Question: PREPARE INCOME STATEMENTS PART 1: In 2015, Patsy Jackson opened Patsy's Posies, a small retail shop selling floral arrangements. On December 31, 2016, her accounting

PREPARE INCOME STATEMENTS

PART 1: In 2015, Patsy Jackson opened Patsy's Posies, a small retail shop selling floral arrangements. On December 31, 2016, her accounting records show the following:

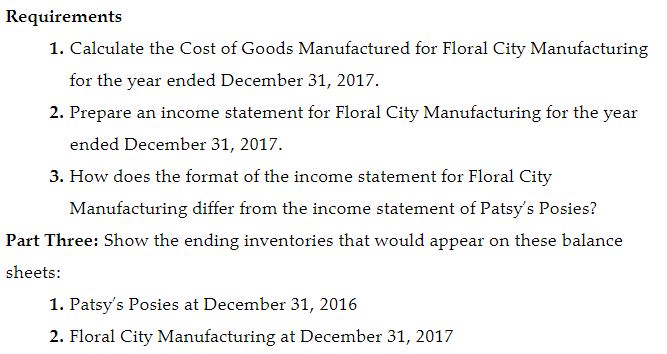

REQUIREMENT:

Prepare an income statement for Patsy's Posies, a merchandiser, for the year ended December 31, 2016.

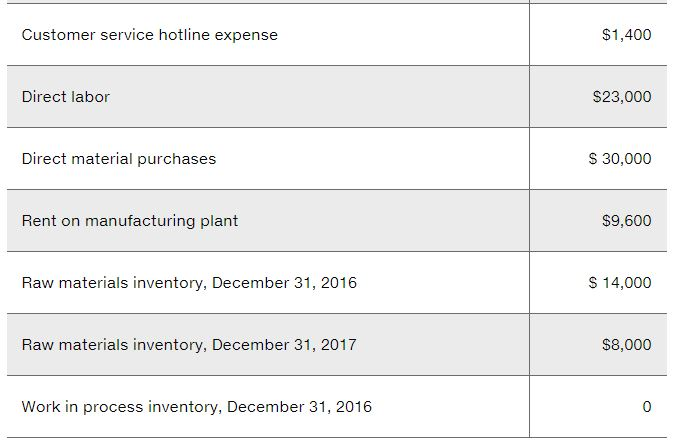

PART 2: Patsy's Posies was so successful that Patsy decided to manufacture her own brand of floral supplies: Floral City Manufacturing. At the end of December 2017, her accounting records show the following:

Sales revenue S53,000 Utilities for shop S 1,100 Inventory on December 31, 2016 S 9,100 Inventory on January 1, 2016 S12,000 Rent for shop $ 4,600 Sales commissions $ 4,000 Purchases of merchandise $36,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts