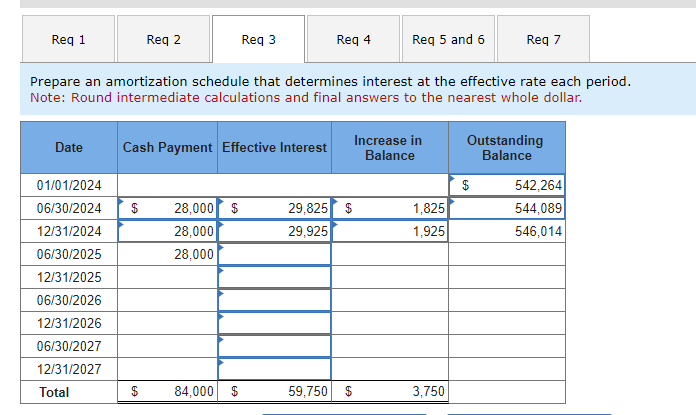

Question: Prepare an amortization schedule that determines interest at the effective rate each period. Note: Round intermediate calculations and final answers to the nearest whole dollar.

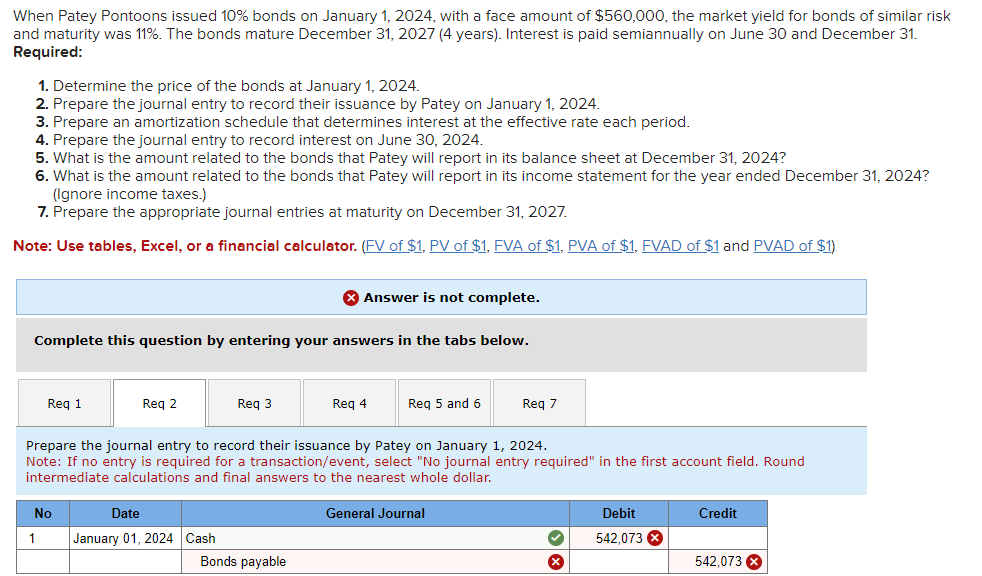

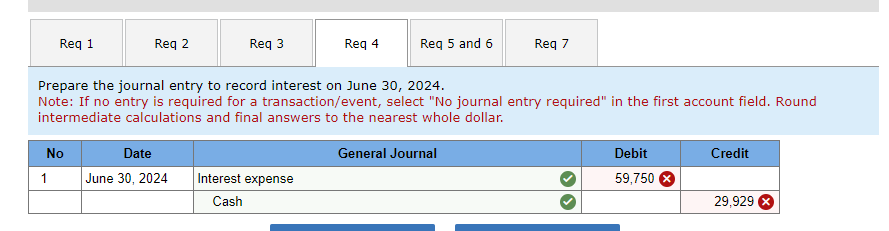

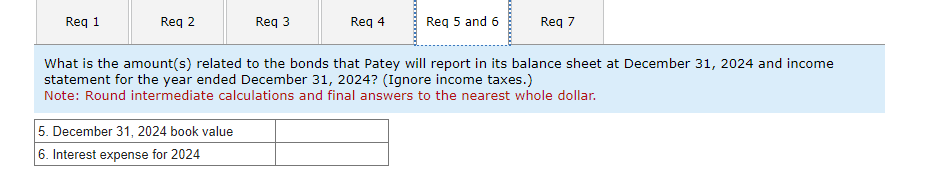

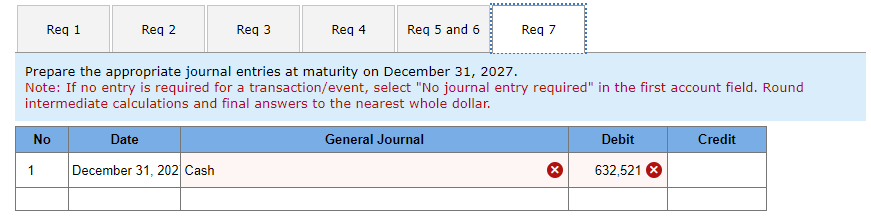

Prepare an amortization schedule that determines interest at the effective rate each period. Note: Round intermediate calculations and final answers to the nearest whole dollar. What is the amount(s) related to the bonds that Patey will report in its balance sheet at December 31, 2024 and income statement for the year ended December 31, 2024? (Ignore income taxes.) Note: Round intermediate calculations and final answers to the nearest whole dollar. Prepare the journal entry to record interest on June 30, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar. Prepare the appropriate journal entries at maturity on December 31, 2027. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar. When Patey Pontoons issued 10% bonds on January 1,2024 , with a face amount of $560,000, the market yield for bonds of similar risk and maturity was 11\%. The bonds mature December 31, 2027 (4 years). Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2024. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2024. 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2024 ? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2027. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record their issuance by Patey on January 1, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts