Question: Prepare journal entries and write down how it affect the accounting equation A=L+C During 2009 , J.D.F. entered into the following transactions. 1. Made credit

Prepare journal entries and write down how it affect the accounting equation A=L+C

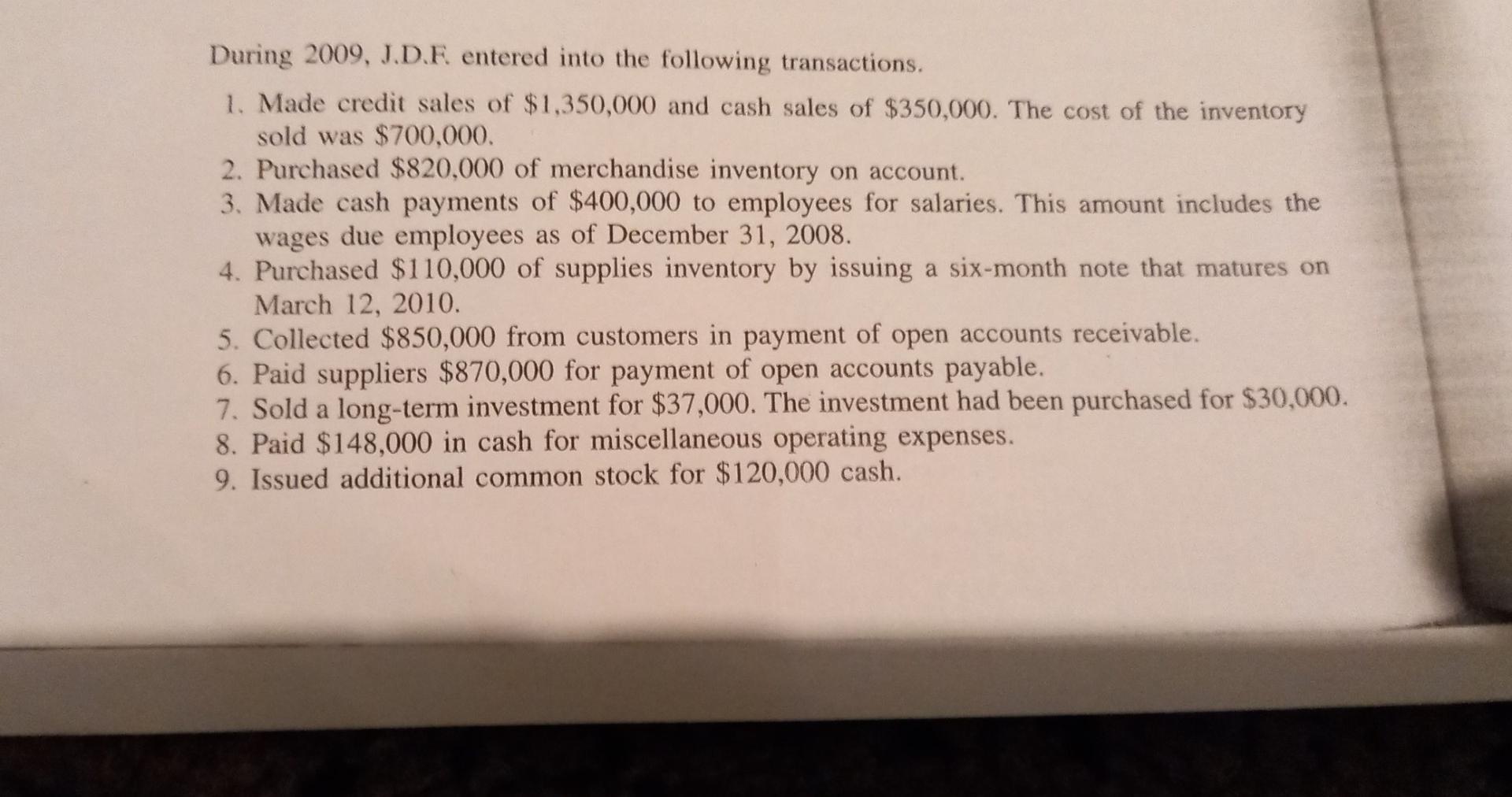

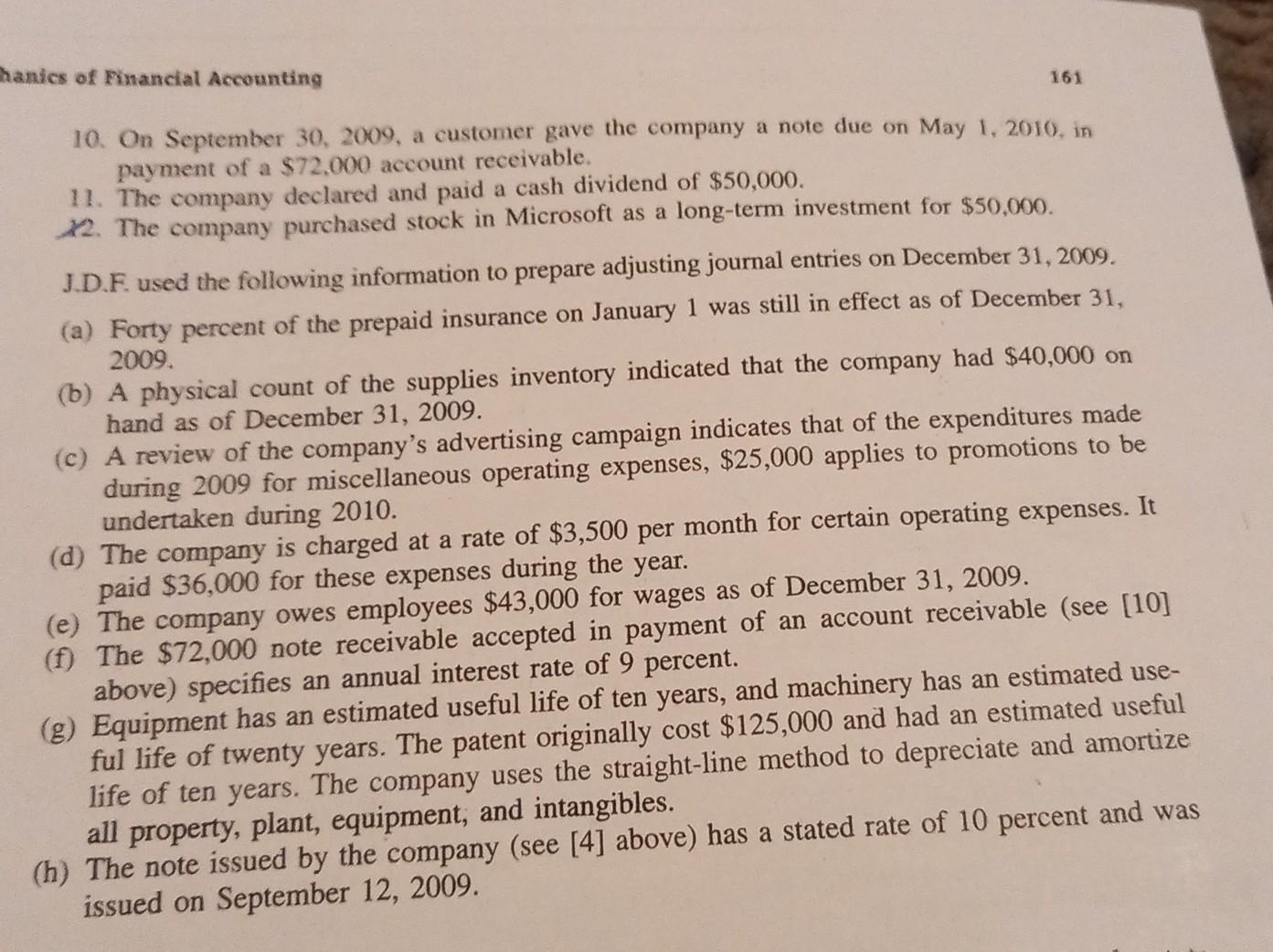

During 2009 , J.D.F. entered into the following transactions. 1. Made credit sales of $1,350,000 and cash sales of $350,000. The cost of the inventory sold was $700,000. 2. Purchased $820,000 of merchandise inventory on account. 3. Made cash payments of $400,000 to employees for salaries. This amount includes the wages due employees as of December 31,2008. 4. Purchased $110,000 of supplies inventory by issuing a six-month note that matures on March 12, 2010. 5. Collected $850,000 from customers in payment of open accounts receivable. 6. Paid suppliers $870,000 for payment of open accounts payable. 7. Sold a long-term investment for $37,000. The investment had been purchased for $30,000. 8. Paid $148,000 in cash for miscellaneous operating expenses. 9. Issued additional common stock for $120,000 cash. Ianics of Financial Accounting 161 10. On September 30, 2009, a customer gave the company a note due on May 1, 2010, in payment of a $72,000 account receivable. 11. The company declared and paid a cash dividend of $50,000. 12. The company purchased stock in Microsoft as a long-term investment for $50,000. J.D.F. used the following information to prepare adjusting journal entries on December 31,2009. (a) Forty percent of the prepaid insurance on January 1 was still in effect as of December 31 , (b) A physical count of the supplies inventory indicated that the company had $40,000 on 2009. (c) A review of the company's advertising campaign indicates that of the expenditures made hand as of December 31,2009. during 2009 for miscellaneous operating expenses, $25,000 applies to promotions to be (d) The company is charged at a rate of $3,500 per month for certain operating expenses. It undertaken during 2010. paid $36,000 for these expenses during the year. (e) The company owes employees $43,000 for wages as of December 31,2009. (f) The $72,000 note receivable accepted in payment of an account receivable (see [10] above) specifies an annual interest rate of 9 percent. (g) Equipment has an estimated useful life of ten years, and machinery has an estimated useful life of twenty years. The patent originally cost $125,000 and had an estimated useful life of ten years. The company uses the straight-line method to depreciate and amortize all property, plant, equipment, and intangibles. (h) The note issued by the company (see [4] above) has a stated rate of 10 percent and was issued on September 12, 2009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts