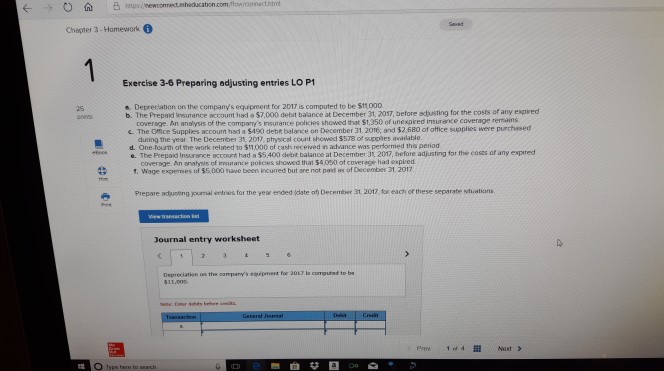

Question: ** Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations. Chapter 3-Homework Exercise 3-6 Prepering

** Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations.

Chapter 3-Homework Exercise 3-6 Prepering adjusting entries LO P1 Depreciation on the company's equipment for 2017 is computed to be $11,000 b. The Prepad insurance Kcount had S7 000 debi, balance at December 31, 2017, before adjusting for the costs of any expred powm coverage. An anolysis of the comparty's insurance policies showed that $1,350 of unexpired insurarce coverage remains c. The Office Supplies account had a $490 debt belance on December 31. 2016, and $2.680 of office supplies were purchssed during the year. The December 31. 2017. physicel count showed $578 of suppies available d. One-fourth of me work rel ned $1000 of cash verved n advance was performed this period e. The Prepaid Insurarce account had a $5.400 debit balance at December 31, 2017, befare adjusting for the costs of any expired coverage An analysis of insutance poloes showed that $4,0%0 of coverage had expired t. Wage expeses of $5,000 have been incurred but are not paid os of Dacember 31.2017 Prepare adueting yournal entres for the yeax ended idste of) December 31, 2017, tor each of these separate stualians Journal entry worksheet Deprediation on the company's eaigment for 3017 is computed to ba

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts