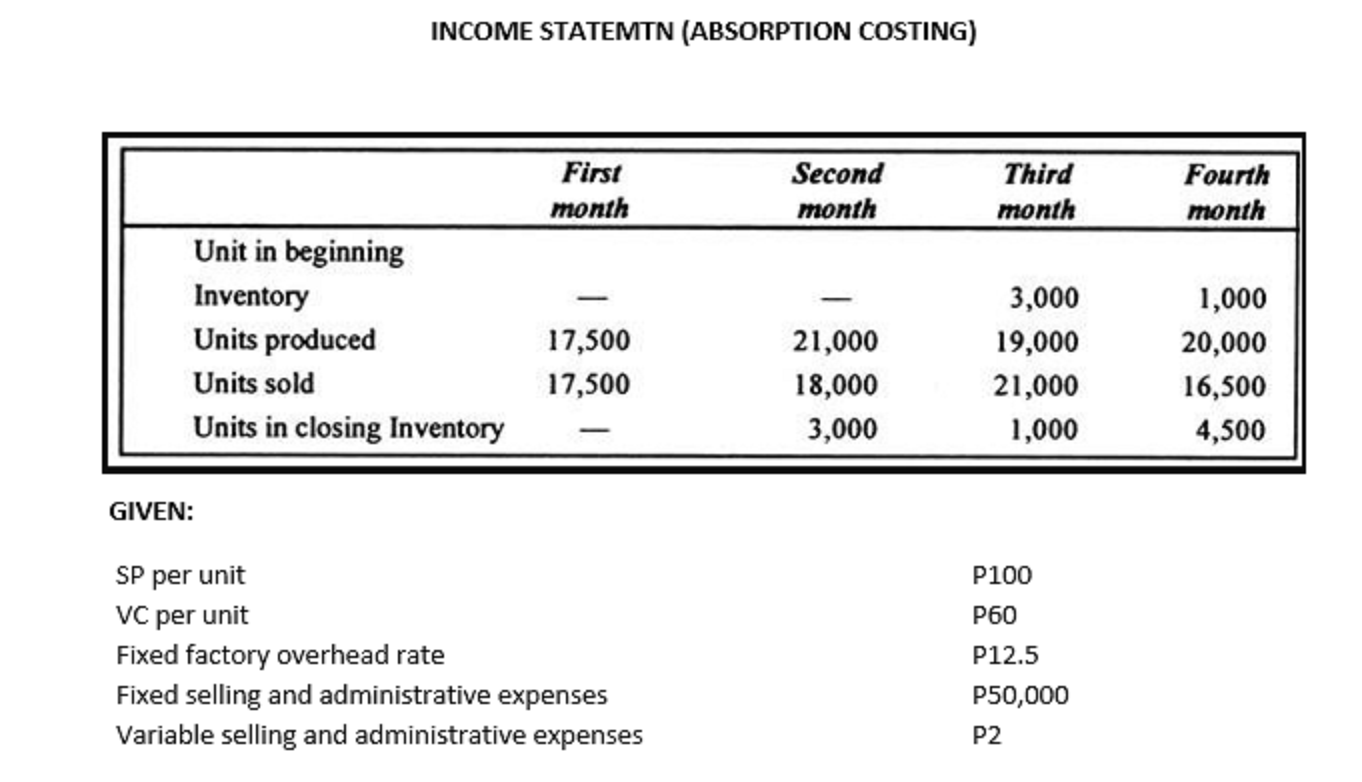

Question: Prepare Income Statement(absorption costing) for the second, third and fourth month. SALES (SP X unit sold) INCOME STATEMENT FORMAT (ABSORPTION COSTING) XXX Less: Cost of

Prepare Income Statement(absorption costing) for the second, third and fourth month.

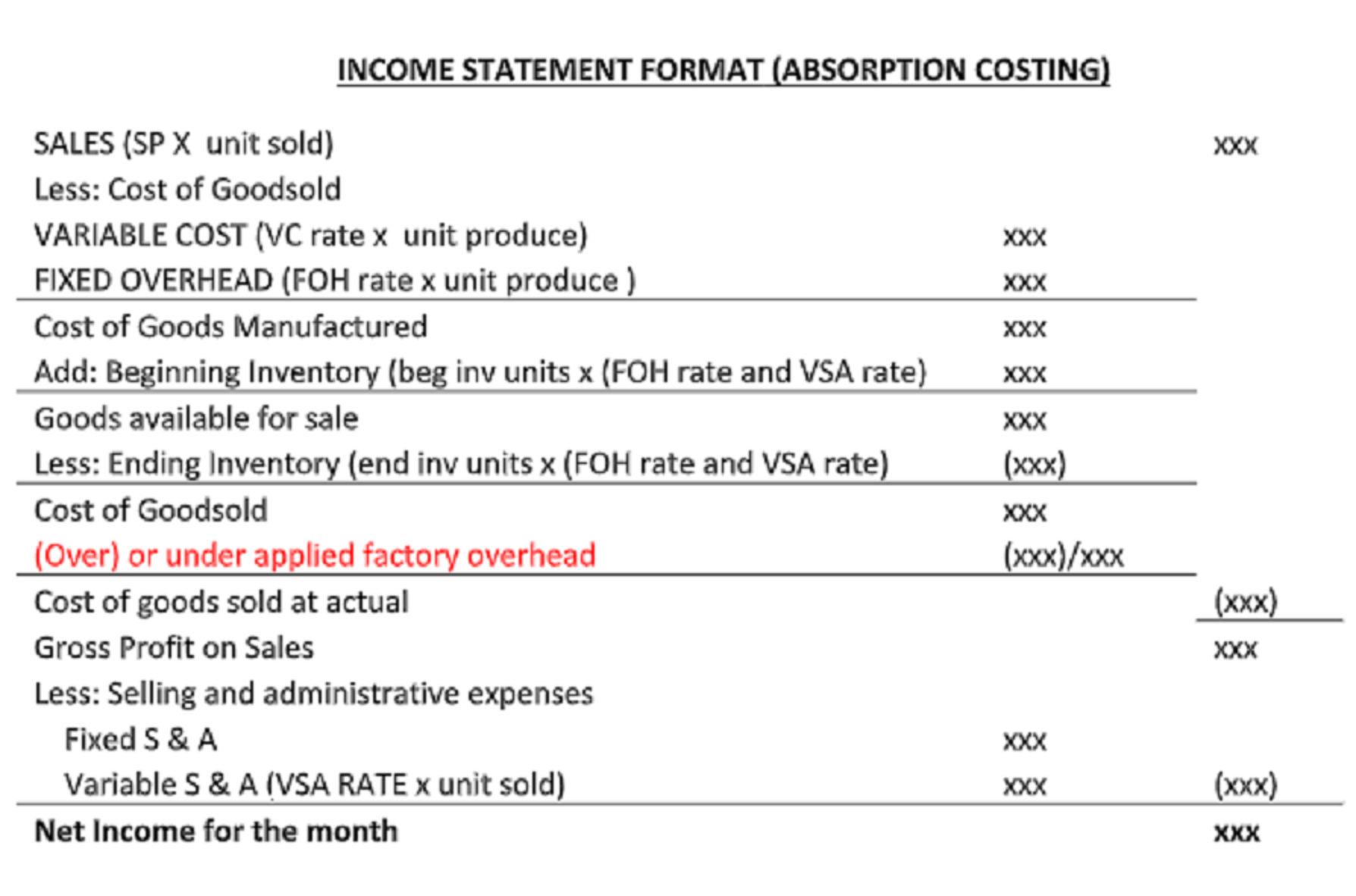

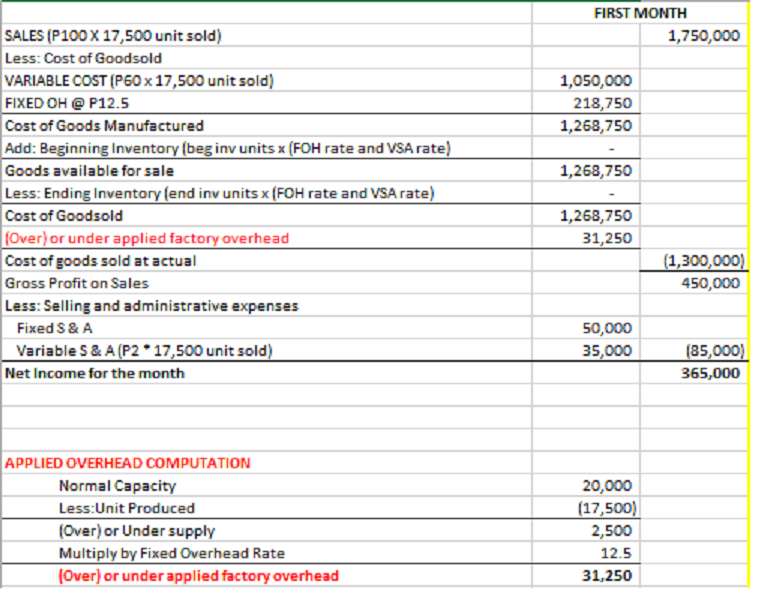

SALES (SP X unit sold) INCOME STATEMENT FORMAT (ABSORPTION COSTING) XXX Less: Cost of Goodsold VARIABLE COST (VC rate x unit produce) FIXED OVERHEAD (FOH rate x unit produce) Cost of Goods Manufactured Add: Beginning Inventory (beg inv units x (FOH rate and VSA rate) Goods available for sale Less: Ending Inventory (end inv units x (FOH rate and VSA rate) Cost of Goodsold XXX XXX XXX XXX XXX (xxx) XXX (XXX)/xxx (xxx) XXX (Over) or under applied factory overhead Cost of goods sold at actual Gross Profit on Sales Less: Selling and administrative expenses Fixed S & A XXX Variable S & A (VSA RATE x unit sold) XXX (xxx) Net Income for the month XXX

Step by Step Solution

There are 3 Steps involved in it

Given Data 1 Selling Price SP according to unit P100 2 Variable Cost VC consistent with unit P60 3 Fixed Factory Overhead FOH fee per unit P125 4 Fixed Selling and Administrative Expenses P50000 5 Var... View full answer

Get step-by-step solutions from verified subject matter experts