Question: prepare journal entries to record the initial transaction prepare the adjusting entries required on dec31 assuming crane records adjusting entries manually The following information is

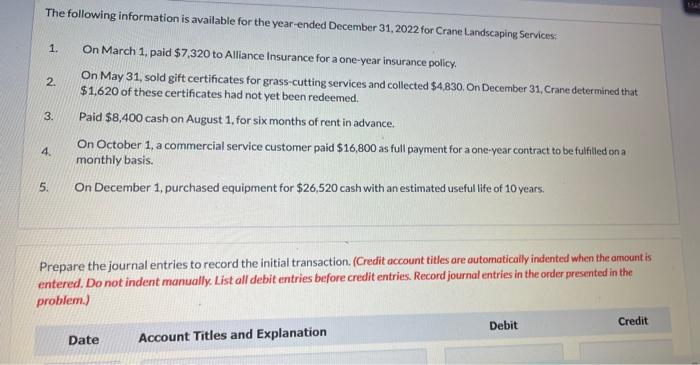

The following information is available for the year-ended December 31, 2022 for Crane Landscaping Services: 1. 2. 3. On March 1, paid $7,320 to Alliance Insurance for a one-year insurance policy. On May 31, sold gift certificates for grass-cutting services and collected $4,830. On December 31, Crane determined that $1,620 of these certificates had not yet been redeemed. Paid $8,400 cash on August 1, for six months of rent in advance. On October 1, a commercial service customer paid $16,800 as full payment for a one-year contract to be fulfilled on a monthly basis. On December 1, purchased equipment for $26,520 cash with an estimated useful life of 10 years, 4. 5 Prepare the journal entries to record the initial transaction. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Debit Credit Date Account Titles and Explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts