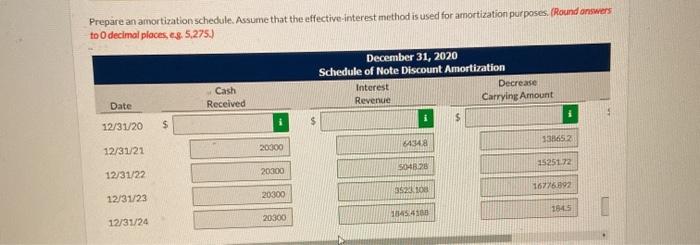

Question: Prepare an amortization schedule. Assume that the effective interest method is used for amortization purposes. (Round answers to O decimal places, c.8. 5.275.) Cash Received

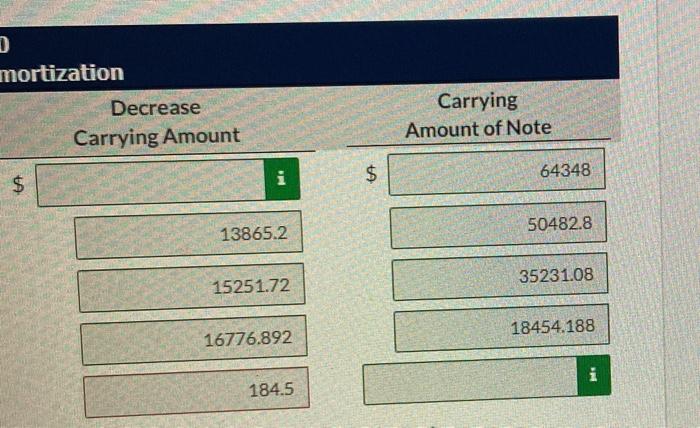

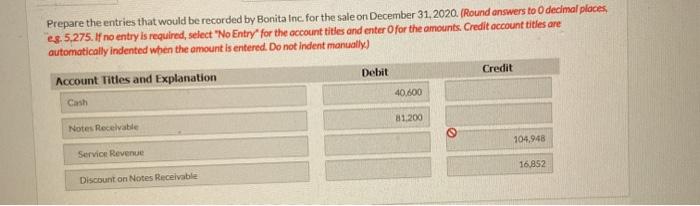

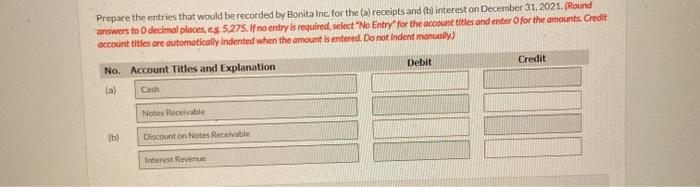

Prepare an amortization schedule. Assume that the effective interest method is used for amortization purposes. (Round answers to O decimal places, c.8. 5.275.) Cash Received December 31, 2020 Schedule of Note Discount Amortization Interest Decrease Revenue Carrying Amount i $ Date i 1 12/31/20 $ 84348 33652 20300 12/31/21 1904828 1525172 12/31/22 20300 352 103 16776.92 12/31/23 20300 1045:41 164 20300 12/31/24 D mortization Decrease Carrying Amount Carrying Amount of Note i $ 64348 $ 50482.8 13865.2 35231.08 15251.72 18454.188 16776.892 i P 184.5 Prepare the entries that would be recorded by Bonita Inc for the sale on December 31, 2020. (Round answers to decimal places, es 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Debit Credit Account Titles and Explanation 40.600 Cash 81.200 Notes Receivable 104,948 Service Revenue 16.852 Discount on Notes Receivable Prepare the entries that would be recorded by Bonita Inc. for the (a) receipts and (b) interest on December 31, 2021. (Round answers to decimal places, es 5.275. If no entry is required, select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when the amount is entered. Do not indent manually) No. Account Titles and Explanation Debit Credit (a) Ca Not Receivable (b) Discount on Notes Receivable Interest Revenue Prepare an amortization schedule. Assume that the effective interest method is used for amortization purposes. (Round answers to O decimal places, c.8. 5.275.) Cash Received December 31, 2020 Schedule of Note Discount Amortization Interest Decrease Revenue Carrying Amount i $ Date i 1 12/31/20 $ 84348 33652 20300 12/31/21 1904828 1525172 12/31/22 20300 352 103 16776.92 12/31/23 20300 1045:41 164 20300 12/31/24 D mortization Decrease Carrying Amount Carrying Amount of Note i $ 64348 $ 50482.8 13865.2 35231.08 15251.72 18454.188 16776.892 i P 184.5 Prepare the entries that would be recorded by Bonita Inc for the sale on December 31, 2020. (Round answers to decimal places, es 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Debit Credit Account Titles and Explanation 40.600 Cash 81.200 Notes Receivable 104,948 Service Revenue 16.852 Discount on Notes Receivable Prepare the entries that would be recorded by Bonita Inc. for the (a) receipts and (b) interest on December 31, 2021. (Round answers to decimal places, es 5.275. If no entry is required, select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when the amount is entered. Do not indent manually) No. Account Titles and Explanation Debit Credit (a) Ca Not Receivable (b) Discount on Notes Receivable Interest Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts