Question: Prepare a written response: 1. Based on the attached balance sheet, answer the questions about the companys cash flows for the year. An income statement

October | November | December | |

Sales | $ 65,000 | $ 55,000 | $ 52,000 |

Cash Receipts | |||

Cash sales | $ 48,750 | $ 41,250 | $ 39,000 |

1-month lag sales | 15,000 | 16,250 | 13,750 |

Total Cash Receipts | $ 63,750 | $ 57,500 | $ 52,750 |

Cash Disbursements | |||

Purchases | $ 45,500 | $ 38,500 | $ 36,400 |

Wages | 12,000 | 13,000 | 11,000 |

Rent | 2,000 | 2,000 | 2,000 |

Sales Tax | 3,250 | 2,750 | 2,600 |

Income Tax | - | - | 12,000 |

Utilities | 400 | 400 | 400 |

Total Cash Disbursements | $ 63,150 | $ 56,650 | $ 64,400 |

Net Cash Flow | $ 600 | $ 850 | $ (11,650) |

Beginning Balance | 1,250 | $ 1,850 | $ 2,700 |

Ending Balance | $ 1,850 | $ 2,700 | $ (8,950) |

Minimum Cash Balance | 1,500 | 1,500 | 1,500 |

Excess Cash or Required Financing | $ 350 | $ 1,200 | $ (10,450) |

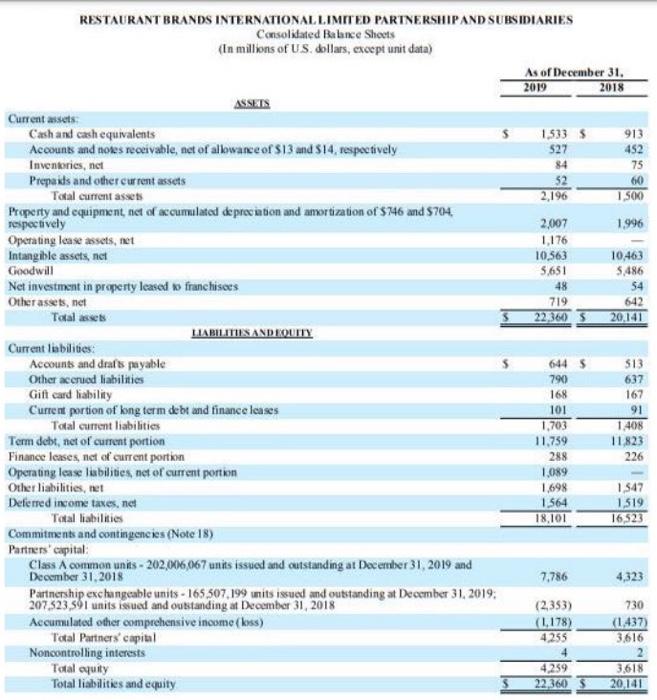

60 642 RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP AND SUBSIDIARIES Consolidated Balance Sheets (In millions of US dollars, except unit data) As of December 31. 2019 2018 ASSETS Current assets: Cash and cash equivalents 1.5335 913 Accounts and notes receivable, net of allowanceof S13 and 514, respectively 527 452 Inventories, net 75 Prepaids and other current assets 52 Total current assets 2,196 1,500 Property and equipment, net of accumulated depreciation and amortization of $746 and 8704, respectively 2,007 1996 Operating lease assets, net 1,176 Intangible assets, net 10,563 10,463 Goodwill 5,651 5,486 Net investment in property leased franchises 48 Other assets, net 719 Total assets 22,360 5 20,141 LIABILITIES AND EQUITY Current liabilities: Accounts and drafts payable 6445 513 Other accrued liabilities 790 Gift card liability 168 167 Current portion of long term debt and finance leases Total current liabilities 1,703 Term debt, net of current portion 11.759 11823 Finance leases, net of current portion 288 226 Operating lease libilities net of current portion Other liabilities, net 1.698 1.547 Deferred income taxes, net 1.564 1,519 Total liabilities 18,101 16,523 Commitments and contingencies (Note 18) Partners' capital Class A common units - 202,006,067 units issued and outstanding at December 31, 2019 and December 31, 2018 7,786 4,323 Partnership exchangeable units - 165,507.199 units issued and outstanding at December 31, 2019: 207.523,591 units isued and outstanding at December 31, 2018 (2,353) Accumulated other comprehensive income (koss) (L.178) (1.437) Total Partners' capital 4.255 3.616 Noncontrolling interests Total aquity 4.259 3,618 Total liabilities and equity 20,141 637 101 91 1.408 1,089 730 22,360 $ 60 642 RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP AND SUBSIDIARIES Consolidated Balance Sheets (In millions of US dollars, except unit data) As of December 31. 2019 2018 ASSETS Current assets: Cash and cash equivalents 1.5335 913 Accounts and notes receivable, net of allowanceof S13 and 514, respectively 527 452 Inventories, net 75 Prepaids and other current assets 52 Total current assets 2,196 1,500 Property and equipment, net of accumulated depreciation and amortization of $746 and 8704, respectively 2,007 1996 Operating lease assets, net 1,176 Intangible assets, net 10,563 10,463 Goodwill 5,651 5,486 Net investment in property leased franchises 48 Other assets, net 719 Total assets 22,360 5 20,141 LIABILITIES AND EQUITY Current liabilities: Accounts and drafts payable 6445 513 Other accrued liabilities 790 Gift card liability 168 167 Current portion of long term debt and finance leases Total current liabilities 1,703 Term debt, net of current portion 11.759 11823 Finance leases, net of current portion 288 226 Operating lease libilities net of current portion Other liabilities, net 1.698 1.547 Deferred income taxes, net 1.564 1,519 Total liabilities 18,101 16,523 Commitments and contingencies (Note 18) Partners' capital Class A common units - 202,006,067 units issued and outstanding at December 31, 2019 and December 31, 2018 7,786 4,323 Partnership exchangeable units - 165,507.199 units issued and outstanding at December 31, 2019: 207.523,591 units isued and outstanding at December 31, 2018 (2,353) Accumulated other comprehensive income (koss) (L.178) (1.437) Total Partners' capital 4.255 3.616 Noncontrolling interests Total aquity 4.259 3,618 Total liabilities and equity 20,141 637 101 91 1.408 1,089 730 22,360 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts