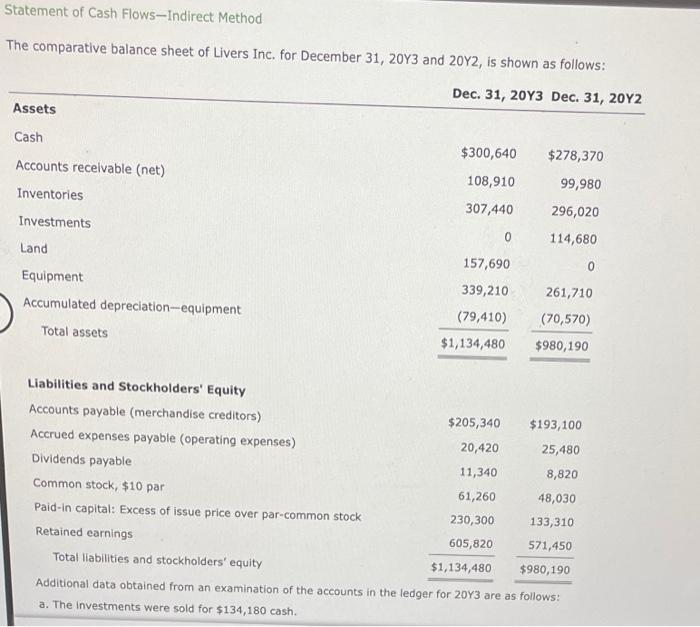

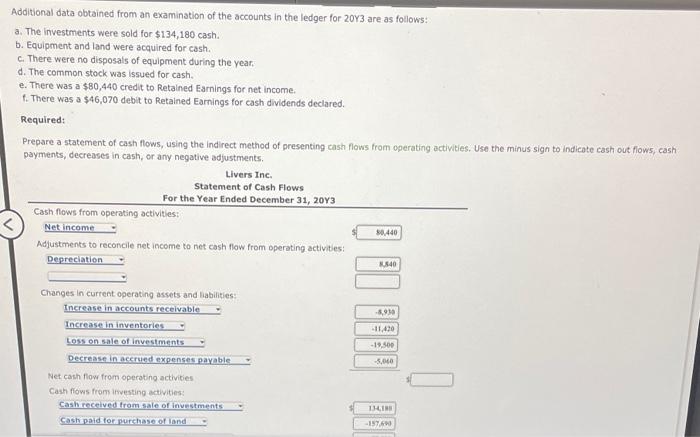

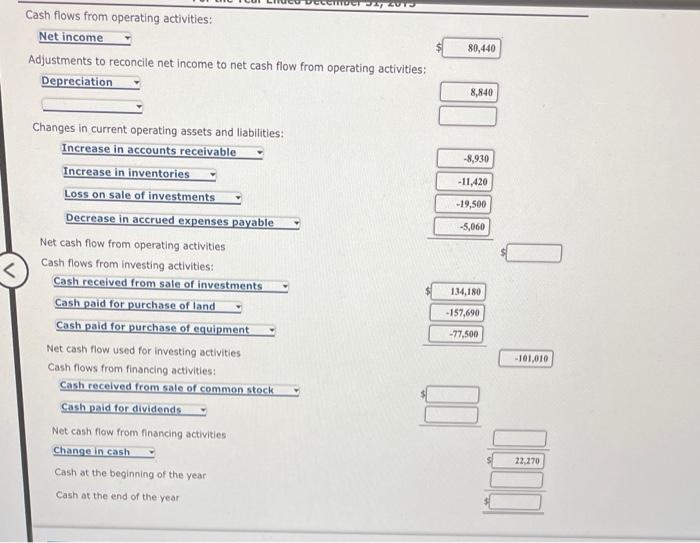

Statement of Cash Flows-Indirect Method The comparative balance sheet of Livers Inc. for December 31, 2013 and 2042, is shown as follows: Dec. 31, 20Y3 Dec. 31, 20Y2 Assets Cash $300,640 Accounts receivable (net) $278,370 99,980 108,910 Inventories 307,440 Investments 296,020 0 114,680 Land 157,690 0 339,210 Equipment Accumulated depreciation-equipment Total assets (79,410) $1,134,480 261,710 (70,570) $980,190 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $205,340 $193,100 Accrued expenses payable (operating expenses) 20,420 25,480 Dividends payable 11,340 8,820 Common stock, $10 par 61,260 48,030 Paid-in capital: Excess of issue price over par-common stock 230,300 133,310 Retained earnings 605,820 571,450 Total liabilities and stockholders' equity $1,134,480 $980, 190 Additional data obtained from an examination of the accounts in the ledger for 2013 are as follows: a. The investments were sold for $134,180 cash. Additional data obtained from an examination of the accounts in the ledger for 2073 are as follows: a. The investments were sold for $134,180 cash. b. Equipment and land were acquired for cash. c. There were no disposals of equipment during the year, d. The common stock was issued for cash. e. There was a $80,440 credit to Retained Earnings for net income f. There was a $46,070 debit to retained Earnings for cash dividends declared. Required: Prepare a statement of cash Mows, using the Indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments Livers Inc. Statement of Cash Flows For the Year Ended December 31, 2083 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation 30.440 0540 8,91 11,420 -19.500 Changes in current operating assets and liabilities: Increase in accounts receivable Increase in Inventories Low on sale of investments Decrease in accrued expenses payable Net cash flow from operating activities Cash flows from investing activities Cash received from sale of investments Cash paid for purchase of land -5,000 IHIN -19760 TUT Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation 80,440 8,840 -8,930 - 11,420 -19,500 -5,060 Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Loss on sale of investments Decrease in accrued expenses payable Net cash flow from operating activities Cash flows from investing activities: Cash received from sale of investments Cash paid for purchase of land Cash paid for purchase of equipment Net cash flow used for investing activities Cash flows from financing activities: Cash received from sale of common stock Cash paid for dividends Net cash flow from financing activities 134,180 - 157,690 -77,500 -101,010 10 Change in cash 22,270 Cash at the beginning of the year Cash at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts