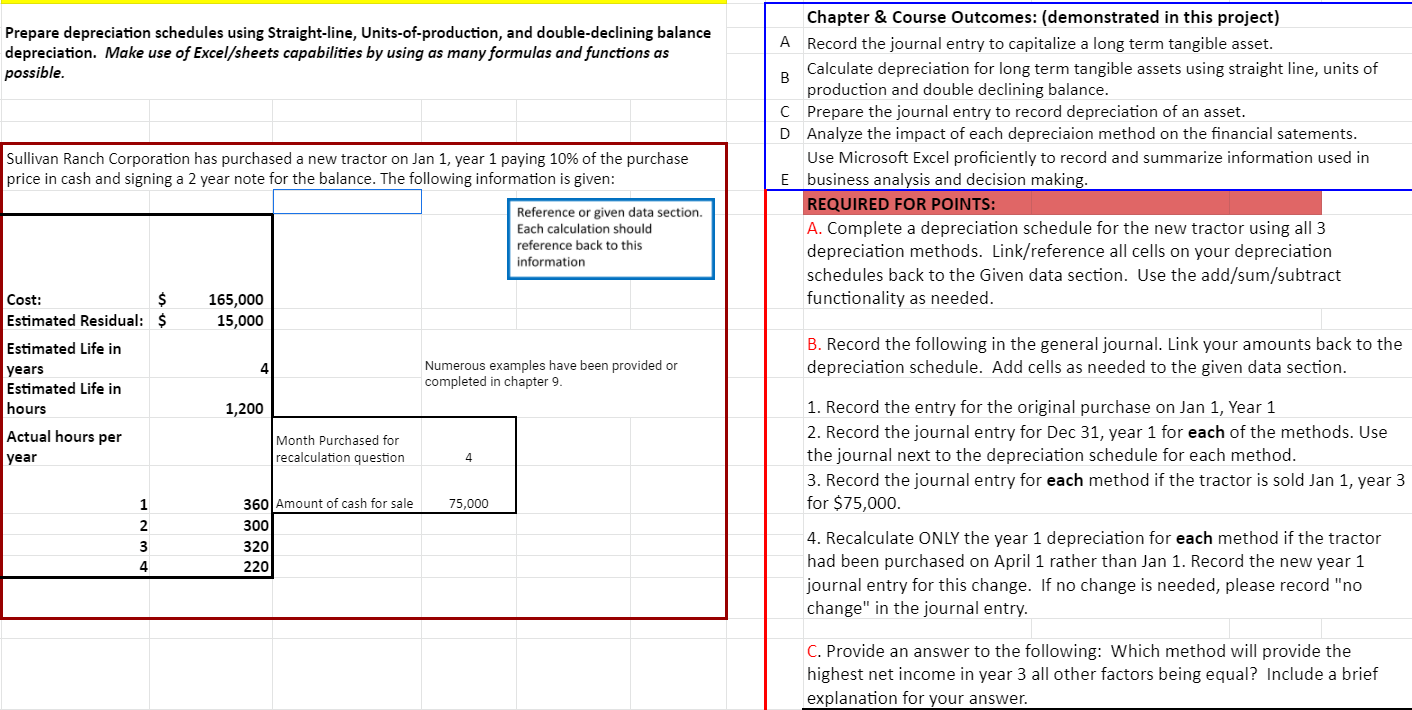

Question: Prepare depreciation schedules using Straight-line, Units-of-production, and double-declining balance depreciation. Make use of Excel/sheets capabilities by using as many formulas and functions as possible. Sullivan

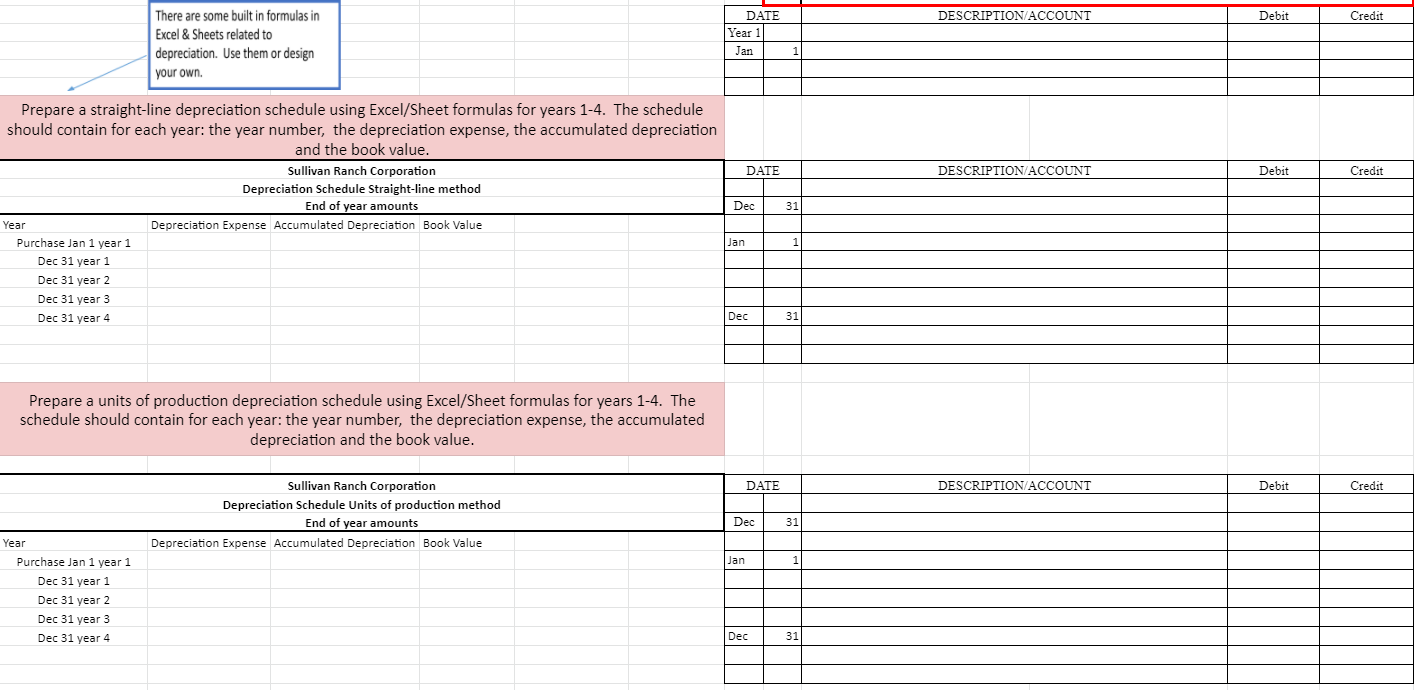

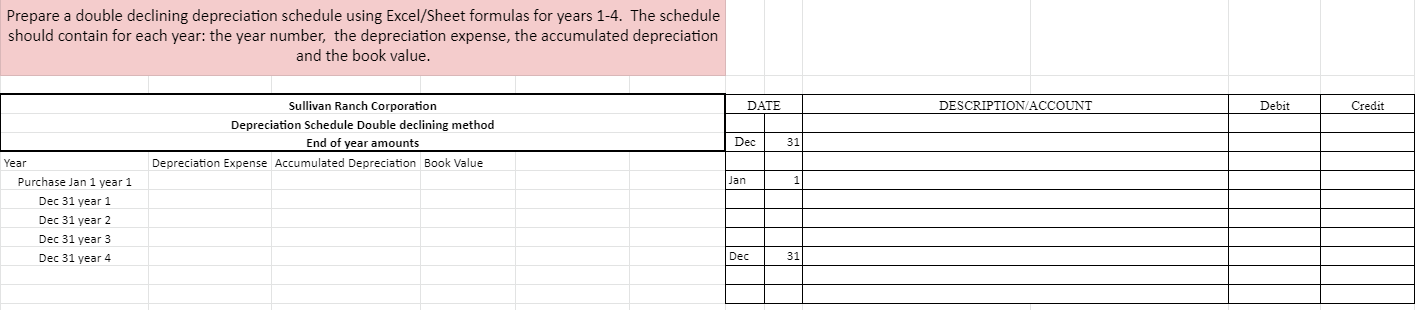

Prepare depreciation schedules using Straight-line, Units-of-production, and double-declining balance depreciation. Make use of Excel/sheets capabilities by using as many formulas and functions as possible. Sullivan Ranch Corporation has purchased a new tractor on Jan 1, year 1 paying 10% of the purchase price in cash and signing a 2 year note for the balance. The following information is given: Chapter & Course Outcomes: (demonstrated in this project) Record the journal entry to capitalize a long term tangible asset. Calculate depreciation for long term tangible assets using straight line, units of B production and double declining balance. C Prepare the journal entry to record depreciation of an asset. D Analyze the impact of each depreciaion method on the financial satements. Use Microsoft Excel proficiently to record and summarize information used in E business analysis and decision making. REQUIRED FOR POINTS: A. Complete a depreciation schedule for the new tractor using all 3 depreciation methods. Link/reference all cells on your depreciation schedules back to the Given data section. Use the add/sum/subtract functionality as needed. Reference or given data section. Each calculation should reference back to this information Cost: $ Estimated Residual: $ 165,000 15,000 Estimated Life in years Estimated Life in hours B. Record the following in the general journal. Link your amounts back to the depreciation schedule. Add cells as needed to the given data section. Numerous examples have been provided or completed in chapter 9 1,200 Actual hours per year Month Purchased for recalculation question 4 75,000 1 2 3 4 360 Amount of cash for sale 3001 320 220 1. Record the entry for the original purchase on Jan 1, Year 1 2. Record the journal entry for Dec 31, year 1 for each of the methods. Use the journal next to the depreciation schedule for each method. 3. Record the journal entry for each method if the tractor is sold Jan 1, year 3 for $75,000. 4. Recalculate ONLY the year 1 depreciation for each method if the tractor had been purchased on April 1 rather than Jan 1. Record the new year 1 journal entry for this change. If no change is needed, please record "no change" in the journal entry. C. Provide an answer to the following: Which method will provide the highest net income in year 3 all other factors being equal? Include a brief explanation for your answer. DESCRIPTION ACCOUNT Debit Credit There are some built in formulas in Excel & Sheets related to depreciation. Use them or design your own. DATE Year 1 Jan 1 DATE DESCRIPTION ACCOUNT Debit Credit Dec 31 Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain for each year: the year number, the depreciation expense, the accumulated depreciation and the book value. Sullivan Ranch Corporation Depreciation Schedule Straight-line method End of year amounts Depreciation Expense Accumulated Depreciation Book Value Purchase Jan 1 year 1 Dec 31 year 1 Dec 31 year 2 Dec 31 year 3 Dec 31 year 4 4 Year Jan 1 Dec 31 Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain for each year: the year number, the depreciation expense, the accumulated depreciation and the book value. DATE DESCRIPTION ACCOUNT Debit Credit Sullivan Ranch Corporation Depreciation Schedule Units of production method End of year amounts Depreciation Expense Accumulated Depreciation Book Value Dec 31 Jan 1 Year Purchase Jan 1 year 1 Dec 31 year 1 Dec 31 year 2 Dec 31 year 3 Dec 31 year 4 Dec 31 Prepare a double declining depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain for each year: the year number, the depreciation expense, the accumulated depreciation and the book value. DATE DESCRIPTION ACCOUNT Debit Credit Sullivan Ranch Corporation Depreciation Schedule Double declining method End of year amounts Depreciation Expense Accumulated Depreciation Book Value Dec 31 Jan Year Purchase Jan 1 year 1 Dec 31 year 1 Dec 31 year 2 Dec 31 year 3 Dec 31 year 4 Dec 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts