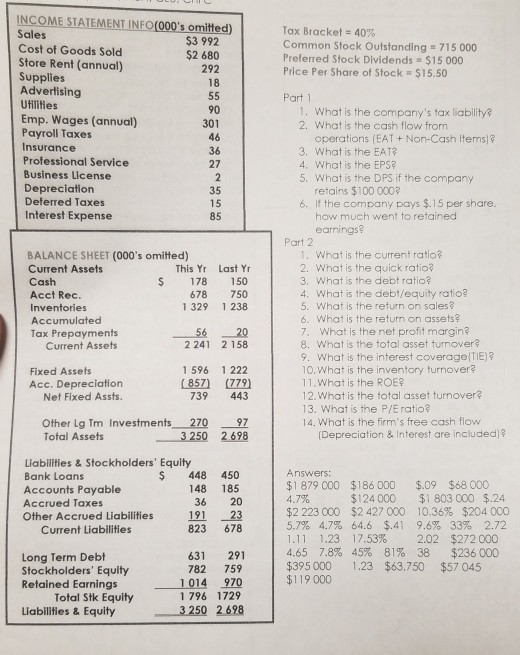

Question: prepare an income statement based on the information provided NCOME STATEMENT INFO(000's omitted) Tax Brackets 40% Common Stock Outstanding 715 000 Preferred Stock Dividends $15

prepare an income statement based on the information provided

NCOME STATEMENT INFO(000's omitted) Tax Brackets 40% Common Stock Outstanding 715 000 Preferred Stock Dividends $15 000 es $3 992 $2 680 292 18 Cost of Goods Sold Store Rent (annual) Supplies Advertising Utilities Emp. Wages (annual) Payroll Taxes Insurance Professional Service Business License Depreciation Deferred Taxes Interest Expense Price Per Share of Stock $15.50 Part 1 90 1. What is the company's tax liability? 2. What is the cash flow from 46 36 operations (EAT + Non-Cash Items)? 3. What is the EAT? 4. What is the EPS? 5. What is the DPS if the company retains $100 000? 6. If the company pays $.15 per share how much went to retained earnings? Part 2 1. What is the current ratio? 2. What is the quick ratio? 3. What is the debt ratio? 4. What is the debt/equity ratio? 5. What is the return on sales? 6. What is the return on assets? 7. What is the net profit margina 8. What is the total asset turnover? 9. What is the interest coverage TIE)? 10. What is the inventory turnover? 11.What is the ROE? 12, what is the total asset turnover 13. What is the P/E ratio? 14. What is the firm's free cash flow BALANCE SHEET (000's omitted) Current Assets Cash Acct Rec. Inventories Accumulated Tax Prepayments This Yr Last Y $ 178 150 678 750 1329 1 238 Current Assets 2 241 2 158 1596 1222 857) 779) Fixed Assets Acc. Depreciation Net Fixed Assts. 739 443 Other Lg Tm Investments 270 97 Total Assets 3250 2698 Depreciation & Interest are included)? Liabilities & Stockholders' Equity Bank Loans $ 448 450 Answers: $1 879 000 $186 000 $.09 $1 803 000 $.24 Accounts Payable 148 185 $68 000 124 000 36 20 823 678 631 291 Accrued Taxes Other Accrued Liabilities $2 223 000 $2 427 000 10.36% $204 000 5.7% 4.7% 64.6 $.41 9.6% 33% 2.72 1.11 1.23 17.53% 2.02 $272 000 4.65 78% 45% 81% 38 $236 000 $395000 1.23 $63,750 $57 045 $119 000 191 23 Current Liabilities Long Term Debt Stockholders' Equity 782 759 Earnings 1014 970 Total Stk Equity 1 796 1729 Liabilities & Equity 3250 2698

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts