Question: prepare a statement of cash flows using the indirect method for phillips company and its subsidiary for the year ended dec. 31, 2020 Phillips Company

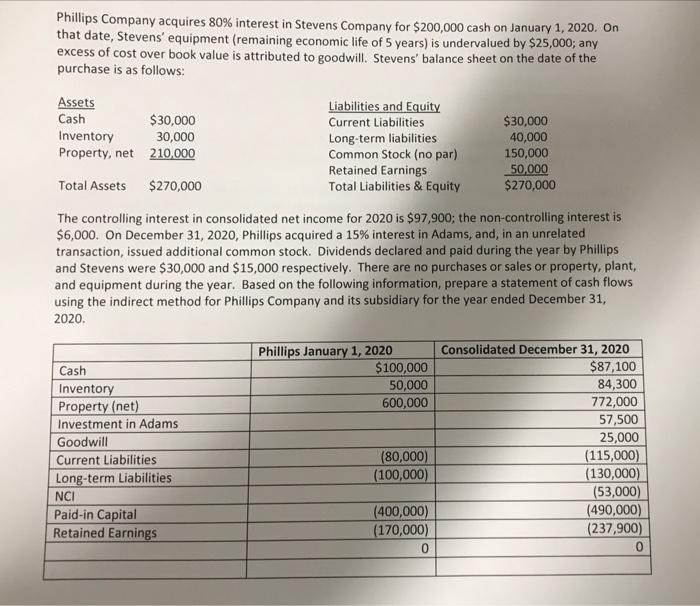

Phillips Company acquires 80% interest in Stevens Company for $200,000 cash on January 1, 2020. On that date, Stevens' equipment (remaining economic life of 5 years) is undervalued by $25,000; any excess of cost over book value is attributed to goodwill. Stevens' balance sheet on the date of the purchase is as follows: Assets Cash $30,000 Inventory 30,000 Property, net 210,000 Liabilities and Equity Current Liabilities Long-term liabilities Common Stock (no par) Retained Earnings Total Liabilities & Equity $30,000 40,000 150,000 50,000 $270,000 Total Assets $270,000 The controlling interest in consolidated net income for 2020 is $97,900; the non-controlling interest is $6,000. On December 31, 2020, Phillips acquired a 15% interest in Adams, and, in an unrelated transaction, issued additional common stock. Dividends declared and paid during the year by Phillips and Stevens were $30,000 and $15,000 respectively. There are no purchases or sales or property, plant, and equipment during the year. Based on the following information, prepare a statement of cash flows using the indirect method for Phillips Company and its subsidiary for the year ended December 31, 2020. Phillips January 1, 2020 $100,000 50,000 600,000 Cash Inventory Property (net) Investment in Adams Goodwill Current Liabilities Long-term Liabilities NCI Paid-in Capital Retained Earnings Consolidated December 31, 2020 $87,100 84,300 772,000 57,500 25,000 (115,000) (130,000) (53,000) (490,000) (237,900) 0 (80,000) (100,000) (400,000) (170,000) 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts