Question: Prepare a working capital forecast for Saanidhya Ltd from the following information: Production level during the previous year was 10 lakh units. During the

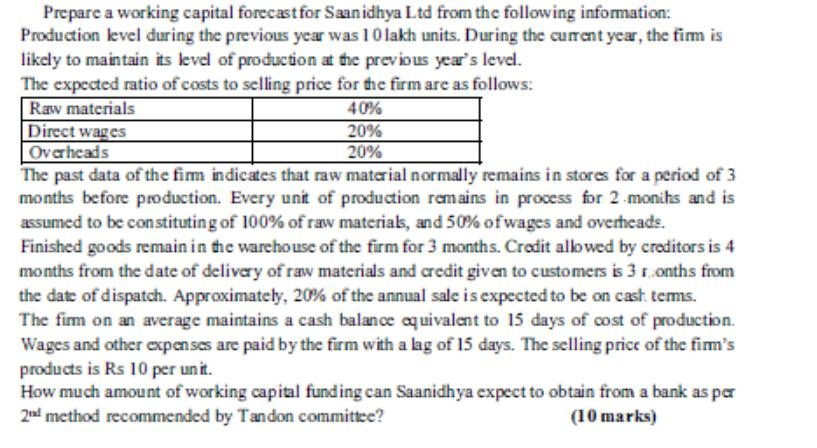

Prepare a working capital forecast for Saanidhya Ltd from the following information: Production level during the previous year was 10 lakh units. During the current year, the firm is likely to maintain its level of production at the previous year's level. The expected ratio of costs to selling price for the firm are as follows: Raw materials Direct wages 40% 20% 20% Overheads The past data of the firm indicates that raw material normally remains in stores for a period of 3 months before production. Every unit of production remains in process for 2 months and is assumed to be constituting of 100% of raw materials, and 50% of wages and overheads. Finished goods remain in the warehouse of the firm for 3 months. Credit allowed by creditors is 4 months from the date of delivery of raw materials and credit given to customers is 31, onths from the date of dispatch. Approximately, 20% of the annual sale is expected to be on cash terms. The firm on an average maintains a cash balance equivalent to 15 days of cost of production. Wages and other expenses are paid by the firm with a lag of 15 days. The selling price of the firm's products is Rs 10 per unit. How much amount of working capital funding can Saanidhya expect to obtain from a bank as per 2nd method recommended by Tandon committee? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Production level 10 lakh units Selling price per unit Rs 10 Ratio of costs to selling price Raw mate... View full answer

Get step-by-step solutions from verified subject matter experts