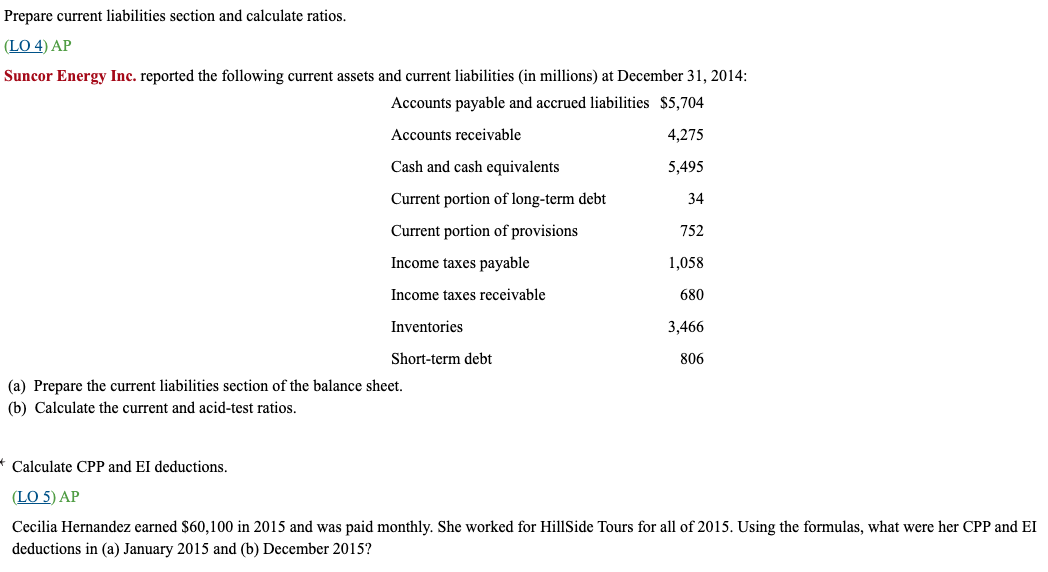

Question: -------------------------------------------------------------------------------++++++++++++++++++++ Prepare current liabilities section and calculate ratios. LO 4) AP Suncor Energy Inc. reported the following current assets and current liabilities (in millions) at

-------------------------------------------------------------------------------++++++++++++++++++++

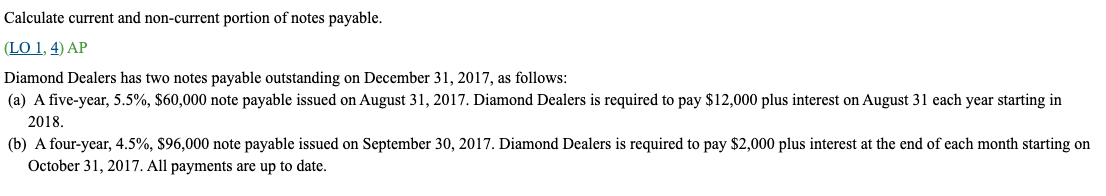

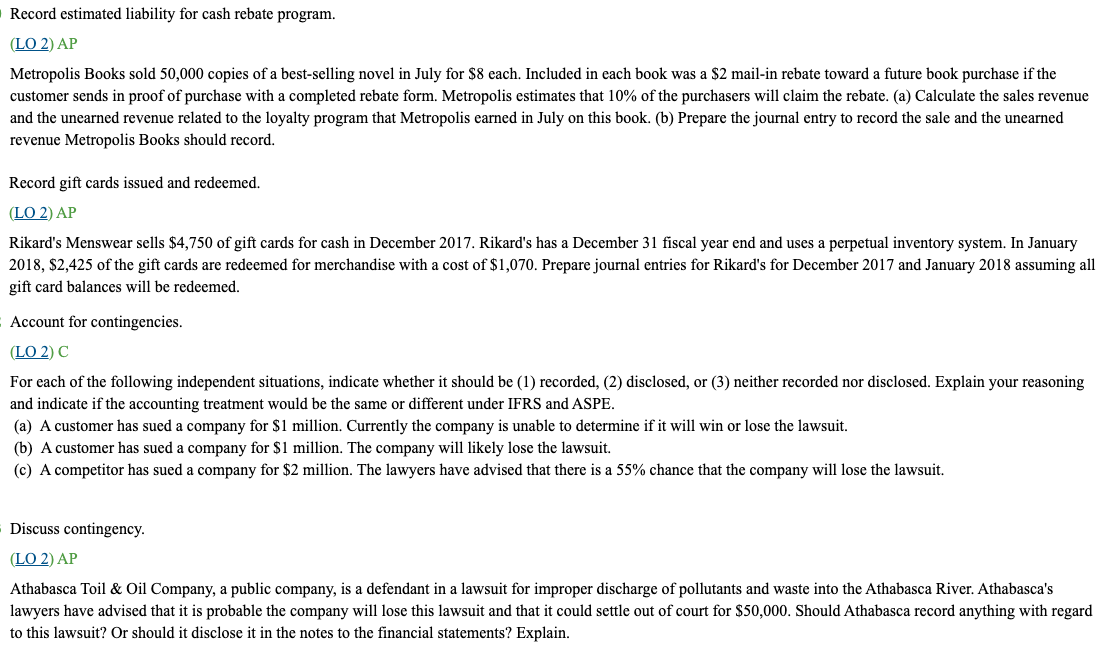

Prepare current liabilities section and calculate ratios. LO 4) AP Suncor Energy Inc. reported the following current assets and current liabilities (in millions) at December 31, 2014: Accounts payable and accrued liabilities $5,704 Accounts receivable 4,275 Cash and cash equivalents 5,495 Current portion of long-term debt 34 Current portion of provisions 752 Income taxes payable 1,058 Income taxes receivable 680 Inventories 3,466 Short-term debt 806 (a) Prepare the current liabilities section of the balance sheet. (b) Calculate the current and acid-test ratios. Calculate CPP and EI deductions. (LO 5) AP Cecilia Hernandez earned $60,100 in 2015 and was paid monthly. She worked for HillSide Tours for all of 2015. Using the formulas, what were her CPP and EI deductions in (a) January 2015 and (b) December 2015?Calculate current and non-current portion of notes payable. {LO 1, QAP Diamond Dealers has two notes payable outstanding on December 31, 2017, as follows: (a) A ve-year, 5.5%, $60,000 note payable issued on August 31, 2017. Diamond Dealers is required to pay $12,000 plus interest on August 31 each year starting in 2018. (b) A four-year, 4.5%, $96,000 note payable issued on September 30, 2017. Diamond Dealers is required to pay $2,000 plus interest at the end of each month starting on October 31, 201?. All payments are up to date. I Record estimated liability for cash rebate program. LO 2 AP Metropolis Books sold 50,000 copies of a best-selling novel in July for $8 each. Included in each book was a $2 mail-in rebate toward a future book purchase if the customer sends in proof of purchase with a completed rebate form. Metropolis estimates that 10% of the purchasers will claim the rebate. (a) Calculate the sales revenue and the unearned revenue related to the loyalty program that Metropolis earned in July on this book. (b) Prepare the journal entry to record the sale and the unearned revenue Metropolis Books should record. Record gi cards issued and redeemed LO 2 AP Rikard's Menswear sells $4,750 of gift cards for cash in December 2017. Rikard's has a December 31 scal year end and uses a perpetual inventory system. In January 2018, $2,425 of the gift cards are redeemed for merchandise with a cost of$1,0'1r'0. Prepare journal entries for Rikard's for December 2017Ir and January 2018 assuming all gift card balances will be redeemed. ; Account for contingencies. IL02}C For each of the following independent situations, indicate whether it should be {1) recorded, (2) disclosed, or (3) neither recorded nor disclosed. Explain your reasoning and indicate if the accounting treatment would be the same or different under IFRS and ASPE. (a) A customer has sued a company for $1 million Currently the company is unable to determine if it will win or lose the lawsuit. (b) A customer has sued a company for $1 million. The company will likely lose the lawsuit. (c) A competitor has sued a company for $2 million. The lawyers have advised that there is a 55% chance that the company will lose the lawsuit. . Discuss contingency. LO 2 AP Athabasca Toil Sr. Oil Company, a public company, is a defendant in a lawsuit for improper discharge of pollutants and waste into the Athabasca River. Athabasca's lawyers have advised that it is probable the company will lose tbis lawsuit and that it could settle out of court for $50,000. Should Atbabasca record anything with regard to this lawsuit? Or should it disclose it in the notes to the nancial statements? Explain