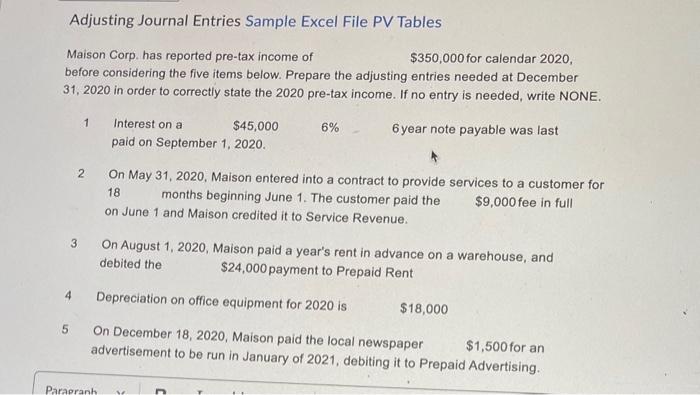

Question: prepare adjusting entries Adjusting Journal Entries Sample Excel File PV Tables Maison Corp. has reported pre-tax income of $350,000 for calendar 2020 , before considering

Adjusting Journal Entries Sample Excel File PV Tables Maison Corp. has reported pre-tax income of $350,000 for calendar 2020 , before considering the five items below. Prepare the adjusting entries needed at December 31,2020 in order to correctly state the 2020 pre-tax income. If no entry is needed, write NONE. 1 Interest on a $45,0006%6 year note payable was last paid on September 1, 2020. 2 On May 31, 2020. Maison entered into a contract to provide services to a customer for 18 months beginning June 1. The customer paid the $9,000 fee in full on June 1 and Maison credited it to Service Revenue. 3 On August 1, 2020, Maison paid a year's rent in advance on a warehouse, and debited the \$24,000 payment to Prepaid Rent 4 Depreciation on office equipment for 2020 is $18,000 5 On December 18, 2020, Maison paid the local newspaper $1,500 for an advertisement to be run in January of 2021, debiting it to Prepaid Advertising

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts