Question: prepare an adjusted journal entry for these ajusting entries AC 300-02 Fall 2019 The following information is available related to adjusting entries prior to preparing

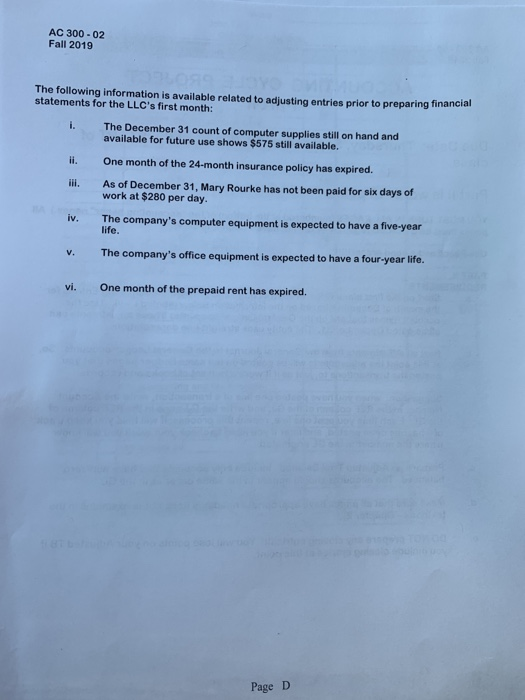

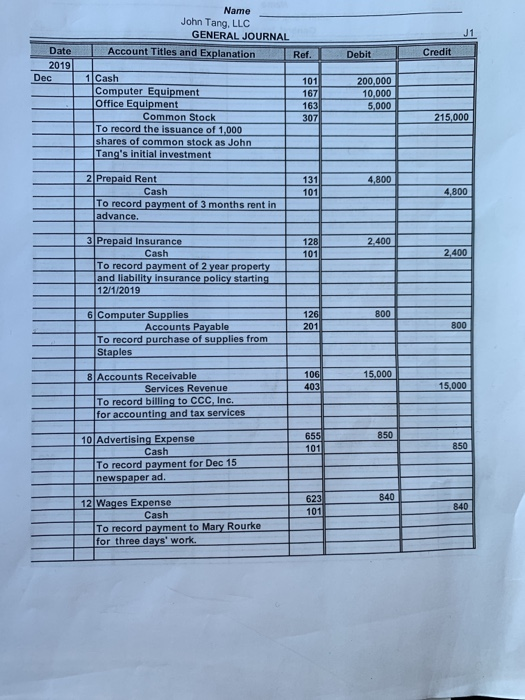

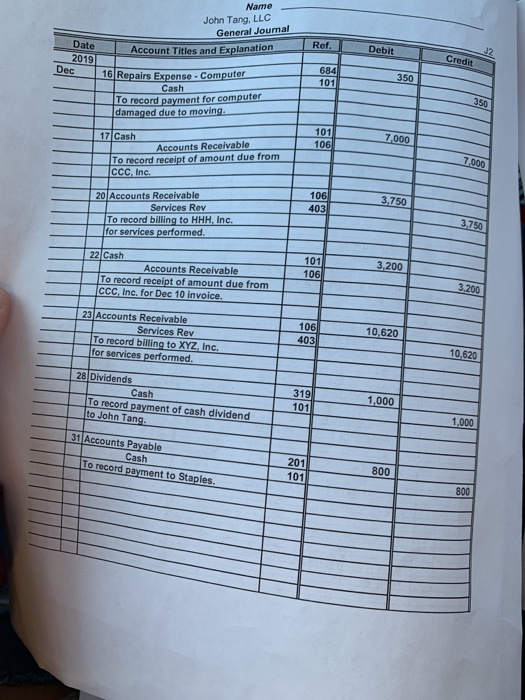

AC 300-02 Fall 2019 The following information is available related to adjusting entries prior to preparing financial statements for the LLC's first month: The December 31 count of computer supplies still on hand and available for future use shows $575 still available. One month of the 24-month insurance policy has expired. As of December 31, Mary Rourke has not been paid for six days of work at $280 per day. The company's computer equipment is expected to have a five-year life. V. The company's office equipment is expected to have a four-year life. vi. One month of the prepaid rent has expired. Page D Name John Tang, LLC GENERAL JOURNAL Account Titles and Explanation Ref. Debit Credit Date 2019 Dec 1 Cash Computer Equipment loffice Equipment Common Stock To record the issuance of 1,000 Ishares of common stock as John Tang's initial investment 101 167 1631 3071 2 00.000 1 0.000 5,000 215.000 4.800 131 1011 4.800 2. Prepaid Rent Cash To record payment of 3 months rent in advance. 2.400 128 101 2.400 3 Prepaid Insurance Cash To record payment of 2 year property and liability Insurance policy starting 12/1/2019 126 201 8 00 BOO 6 Computer Supplies Accounts Payable To record purchase of supplies from Staples 1 5,000 106 403 15.000 B Accounts Receivable Services Revenue To record billing to CCC Inc. for accounting and tax services 8 50 655 101 850 10 Advertising xpense Cash To record payment for Dec 15 newspaper ad. T 8 40 623 1011 12 Wages Expense Cash To record payment to Mary Rourke for three days' work. Name John Tang, LLC General Journal Account Titles and Explanation Ref. Date 2019 Dec Credit 684 101 350 16 Repairs Eynense. Computer Cash Jo record payment for computer damaged due to moving 1101 106 17 Cash Accounts Receivable To record receipt of amount due from CCC, Inc. 106 403 20 Accounts Receivable Services Rey To record billing to HHH, Inc. for services performed 22 Cash Accounts Receivable To record receipt of amount due from CCC Inc. for Dec 10 invoice. 101 106 23 Accounts Receivable Services Rev To record billing to XYZ, Inc. for services performed. 106 403 10.620 0.620 28 Dividends Cash 319 101 To record payment of cash dividend to John Tang. 1,000 31 Accounts Payable Cash To record payment to Staples 201 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts