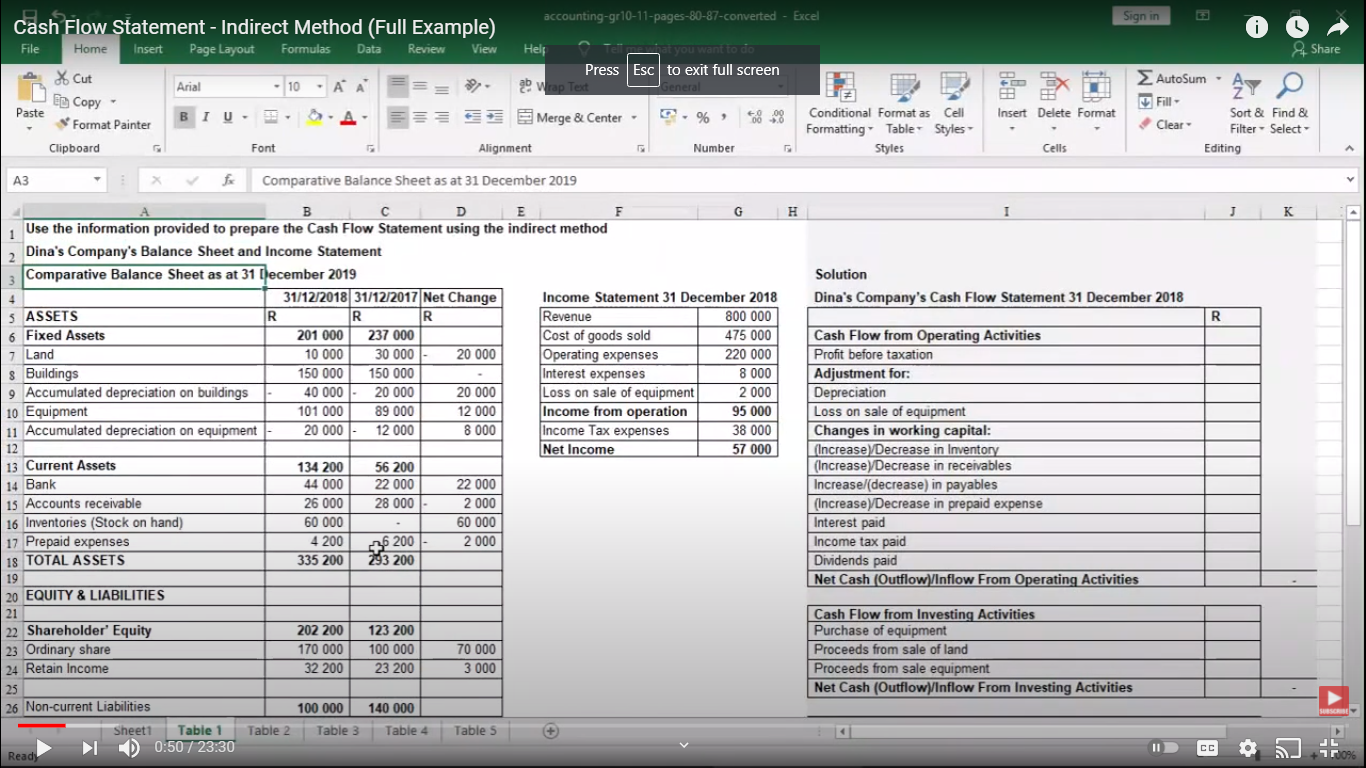

Question: Prepare Indirect Cash Flow Statement using following data accounting-gr10-11-pages-80-87-converted - Excel Sign in Cash Flow Statement - Indirect Method (Full Example) File Home Insert Page

Prepare Indirect Cash Flow Statement using following data

accounting-gr10-11-pages-80-87-converted - Excel Sign in Cash Flow Statement - Indirect Method (Full Example) File Home Insert Page Layout Formulas Data Review View Help you want to do Press Esc to exit full screen & Share * Cut Arial - 10 A 20 Wrap T AutoSum - Fill- ED Copy Paste BIU- Conditional Format as Cell Insert Delete Format 68 08 Merge & Center - %, Format Painter Clear Sort & Find & Filter - Select- Formatting Table Styles Styles Clipboard Font Alignment Number Cells Editing A A3 f Comparative Balance Sheet as at 31 December 2019 H 1 K Solution Dina's Company's Cash Flow Statement 31 December 2018 R B D E F G Use the information provided to prepare the Cash Flow Statement using the indirect method Dina's Company's Balance Sheet and Income Statement Comparative Balance Sheet as at 31 [ecember 2019 4 31/12/2018 31/12/2017 Net Change Income Statement 31 December 2018 5 ASSETS IR IR IR Revenue 800 000 Fixed Assets 201 000 237 000 Cost of goods sold 475 000 7 Land 10 000 30 000 20 000 Operating expenses 220 000 & Buildings 150 000 150 000 Interest expenses 8 000 9 Accumulated depreciation on buildings 40 000 20 000 20 000 Loss on sale of equipment 2 000 10 Equipment 101 000 89 000 12 000 Income from operation 95 000 11 Accumulated depreciation on equipment 20 000 12 000 8 000 Income Tax expenses 38 000 12 Net Income 57 000 13 Current Assets 134 200 56 200 14 Bank 44 000 22 000 22 000 15 Accounts receivable 26 000 28 000 2 000 16 Inventories (Stock on hand) 60 000 60 000 17 Prepaid expenses 4 200 2 000 18 TOTAL ASSETS 335 200 293 200 19 20 EQUITY & LIABILITIES 21 22 Shareholder' Equity 202 200 123 200 23 Ordinary share 170 000 100 000 70 000 24 Retain Income 32 200 23 200 3 000 Cash Flow from Operating Activities Profit before taxation Adjustment for: Depreciation Loss on sale of equipment Changes in working capital: (Increase Decrease in Inventory (Increase)Decrease in receivables Increase/(decrease) in payables (Increase)Decrease in prepaid expense Interest paid Income tax paid Dividends paid Net Cash (Outflow)/Inflow From Operating Activities -26200 Cash Flow from Investing Activities Purchase of equipment Proceeds from sale of land Proceeds from sale equipment Net Cash (Outflow)/Inflow From Investing Activities 23 26 Non-current Liabilities 100 000 140 000 Sheet1 Table 1 Table 2 Table 3 Table 4 Table 5 + D 0:50 / 23:30 Ready accounting-gr10-11-pages-80-87-converted - Excel Sign in Cash Flow Statement - Indirect Method (Full Example) File Home Insert Page Layout Formulas Data Review View Help you want to do Press Esc to exit full screen & Share * Cut Arial - 10 A 20 Wrap T AutoSum - Fill- ED Copy Paste BIU- Conditional Format as Cell Insert Delete Format 68 08 Merge & Center - %, Format Painter Clear Sort & Find & Filter - Select- Formatting Table Styles Styles Clipboard Font Alignment Number Cells Editing A A3 f Comparative Balance Sheet as at 31 December 2019 H 1 K Solution Dina's Company's Cash Flow Statement 31 December 2018 R B D E F G Use the information provided to prepare the Cash Flow Statement using the indirect method Dina's Company's Balance Sheet and Income Statement Comparative Balance Sheet as at 31 [ecember 2019 4 31/12/2018 31/12/2017 Net Change Income Statement 31 December 2018 5 ASSETS IR IR IR Revenue 800 000 Fixed Assets 201 000 237 000 Cost of goods sold 475 000 7 Land 10 000 30 000 20 000 Operating expenses 220 000 & Buildings 150 000 150 000 Interest expenses 8 000 9 Accumulated depreciation on buildings 40 000 20 000 20 000 Loss on sale of equipment 2 000 10 Equipment 101 000 89 000 12 000 Income from operation 95 000 11 Accumulated depreciation on equipment 20 000 12 000 8 000 Income Tax expenses 38 000 12 Net Income 57 000 13 Current Assets 134 200 56 200 14 Bank 44 000 22 000 22 000 15 Accounts receivable 26 000 28 000 2 000 16 Inventories (Stock on hand) 60 000 60 000 17 Prepaid expenses 4 200 2 000 18 TOTAL ASSETS 335 200 293 200 19 20 EQUITY & LIABILITIES 21 22 Shareholder' Equity 202 200 123 200 23 Ordinary share 170 000 100 000 70 000 24 Retain Income 32 200 23 200 3 000 Cash Flow from Operating Activities Profit before taxation Adjustment for: Depreciation Loss on sale of equipment Changes in working capital: (Increase Decrease in Inventory (Increase)Decrease in receivables Increase/(decrease) in payables (Increase)Decrease in prepaid expense Interest paid Income tax paid Dividends paid Net Cash (Outflow)/Inflow From Operating Activities -26200 Cash Flow from Investing Activities Purchase of equipment Proceeds from sale of land Proceeds from sale equipment Net Cash (Outflow)/Inflow From Investing Activities 23 26 Non-current Liabilities 100 000 140 000 Sheet1 Table 1 Table 2 Table 3 Table 4 Table 5 + D 0:50 / 23:30 Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts