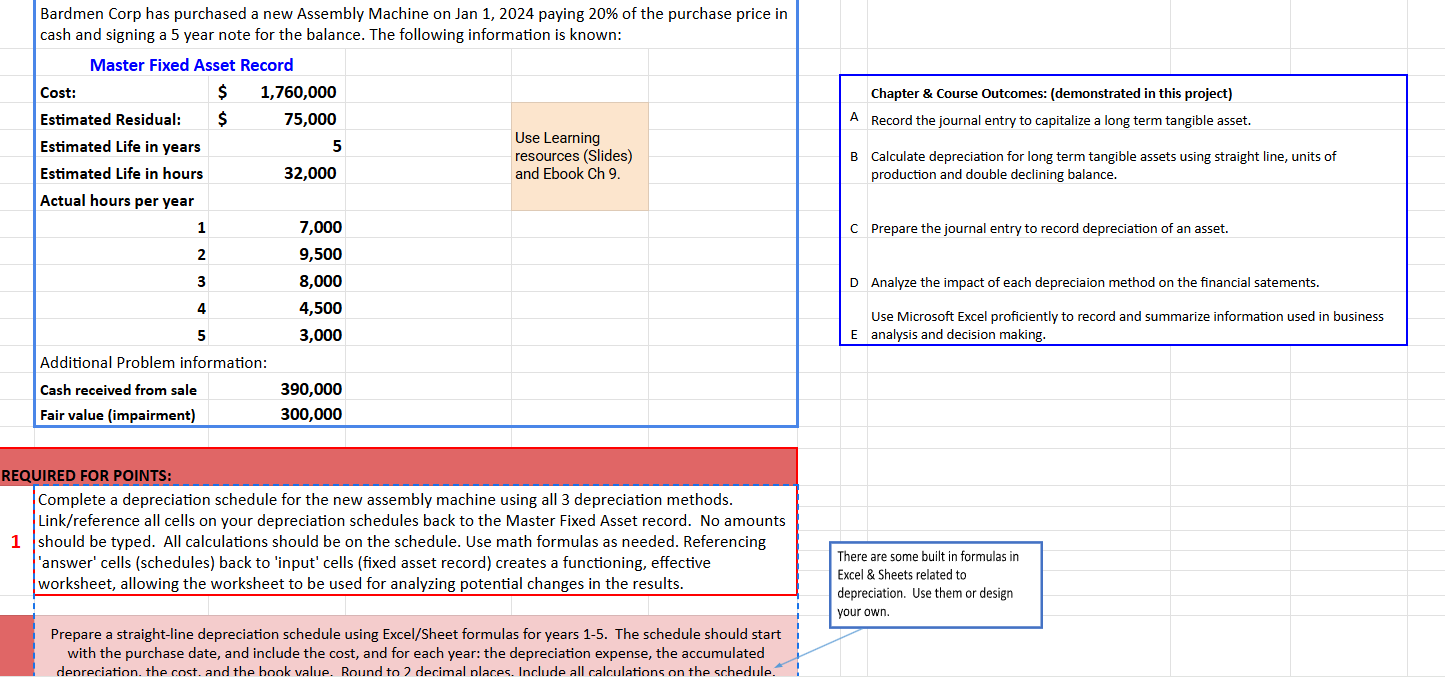

Question: Prepare a straight - line depreciation schedule using Excel / Sheet formulas for years 1 - 5 . The schedule should start with the purchase

Prepare a straightline depreciation schedule using ExcelSheet formulas for years The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to decimal places. Include all calculations on the schedule.

Prepare a units of production depreciation schedule using ExcelSheet formulas for years The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to decimal places. Include all calculations on the schedule. Prepare a double declining balance depreciation schedule using ExcelSheet formulas for years The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to decimal places. Include all calculations on the schedule.

Record the following in the general journal. Linkreference your amounts back to the cells on the depreciation schedule to create a functioning effective multiuse analysis tool for the business.

A Record the entry for the original purchase on Jan Year

B Record the depreciation journal entry for Dec year for all three methods. B Record the depreciation journal entry for Dec year for all three methods.

C Record the journal entry if Assembly Machine sold on Jan Year for both Straightline and DDB methods.

D Record the journal entry if Assembly Machine is written down due to impairment on Dec Year after depreciation recorded for the year for Units of Production method.

E Recalculate ONLY the year depreciation for each method if the machine had been purchased on May E Recalculate ONLY the year depreciation for each method if the machine had been purchased on May rather than Jan Record the new year mathbf journal entry for this change. If no change is needed, please record no change" in the journal entry.

Explain your answers to Req C Are the results different or the same for the methods and why? Response must be supported by the schedule and journal entry response.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock