Question: Prepare a statement of cash flows (using the indirect method) for 2021 for Donna Company. (Show amounts that decrease cash flow with either a -

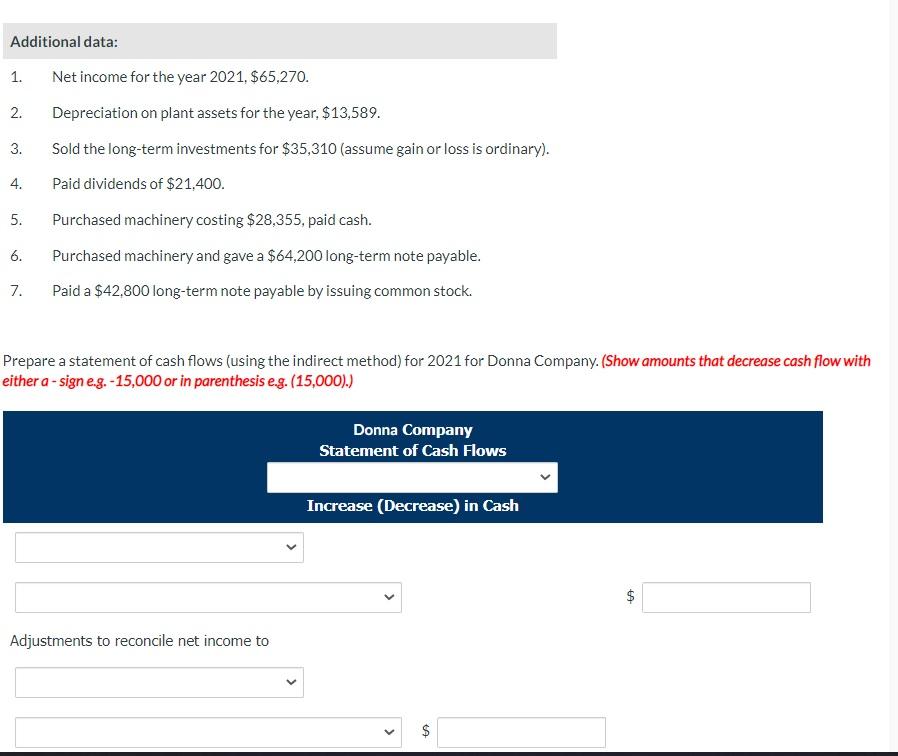

Prepare a statement of cash flows (using the indirect method) for 2021 for Donna Company. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

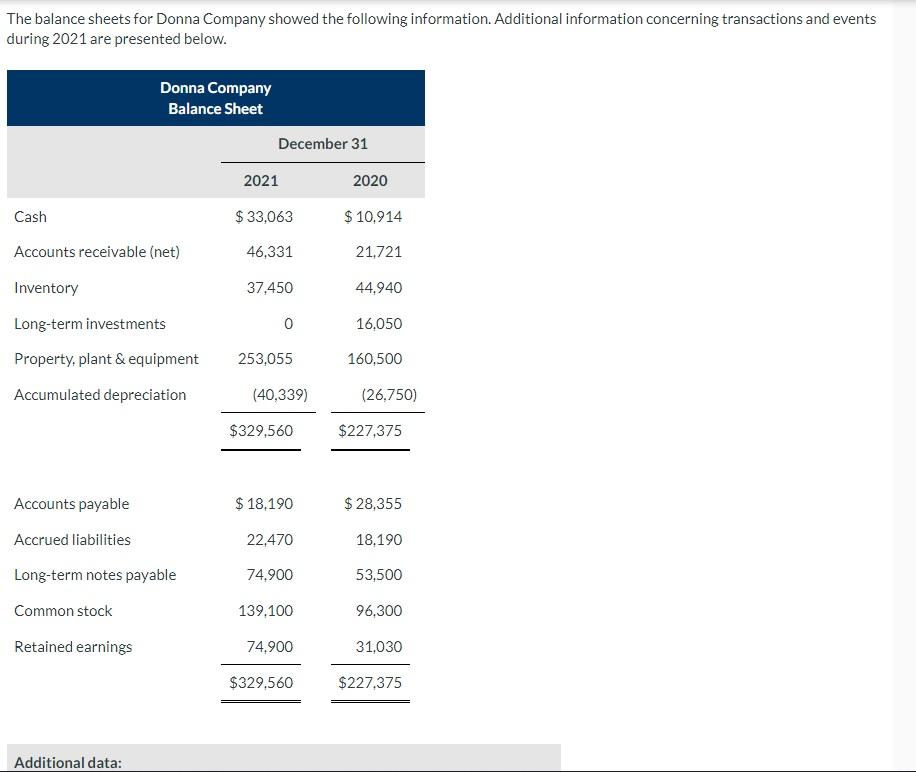

The balance sheets for Donna Company showed the following information. Additional information concerning transactions and events during 2021 are presented below. Donna Company Balance Sheet December 31 2021 Cash $ 33,063 Accounts receivable (net) 46,331 Inventory 37,450 Long-term investments 0 Property, plant & equipment 253,055 Accumulated depreciation Accounts payable Accrued liabilities Long-term notes payable Common stock Retained earnings Additional data: (40,339) $329,560 $ 18,190 22,470 74,900 139,100 74,900 $329,560 2020 $ 10,914 21,721 44,940 16,050 160,500 (26,750) $227,375 $ 28,355 18,190 53,500 96,300 31,030 $227,375 Additional data: 1. Net income for the year 2021, $65,270. 2. Depreciation on plant assets for the year, $13,589. 3. Sold the long-term investments for $35,310 (assume gain or loss is ordinary). 4. Paid dividends of $21,400. 5. Purchased machinery costing $28,355, paid cash. 6. Purchased machinery and gave a $64,200 long-term note payable. 7. Paid a $42,800 long-term note payable by issuing common stock. Prepare a statement of cash flows (using the indirect method) for 2021 for Donna Company. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) Donna Company Statement of Cash Flows Increase (Decrease) in Cash Adjustments to reconcile net income to $ 69 $ $ $ A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts