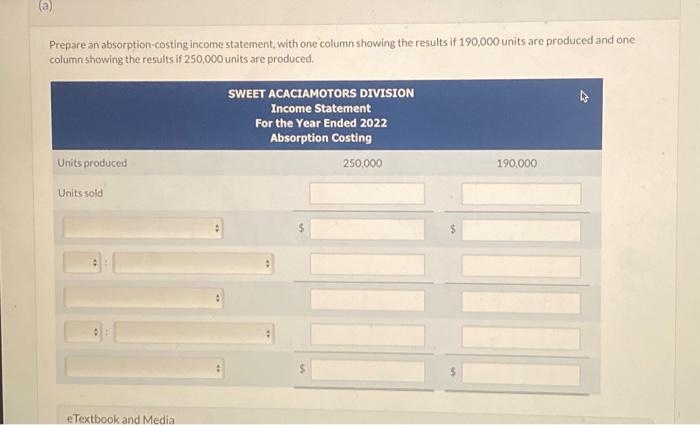

Question: Prepare an absorption-costing income statement, with one column showing the results if 190,000 units are produced and one column showing the results if 250,000 units

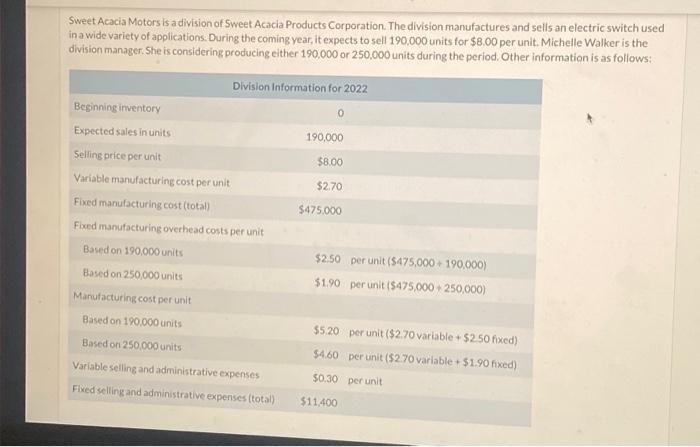

Prepare an absorption-costing income statement, with one column showing the results if 190,000 units are produced and one column showing the results if 250,000 units are produced. Sweet Acacia Motors is a division of Sweet Acacia Products Corporation. The division manufactures and sells an electric switch used in a wide variety of applications. During the coming vear, it expects to sell 190,000 units for $8.00 per unit. Michelle Waller is the division manager. She is considering producing either 190,000 or 250,000 units durine the beriod. Other information is as follows

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock