Question: Prepare journal entries for the transactions shown below. Make sure to clearly differentiate the debit and credit sides; for example: Equipment , 5 , 0

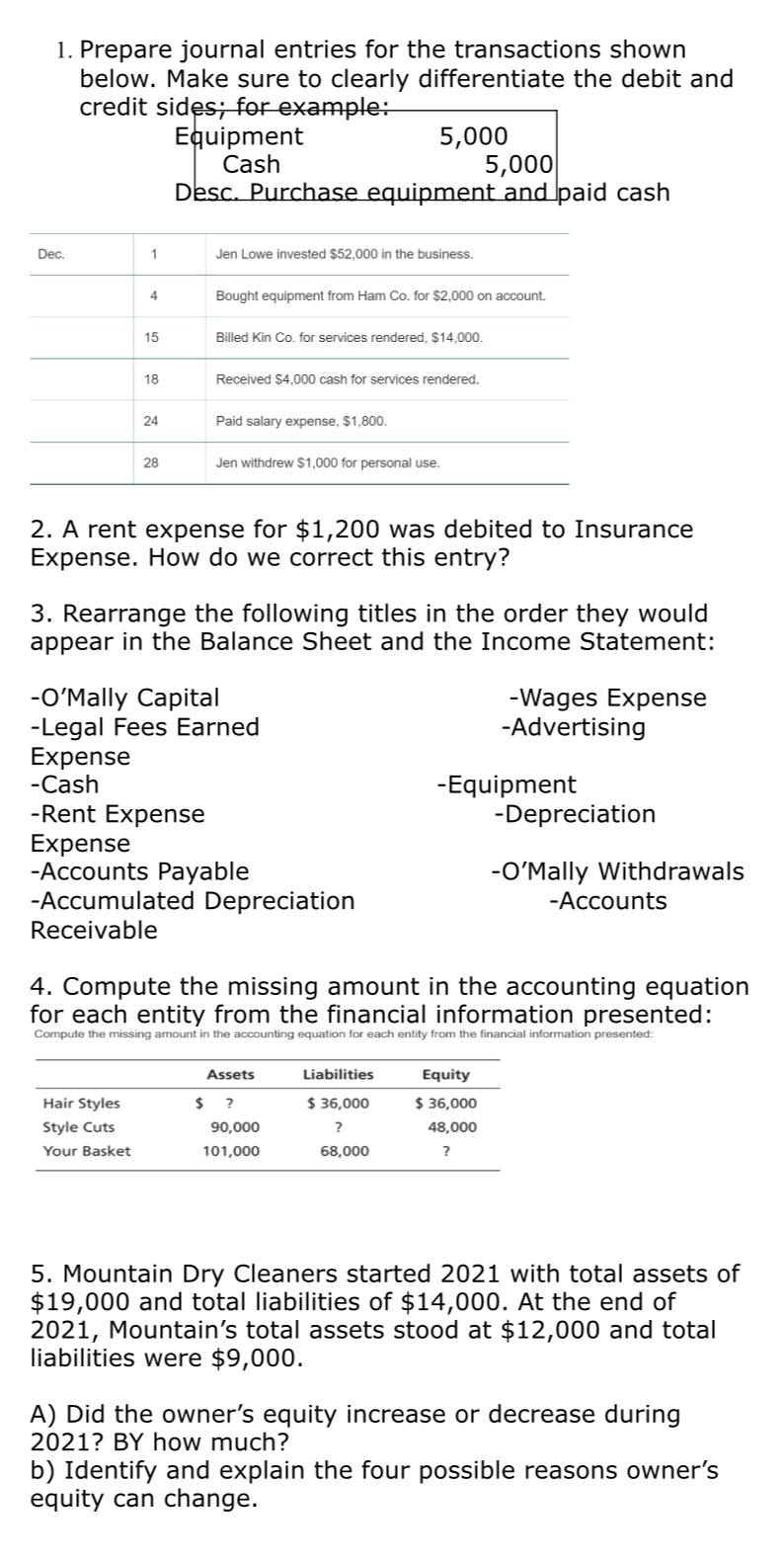

Prepare journal entries for the transactions shown below. Make sure to clearly differentiate the debit and credit sides; for example:

Equipment

Cash

Desc. Purchase equipment and paid cash

tableDecJen Lowe invested $ in the business.Bought equipment from Ham Co for $ on account.,Billed Kin Co for services rendered, $Received $ cash for services rendered.,Paid salary expense, $

A rent expense for $ was debited to Insurance Expense. How do we correct this entry?

Rearrange the following titles in the order they would appear in the Balance Sheet and the Income Statement:

OMally Capital

Legal Fees Earned Expense

Cash

Rent Expense

Expense

Accounts Payable

Accumulated Depreciation Receivable

Wages Expense

Advertising

Equipment

Depreciation

O'Mally Withdrawals

Accounts

Compute the missing amount in the accounting equation for each entity from the financial information presented:

compute the missing amount in the accounting equation for each entity from the financial information presented:

tableAssets,Liabilities,EquityHair Styles,$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock