Question: Prepare Consolidation Entry S, A, I, D, E, P for 2015. Please show how got answers. Thank you. 2. Following is the balance sheet for

Prepare Consolidation Entry S, A, I, D, E, P for 2015.

Please show how got answers. Thank you.

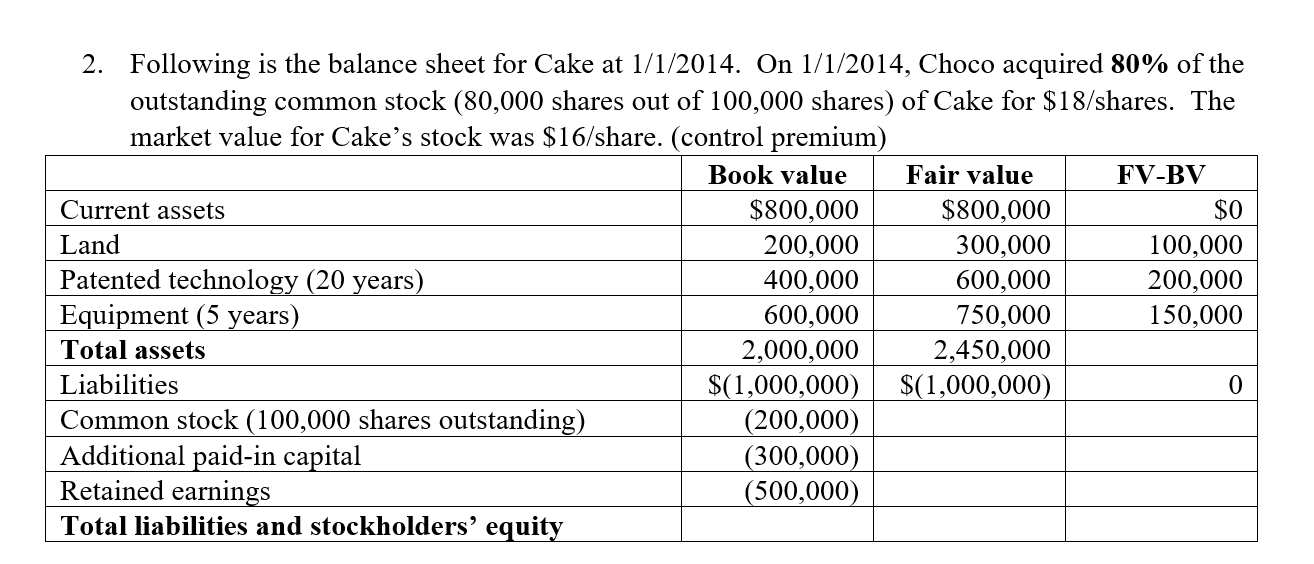

2. Following is the balance sheet for Cake at 1/1/2014. On 1/1/2014, Choco acquired 80% of the outstanding common stock (80,000 shares out of 100,000 shares) of Cake for $18/shares. The market value for Cakes stock was $16/share. (control premium) Book value Fair value FV-BV Current assets $800,000 $800,000 $0 Land 200,000 300,000 100,000 Patented technology (20 years) 400,000 600,000 200,000 Equipment (5 years) 600,000 750,000 150,000 Total assets 2,000,000 2,450,000 Liabilities $(1,000,000) $(1,000,000) 0 Common stock (100,000 shares outstanding) (200,000) Additional paid-in capital (300,000) Retained earnings (500,000) Total liabilities and stockholders' equity 2. Following is the balance sheet for Cake at 1/1/2014. On 1/1/2014, Choco acquired 80% of the outstanding common stock (80,000 shares out of 100,000 shares) of Cake for $18/shares. The market value for Cakes stock was $16/share. (control premium) Book value Fair value FV-BV Current assets $800,000 $800,000 $0 Land 200,000 300,000 100,000 Patented technology (20 years) 400,000 600,000 200,000 Equipment (5 years) 600,000 750,000 150,000 Total assets 2,000,000 2,450,000 Liabilities $(1,000,000) $(1,000,000) 0 Common stock (100,000 shares outstanding) (200,000) Additional paid-in capital (300,000) Retained earnings (500,000) Total liabilities and stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts