Question: Prepare a tax return. What line does this information go on a tax return. 2. A payment of $24,600 to Greatwood day care center was

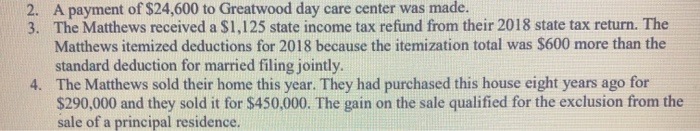

2. A payment of $24,600 to Greatwood day care center was made. 3. The Matthews received a $1,125 state income tax refund from their 2018 state tax return. The Matthews itemized deductions for 2018 because the itemization total was $600 more than the standard deduction for married filing jointly. 4. The Matthews sold their home this year. They had purchased this house eight years ago for $290,000 and they sold it for $450,000. The gain on the sale qualified for the exclusion from the sale of a principal residence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts