Question: Prepare all entries for Crane Central Ltd. from June 29, 2023, to December 31, 2024, Crane Central has a calendar year fiscal period. The head

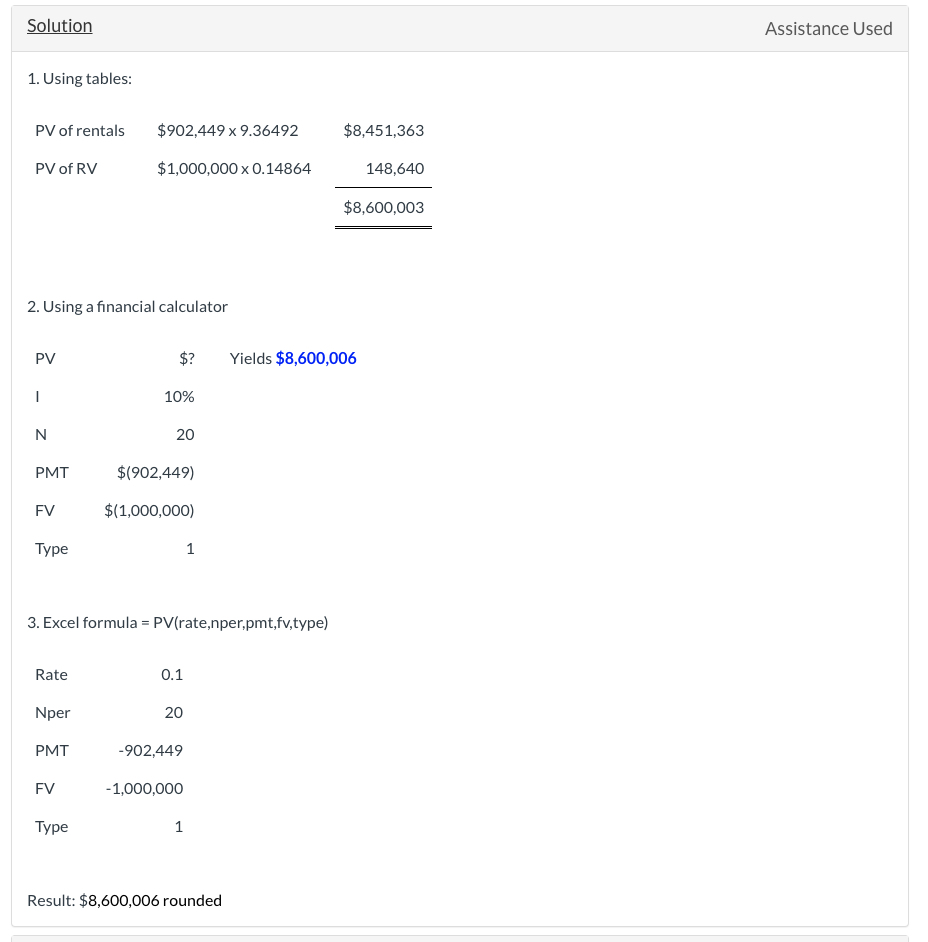

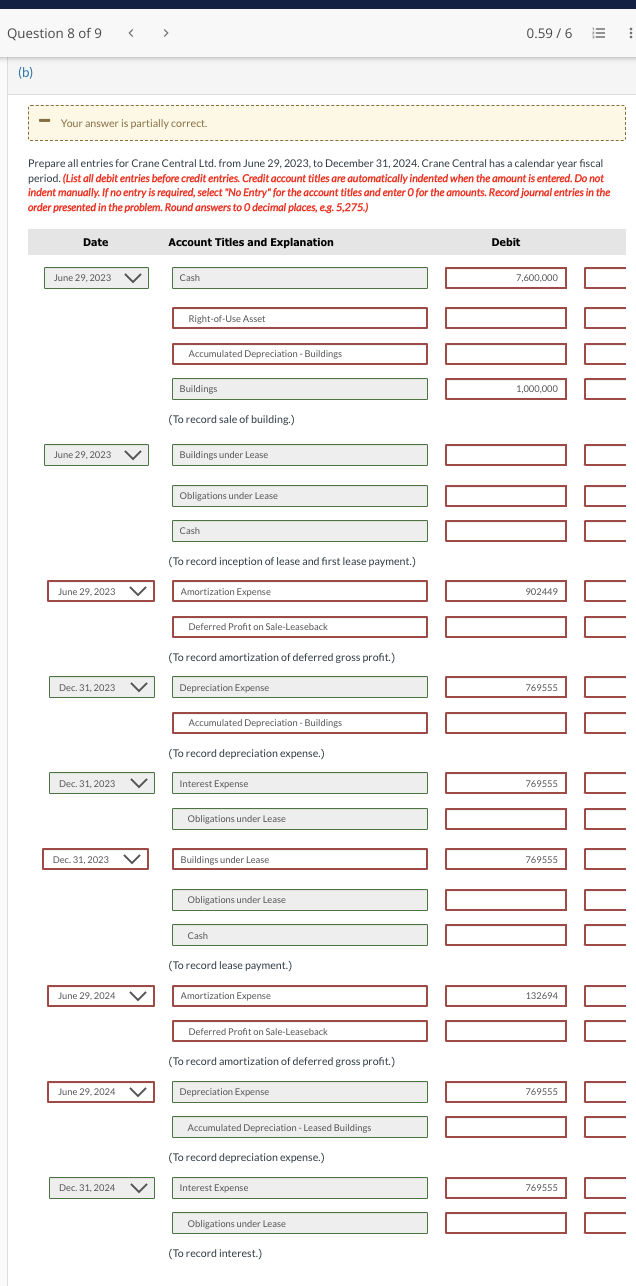

Prepare all entries for Crane Central Ltd. from June 29, 2023, to December 31, 2024, Crane Central has a calendar year fiscal period.

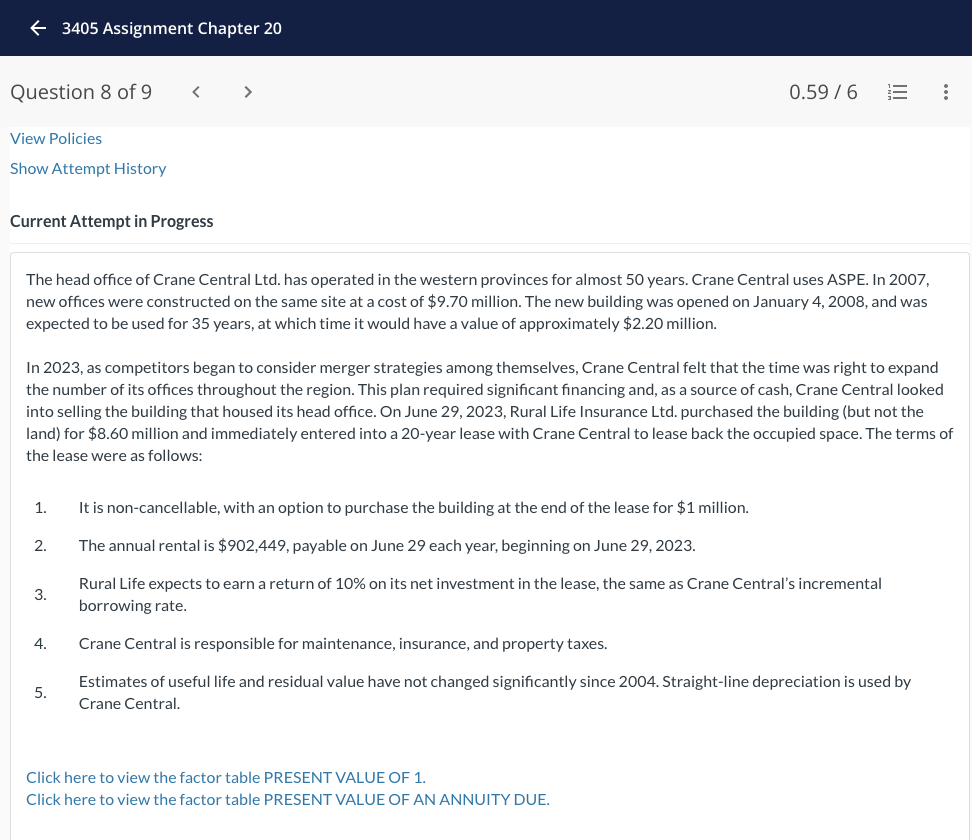

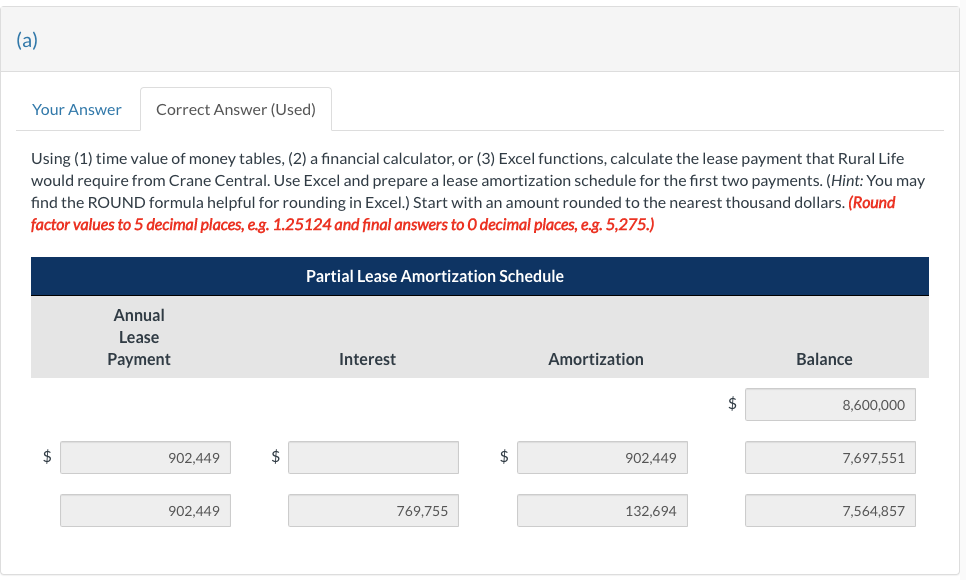

The head office of Crane Central Ltd. has operated in the western provinces for almost 50 years. Crane Central uses ASPE. In 2007, new offices were constructed on the same site at a cost of $9.70 million. The new building was opened on January 4,2008 , and was expected to be used for 35 years, at which time it would have a value of approximately $2.20 million. In 2023, as competitors began to consider merger strategies among themselves, Crane Central felt that the time was right to expand the number of its offices throughout the region. This plan required significant financing and, as a source of cash, Crane Central looked into selling the building that housed its head office. On June 29, 2023, Rural Life Insurance Ltd. purchased the building (but not the land) for $8.60 million and immediately entered into a 20 -year lease with Crane Central to lease back the occupied space. The terms o the lease were as follows: 1. It is non-cancellable, with an option to purchase the building at the end of the lease for $1 million. 2. The annual rental is $902,449, payable on June 29 each year, beginning on June 29,2023 . 3. Rural Life expects to earn a return of 10% on its net investment in the lease, the same as Crane Central's incremental borrowing rate. 4. Crane Central is responsible for maintenance, insurance, and property taxes. 5. Estimates of useful life and residual value have not changed significantly since 2004. Straight-line depreciation is used by Crane Central. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using (1) time value of money tables, (2) a financial calculator, or (3) Excel functions, calculate the lease payment that Rural Life would require from Crane Central. Use Excel and prepare a lease amortization schedule for the first two payments. (Hint: You may find the ROUND formula helpful for rounding in Excel.) Start with an amount rounded to the nearest thousand dollars. (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) 1. Using tables: 2. Using a financial calculator 3. Excel formula =PV( rate,nper,pmt,fv,type ) Result: $8,600,006 rounded Prepare all entries for Crane Central Ltd. from June 29, 2023, to December 31, 2024. Crane Central has a calendar year fiscal period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record joumal entries in the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts