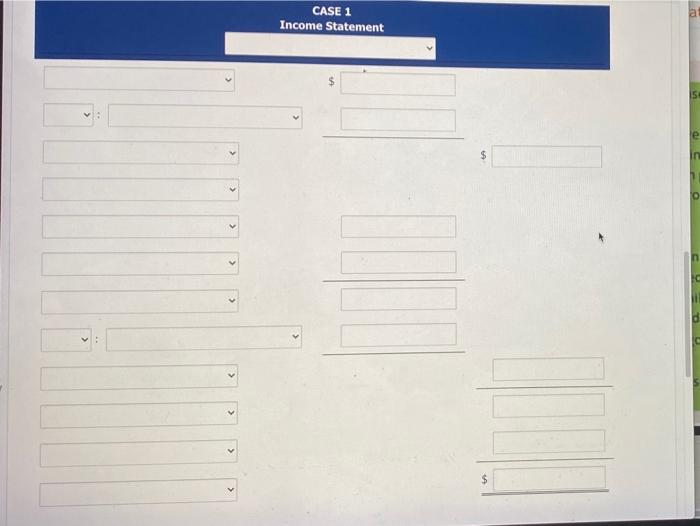

Question: Prepare an income statement for Case 1 Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Beginning work in process inventory Ending work in

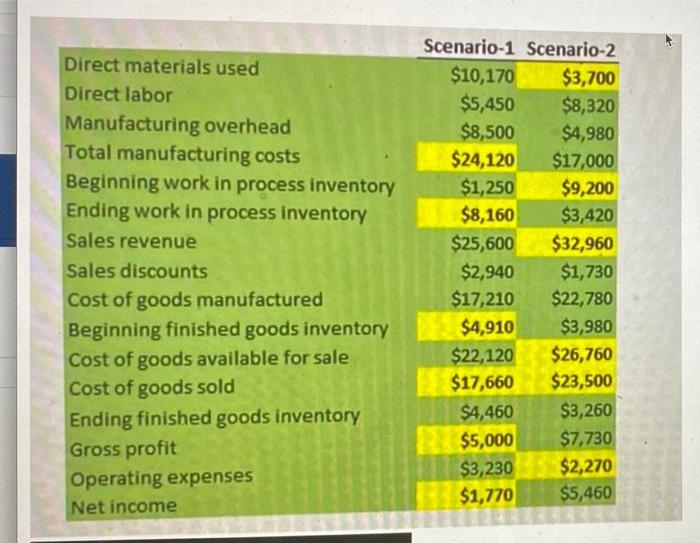

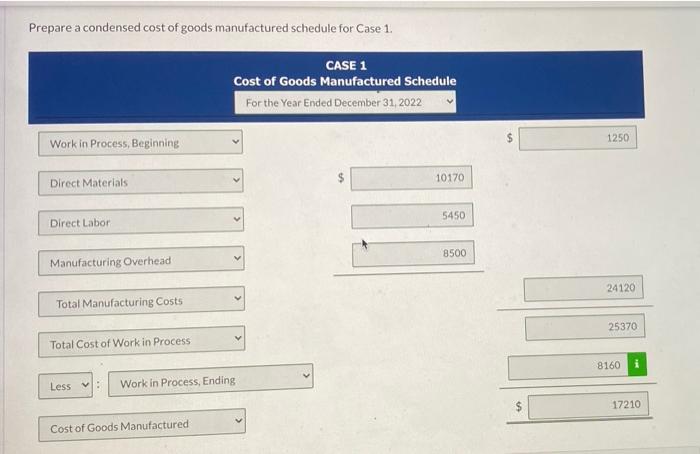

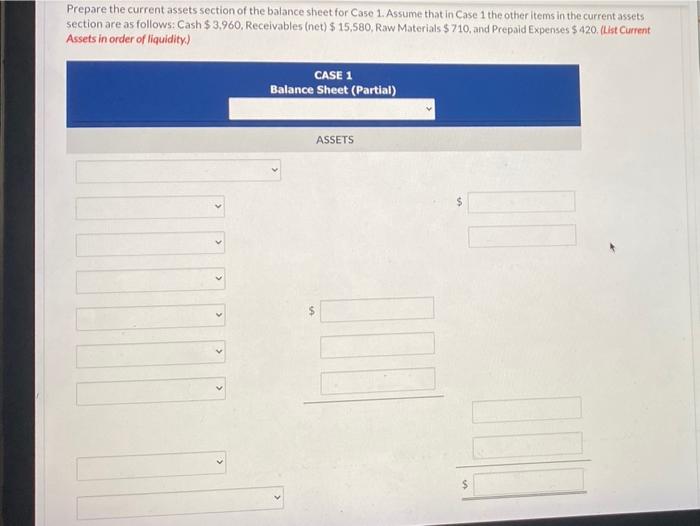

Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Beginning work in process inventory Ending work in process inventory Sales revenue Sales discounts Cost of goods manufactured Beginning finished goods inventory Cost of goods available for sale Cost of goods sold Ending finished goods inventory Gross profit Operating expenses Net income Scenario-1 Scenario-2 $10,170 $3,700 $5,450 $8,320 $8,500 $4,980 $24,120 $17,000 $1,250 $9,200 $8,160 $3,420 $25,600 $32,960 $2,940 $1,730 $17,210 $22,780 $4,910 $3,980 $22,120 $26,760 $17,660 $23,500 $4,460 $3,260 $5,000 $7,730 $3,230 $2,270 $1,770 $5,460 Prepare a condensed cost of goods manufactured schedule for Case 1 CASE 1 Cost of Goods Manufactured Schedule For the Year Ended December 31, 2022 1250 Work in Process, Beginning Direct Materials 10170 5450 Direct Labor 8500 Manufacturing Overhead 24120 Total Manufacturing Costs 25370 Total Cost of Work in Process 8160 Less : Work in Process, Ending 17210 Cost of Goods Manufactured CASE 1 Income Statement 15 le > > > > > > $ Prepare the current assets section of the balance sheet for Case 1. Assume that in Case 1 the other items in the current assets section are as follows: Cash $ 3.960, Receivables (net) $ 15,580, Raw Materials $ 710, and Prepaid Expenses S 420. (List Current Assets in order of liquidity) CASE 1 Balance Sheet (Partial) ASSETS $ > $ S $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts