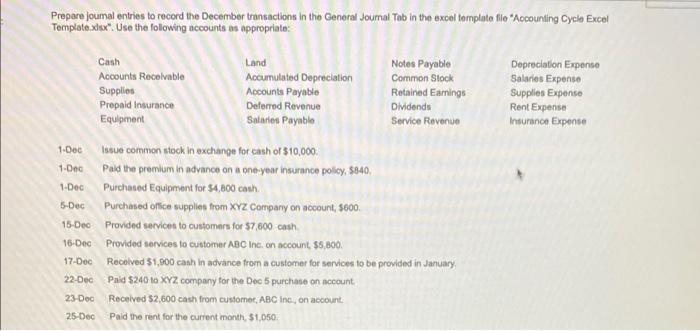

Question: Prepare joumal entries to record the December transactions in the General Joumal Tab in the excel template file Aocounting Cycle Excel Template. dxx2 : Use

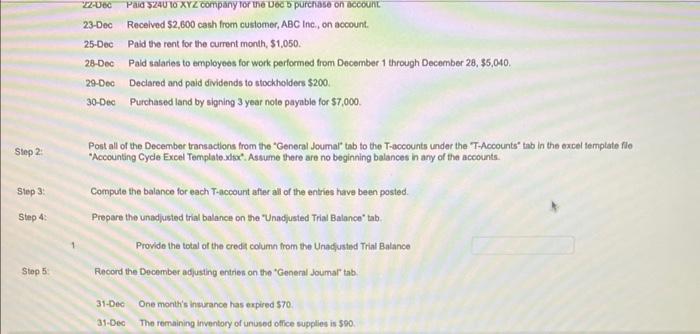

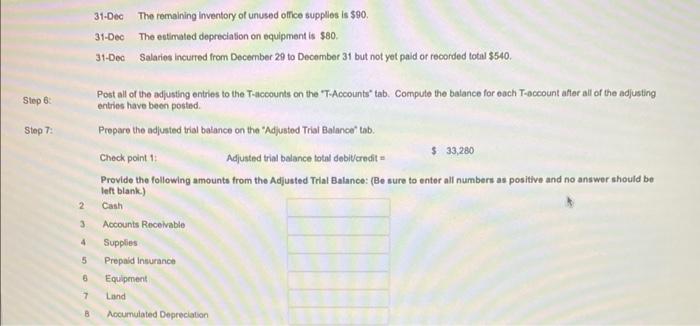

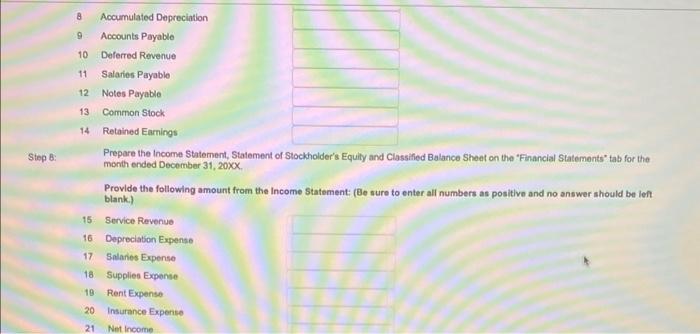

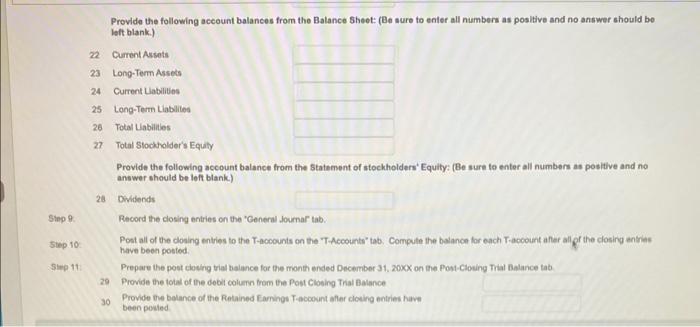

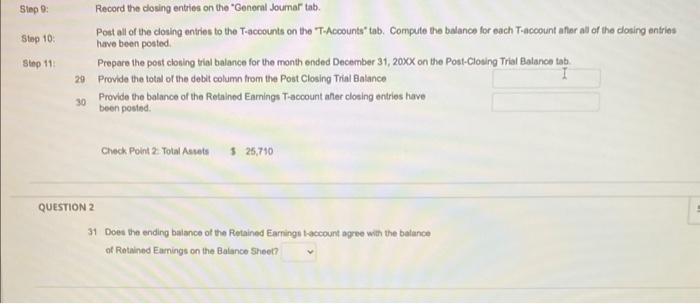

Prepare joumal entries to record the December transactions in the General Joumal Tab in the excel template file "Aocounting Cycle Excel Template. dxx2 : Use the following accounts as appropriale: Z2U Uec Paid 324010 XYZ company tor the Dec 5 purchase on account 23-Dec Received $2,600 cash from customer, ABC inc, on account. 25-Dec Paid the rent for the current month, \$1,050. 28-Dec Pald salaries to employees for work performed from December 1 through December 28, 35,040. 29-0ec Declared and paid dividends to stockhoiders $200. 30-Dec Purchased land by signing 3 year nole payable for $7,000. sin2: Post all of the December transactions from the "General Joumal" tab to the T-accounts under the "T-Accounts" tab in the excel template fle "Accounting Cyde Excel Template.xdxx". Assume there are no beginning belances in any of the accounts. Slep 3: Compule the balance for each T-account after all of the entries have been posted. Step 4: Prepare the unadjusted trial balance on the "Unadjusted Trial Balance" tab. 1 Provide the total of the creds column from the Unadjusted Trial Balance stop5: Record the December adjusing entries on the "General Joumar" tab. 31-Dec One montt's insurance has erpired 570. 31-Dec The remaining inventory of unused office supplies is 590 . 31-Dec The remaining inventory of unused office supples is $90. 31-Dec The eatimated depreciation on equipment is $80. 31-Dec Salaries incurred from December 29 to December 31 but not yet paid or recorded total $540. Post all of the adjusting entries to the T-accounts on the 'T-Accounts" tab. Compute the balance for each T-occount after all of the adjusting entries have been posted. Prepare the adjusted trial balance on the "Adjusted Trial Balance' tab. Check point 1: Adjusted trial balance total debilcredit = 5 33,280 Provide the following amounts from the Adjusted Trial Balance: (Be sure to enter alf numbers as positive and no answer should be left blank.) Prepare the Income Statement, Statement of Stockholder's Equily and Classified Balance Sheet on the "Financial Statements" tab for the month ended December 31,20X. Provlde the following amount from the income Statement: (Be sure to enter all numbers as positive and no answer ahould be left blank.) Provide the following account balances from the Balance Sheet: (Be aure to enter all numbers as positive and no answer should be left blank.) Provide the following account balance from the statement of stockholders' Equity: (Be sure to enter all numbers as positive and no antwer should be left blank) 28 Dwilends Record the closing eniries on the 'General JoumaF tab. Post all of the cobing entries to the T-acoounts on the "T-Acoounts' tab. Compute the balance for each T-acoount after all pr the closing antins have been posted. Prepare the post clowing trial balance for the month ended December 31. 200 on the Pont-Clowing Trial Balance tab. 20 Provide the total of the dobit coluen from the Post Clowing Trial Balance 30 Provide the belance of the Fetained Carnings Tracoovint afler cloeing entries have been pouled. Step 9: Record the closing entries on the "General Joumar tab. Step 10: Post all of the closing entries to the T-accounts on the "T-Accounts" tab. Compute the balance for each T-acoount afier all of the closing entries have been poated. Step 11. Prepare the pest closing trial balance for the month ended December 31, 20XCX on the Post-Closina Trial Balance tab. 29. Provide the total of the debit column from the Post Closing Trial Balance 30. Provide the balance of the Retained Earnings T-account affer closing entries have been posind. Check Point 2. Total Assets is 25,710 QUESTION 2 31 Does the ending balance of the Retained Earnings haccount agree with the balance of Retained Earnings on the Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts