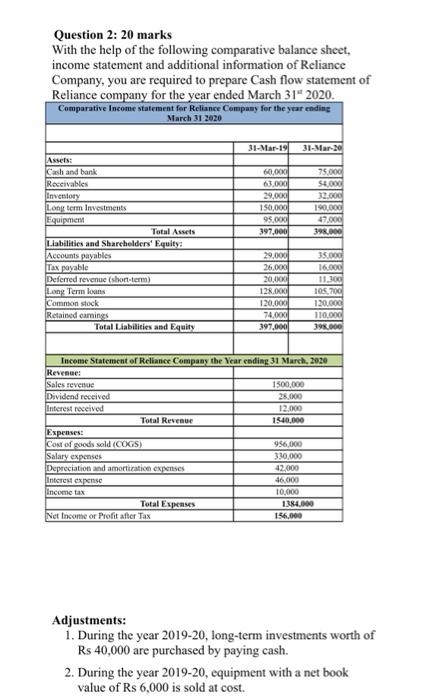

Question: prepare cash flow statement Question 2: 20 marks With the help of the following comparative balance sheet, income statement and additional information of Reliance Company,

Question 2: 20 marks With the help of the following comparative balance sheet, income statement and additional information of Reliance Company, you are required to prepare Cash flow statement of Reliance company for the year ended March 31" 2020. Comparative Income statement for Reliance Company for the year ending March 312020 31-Mar-191 31-Mar-20 60,000 63.000 29,000 150,000 95.000 397,000 75.000 58.000 32.000 190.000 47.000 398.000 Assets: Cash and bank Receivables Inventory Long term Investments Equipment Total Assets Liabilities and Shareholders' Equity Accounts payables Tax payable Deferred revenue (short-term) Long Term loans Common stock Retained earnings Total Liabilities and Equity 29,000 26,000 20,000 128.000 120.00% 74.000 397,000 35.000 16.000 11.300 105.700 120.00 110.000 395.000 Income Statement of Reliance Company the Year ending 31 March, 2020 Revenue Sales revenue 1500,000 Dividend received 28.000 Interest received 12.000 Total Revenue 1540,000 Expenses Cost of goods sold (COGS) 956,000 Salary expenses 330,000 Depreciation and amortization expenses 42.000 Interest expense 46.000 Income tax 10.000 Total Expenses 1884.000 Net Income or Profit after Tax 156,000 Adjustments: 1. During the year 2019-20, long-term investments worth of Rs 40,000 are purchased by paying cash. 2. During the year 2019-20, equipment with a net book value of Rs 6,000 is sold at cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts