Question: Prepare a worksheet like Exhibit 15-9 for Alcorn Products. Using the indirect method, prepare a statement of cash flows for 200S. What problems relating to

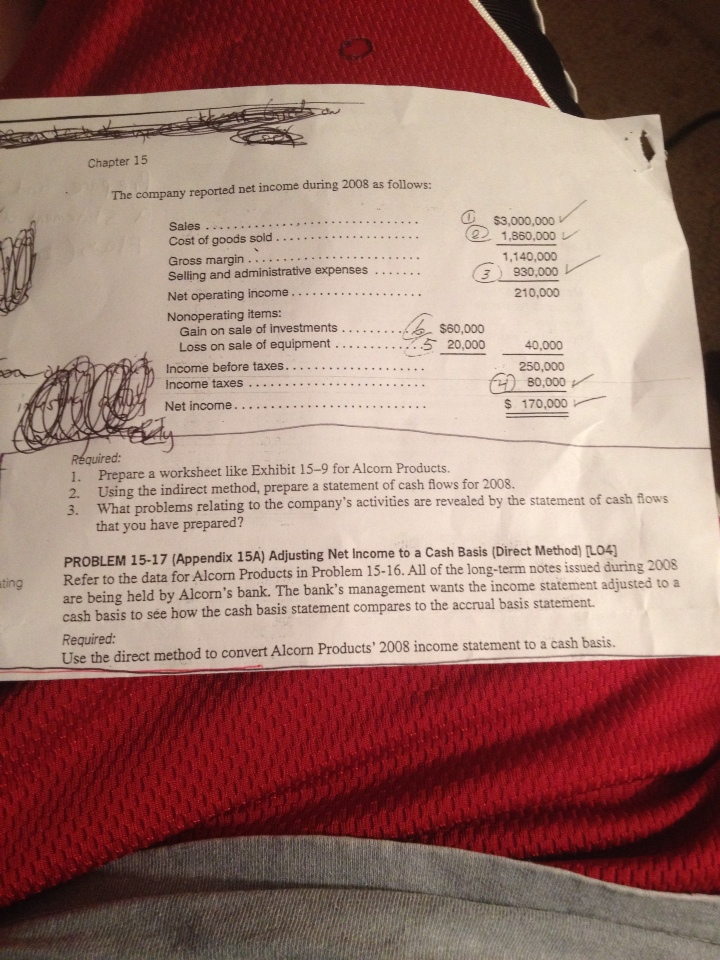

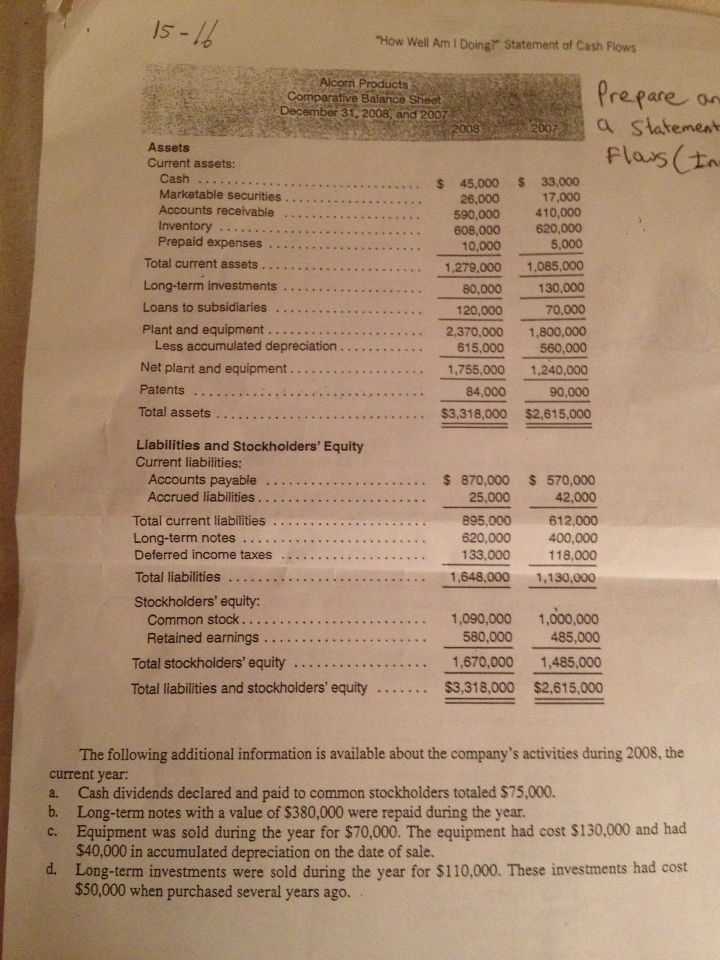

Prepare a worksheet like Exhibit 15-9 for Alcorn Products. Using the indirect method, prepare a statement of cash flows for 200S. What problems relating to the company's activities are revealed by the statement of cash flows that you have prepared? (Appendix 15A) Adjusting Net income to a Cash Basis (Direct Method) [LO4] Refer to the data for Alcorn Products in Problem 15-16. .All of the long-term notes issued during 2008 are being held by Alcorn's bank. The bank's management wants the income statement adjusts cash basis to see how the cash basis statement compares to the accrual basis statement. Required: Use the direct method to convert Alcorn Product's 2008 income statement to a cash basis. The following additional information is available about the company's activities during 2008. the current year: Cash dividends declared and paid to common stockholders totaled $75, 000. Long-term notes with a value of $380,000 were repaid during the year. Equipment was sold during the year for $70,000. The equipment had cost $130,000 and had $40,000 in accumulated depreciation on the date of sale. Long-term investments were sold during the year for $110, 000. These investments had cost $50, 000 when purchased several years ago. Prepare a worksheet like Exhibit 15-9 for Alcorn Products. Using the indirect method, prepare a statement of cash flows for 200S. What problems relating to the company's activities are revealed by the statement of cash flows that you have prepared? (Appendix 15A) Adjusting Net income to a Cash Basis (Direct Method) [LO4] Refer to the data for Alcorn Products in Problem 15-16. .All of the long-term notes issued during 2008 are being held by Alcorn's bank. The bank's management wants the income statement adjusts cash basis to see how the cash basis statement compares to the accrual basis statement. Required: Use the direct method to convert Alcorn Product's 2008 income statement to a cash basis. The following additional information is available about the company's activities during 2008. the current year: Cash dividends declared and paid to common stockholders totaled $75, 000. Long-term notes with a value of $380,000 were repaid during the year. Equipment was sold during the year for $70,000. The equipment had cost $130,000 and had $40,000 in accumulated depreciation on the date of sale. Long-term investments were sold during the year for $110, 000. These investments had cost $50, 000 when purchased several years ago

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts