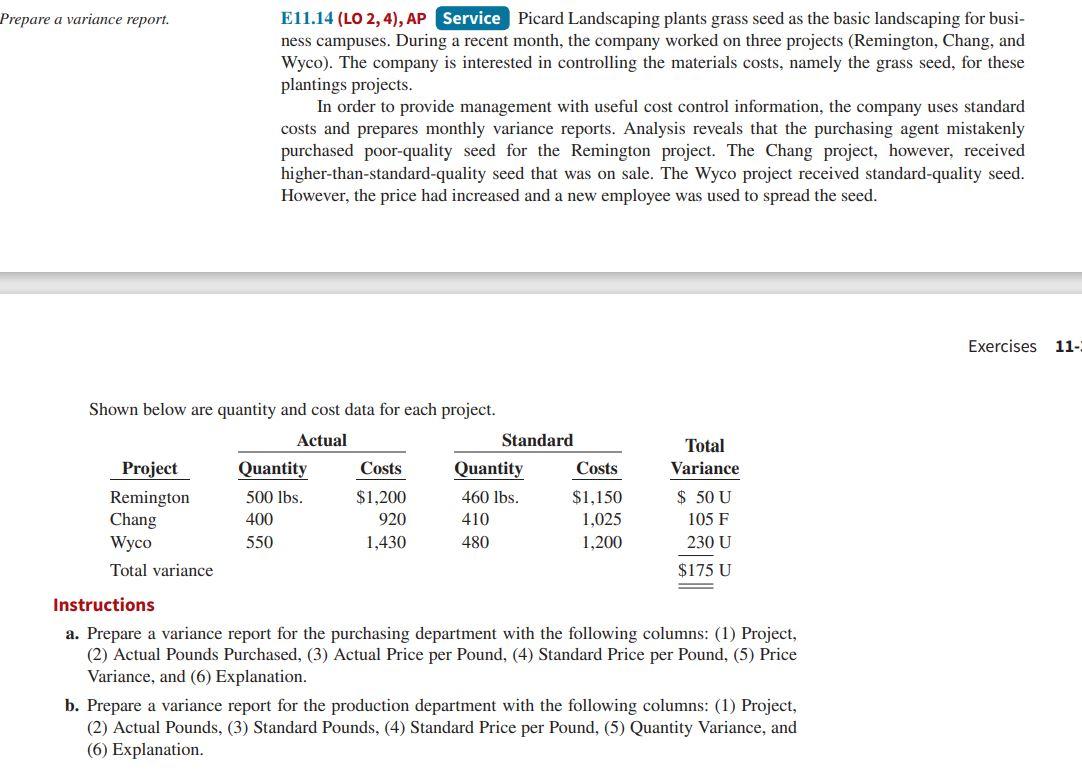

Question: Prepare a variance report. E11.14 (LO 2,4), AP Service Picard Landscaping plants grass seed as the basic landscaping for busi- ness campuses. During a recent

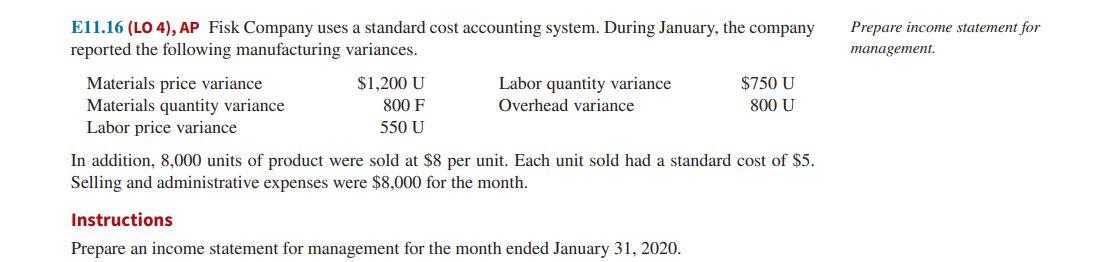

Prepare a variance report. E11.14 (LO 2,4), AP Service Picard Landscaping plants grass seed as the basic landscaping for busi- ness campuses. During a recent month, the company worked on three projects (Remington, Chang, and Wyco). The company is interested in controlling the materials costs, namely the grass seed, for these plantings projects. In order to provide management with useful cost control information, the company uses standard costs and prepares monthly variance reports. Analysis reveals that the purchasing agent mistakenly purchased poor-quality seed for the Remington project. The Chang project, however, received higher-than-standard-quality seed that was on sale. The Wyco project received standard-quality seed. However, the price had increased and a new employee was used to spread the seed. Exercises 11- Shown below are quantity and cost data for each project. Actual Standard Project Quantity Costs Quantity Costs Remington 500 lbs. $1,200 460 lbs. $1,150 Chang 400 920 410 1,025 Wyco 550 1,430 480 1,200 Total variance Total Variance $ 50 U 105 F 230 U $175 U Instructions a. Prepare a variance report for the purchasing department with the following columns: (1) Project, (2) Actual Pounds Purchased, (3) Actual Price per Pound, (4) Standard Price per Pound, (5) Price Variance, and (6) Explanation. b. Prepare a variance report for the production department with the following columns: (1) Project, (2) Actual Pounds, (3) Standard Pounds, (4) Standard Price per Pound, (5) Quantity Variance, and (6) Explanation. Prepare income statement for management E11.16 (LO 4), AP Fisk Company uses a standard cost accounting system. During January, the company reported the following manufacturing variances. Materials price variance $1,200 U Labor quantity variance $750 U Materials quantity variance 800 F Overhead variance 800 U Labor price variance 550 U In addition, 8,000 units of product were sold at $8 per unit. Each unit sold had a standard cost of $5. Selling and administrative expenses were $8,000 for the month. Instructions Prepare an income statement for management for the month ended January 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts