Question: Prepare Form 1120 Schedule M-1 & M2 using the calculations from problem #47 -using 2017 as the dates, instead of 2018. Add the following information:

Prepare Form 1120 Schedule M-1 & M2 using the calculations from problem #47 -using 2017 as the dates, instead of 2018. Add the following information: Cash dividend $150,000 paid Unappropriated retained earnings as of January 1, 2017 $796,010. Please show all calculations.

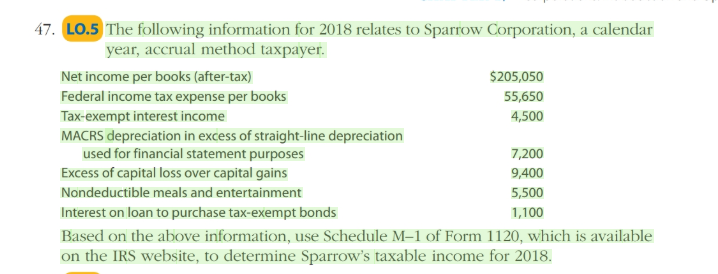

47. LO.5 The following information for 2018 relates to Sparrow Corporation, a calendar year, accrual method taxpayer. Net income per books (after-tax) Federal income tax expense per books Tax-exempt interest income MACRS depreciation in excess of straight-line depreciation $205,050 55,650 4,500 used for financial statement purposes Excess of capital loss over capital gains Nondeductible meals and entertainment Interest on loan to purchase tax-exempt bonds Based on the above information, use Schedule M-1 of Form 1120, which is available on the IRS website, to determine Sparrow's taxable income for 2018. 7,200 9,400 5,500 1,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts