Question: Prepare journal entries. COMPREHENSIVE PROBLEM Transactions: Dec. 1 Your Dog Walker, Inc. sold 20,000 shares of $1 par value common stock for $20,000 2 3

Prepare journal entries.

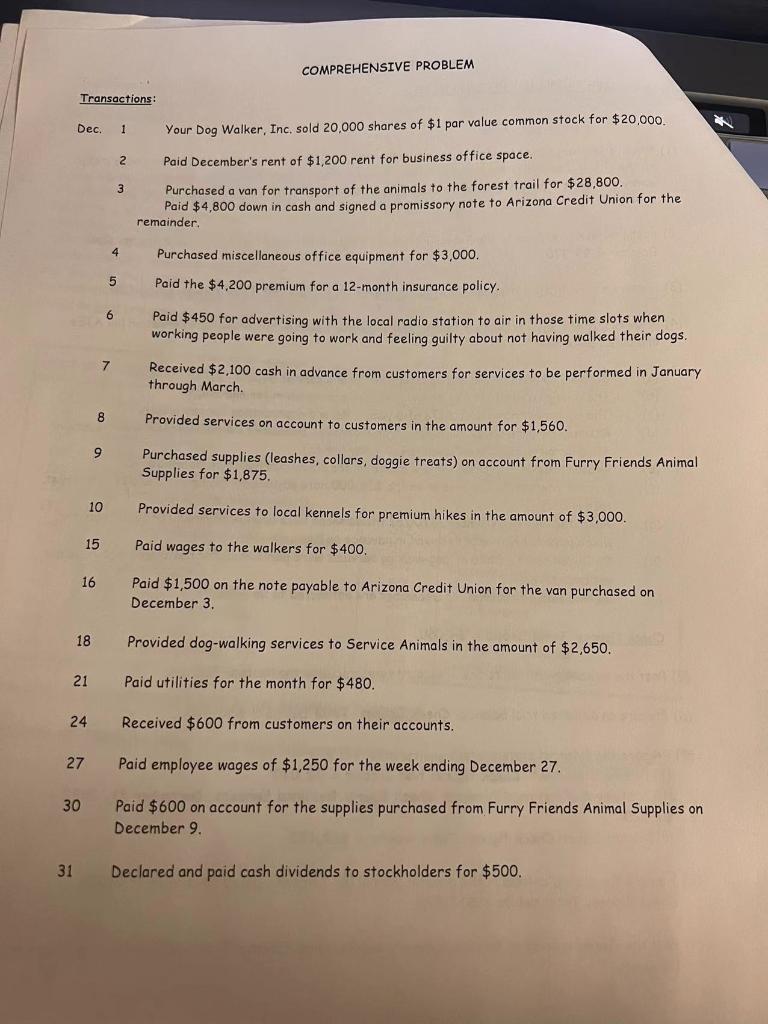

COMPREHENSIVE PROBLEM Transactions: Dec. 1 Your Dog Walker, Inc. sold 20,000 shares of $1 par value common stock for $20,000 2 3 Paid December's rent of $1,200 rent for business office space. Purchased a van for transport of the animals to the forest trail for $28,800. Paid $4,800 down in cash and signed a promissory note to Arizona Credit Union for the remainder 4 Purchased miscellaneous office equipment for $3,000. Paid the $4,200 premium for a 12-month insurance policy. 5 6 Paid $450 for advertising with the local radio station to air in those time slots when working people were going to work and feeling guilty about not having walked their dogs. 7 Received $2,100 cash in advance from customers for services to be performed in January through March. 8 Provided services on account to customers in the amount for $1,560. 9 Purchased supplies (leashes, collars, doggie treats) on account from Furry Friends Animal Supplies for $1,875. 10 Provided services to local kennels for premium hikes in the amount of $3,000. 15 Paid wages to the walkers for $400. 16 Paid $1,500 on the note payable to Arizona Credit Union for the van purchased on December 3. 18 Provided dog-walking services to Service Animals in the amount of $2,650. 21 Paid utilities for the month for $480. 24 Received $600 from customers on their accounts. 27 Paid employee wages of $1,250 for the week ending December 27. 30 Paid $600 on account for the supplies purchased from Furry Friends Animal Supplies on December 9. 31 Declared and paid cash dividends to stockholders for $500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts