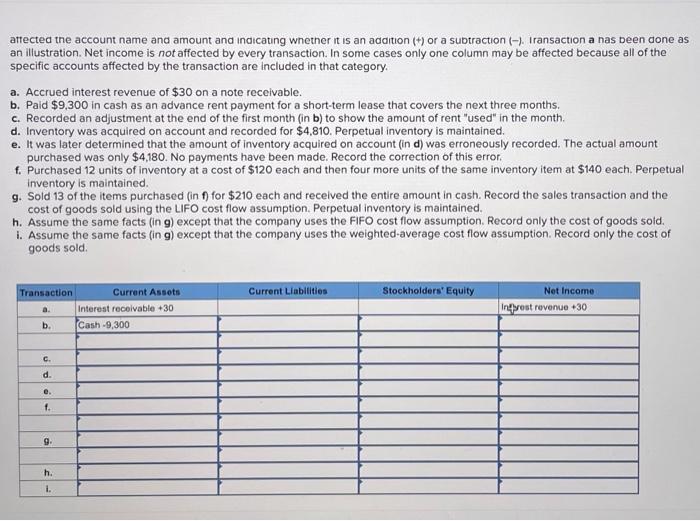

Question: Prepare an answer sheet with the column headings shown here. For each of the following transactions or adjustments, indicate the effect of the transaction or

affected the account name and amount and indicating whether it is an addition (+) or a subtraction (-). Iransaction a nas been done as an illustration. Net income is not affected by every transaction. In some cases only one column may be affected because all of the specific accounts affected by the transaction are included in that category. a. Accrued interest revenue of $30 on a note receivable. b. Paid $9,300 in cash as an advance rent payment for a short-term lease that covers the next three months. c. Recorded an adjustment at the end of the first month (in b) to show the amount of rent "used" in the month. d. Inventory was acquired on account and recorded for $4,810. Perpetual inventory is maintained. e. It was later determined that the amount of inventory acquired on account (in d) was erroneously recorded. The actual amount purchased was only $4,180. No payments have been made. Record the correction of this error. f. Purchased 12 units of inventory at a cost of $120 each and then four more units of the same inventory item at $140 each. Perpetual inventory is maintained. g. Sold 13 of the items purchased (in f) for $210 each and received the entire amount in cash. Record the sales transaction and the cost of goods sold using the LIFO cost flow assumption. Perpetual inventory is maintained. h. Assume the same facts (in g) except that the company uses the FIFO cost flow assumption. Record only the cost of goods sold. i. Assume the same facts (in g) except that the company uses the weighted-average cost flow assumption. Record only the cost of goods sold. Transaction Current Liabilities Stockholders' Equity Current Assets Interest receivable +30 Net Income Intrest revenue +30 a. Cash-9,300 b. C. d. e. f. 9. h. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts