The founder of Frenza asks us to assist her in accounting and analysis of the corporations bonds,

Question:

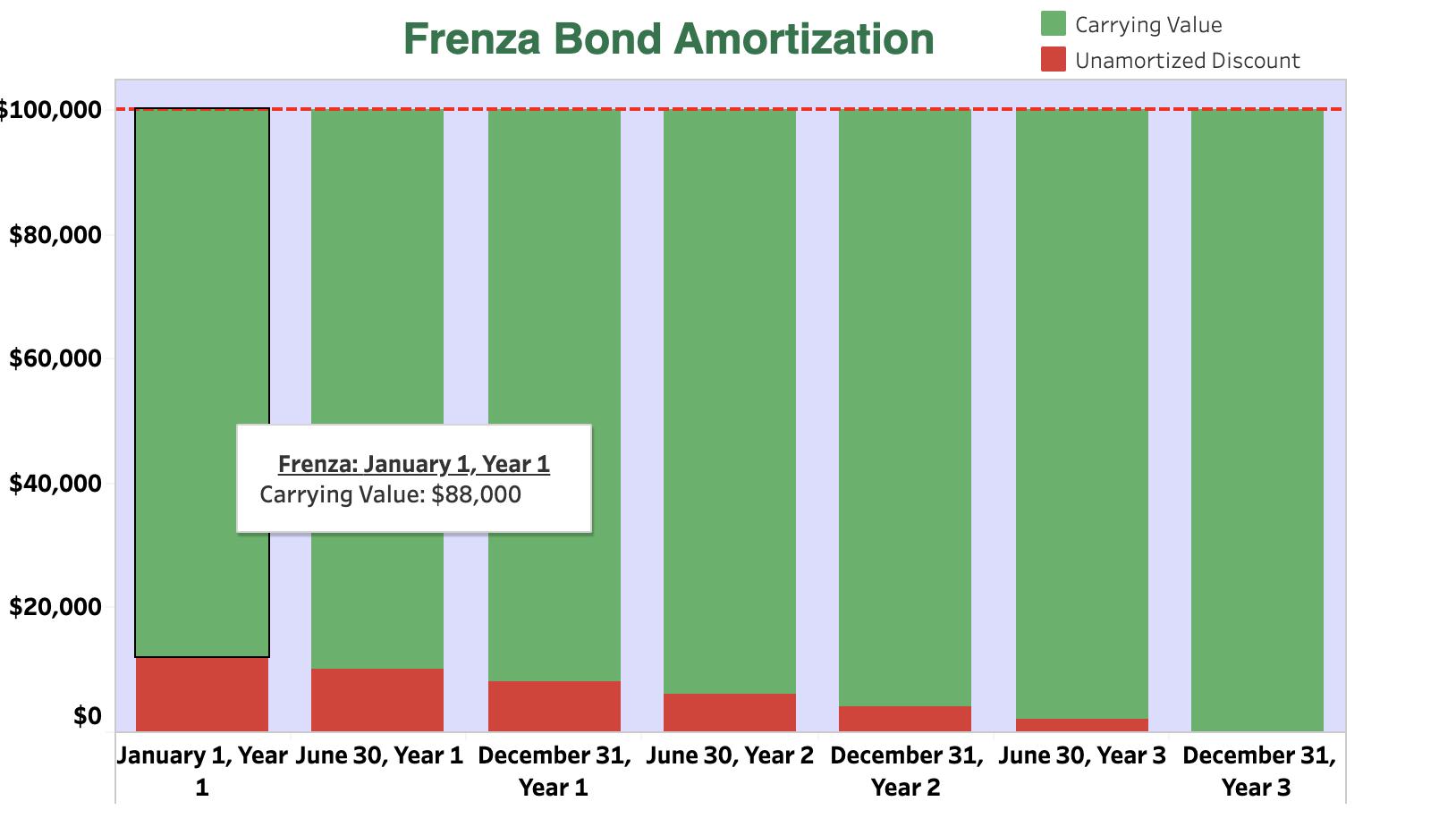

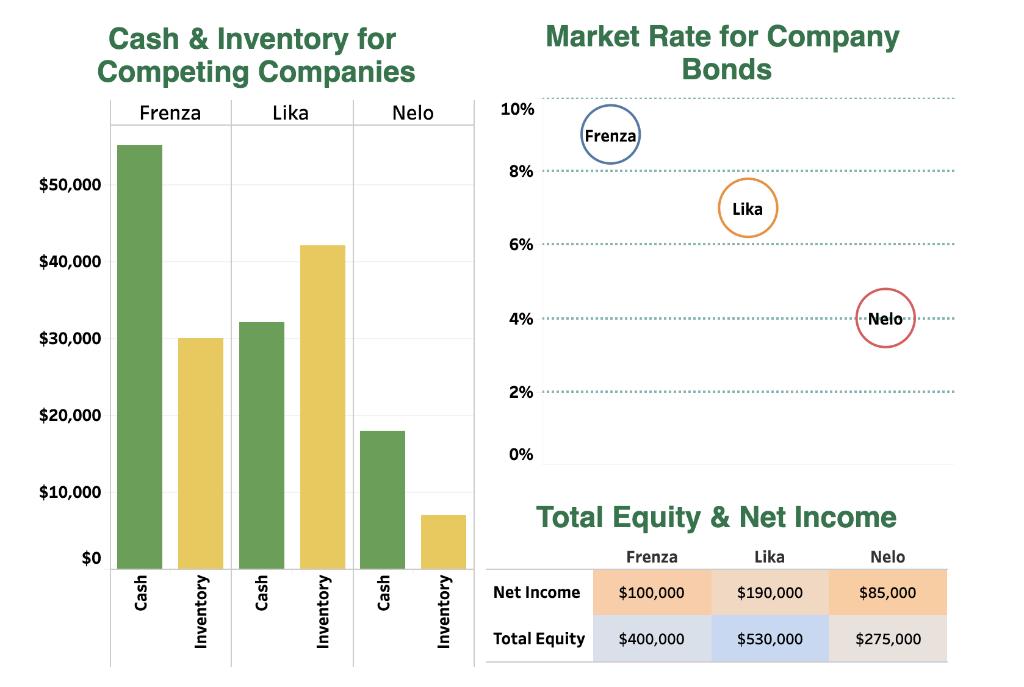

The founder of Frenza asks us to assist her in accounting and analysis of the corporation’s bonds, which have an annual contract rate of 8%. She wants to know the business and accounting implications of further debt issuances as she looks for ways to finance the growth of Frenza. The following Tableau Dashboard is provided to help us address her questions and provide recommendations for her business decisions.

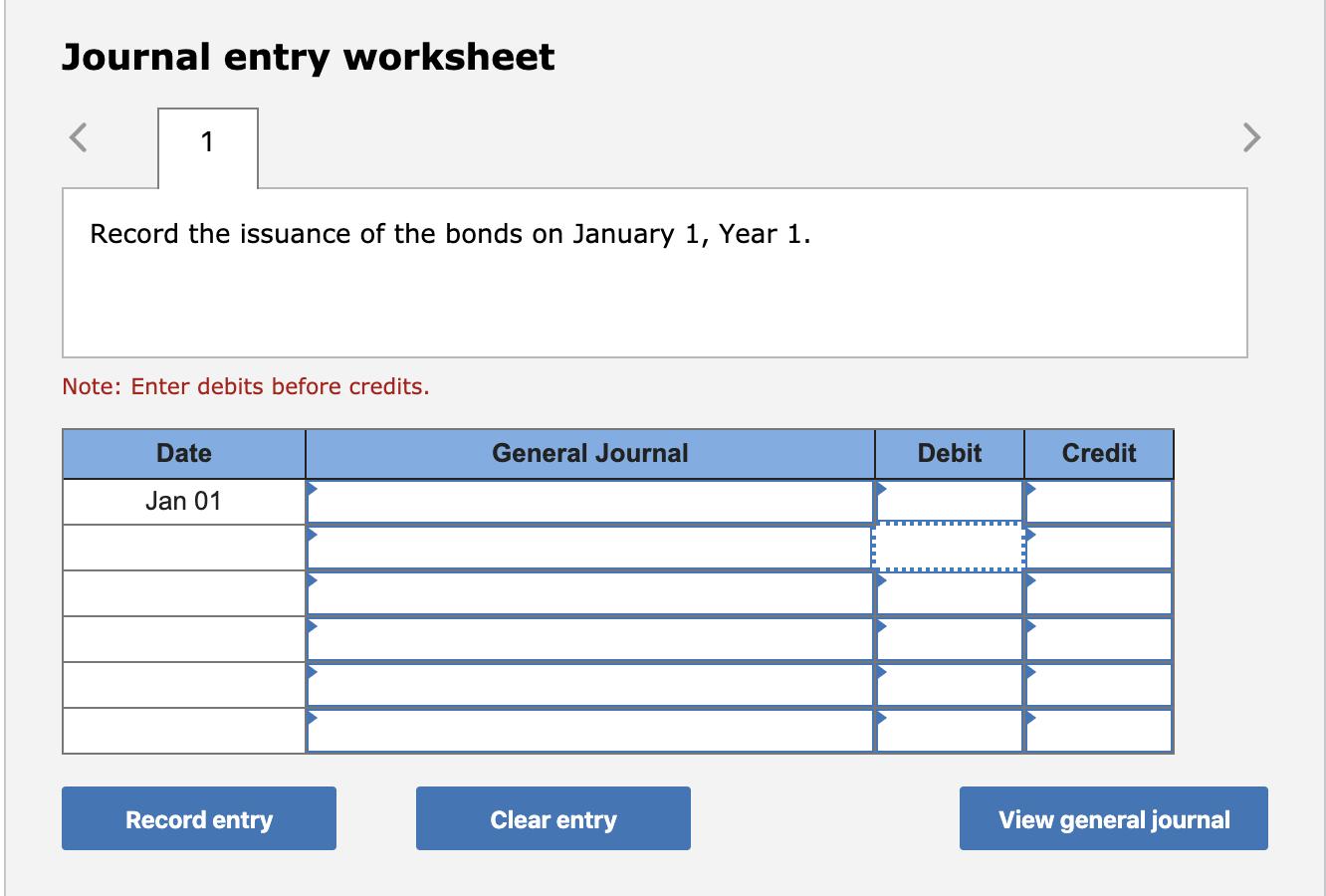

1(a). Prepare journal entries to record the issuance of Frenza bonds on January 1, Year 1.

1(a). Prepare journal entries to record the issuance of Frenza bonds on January 1, Year 1.

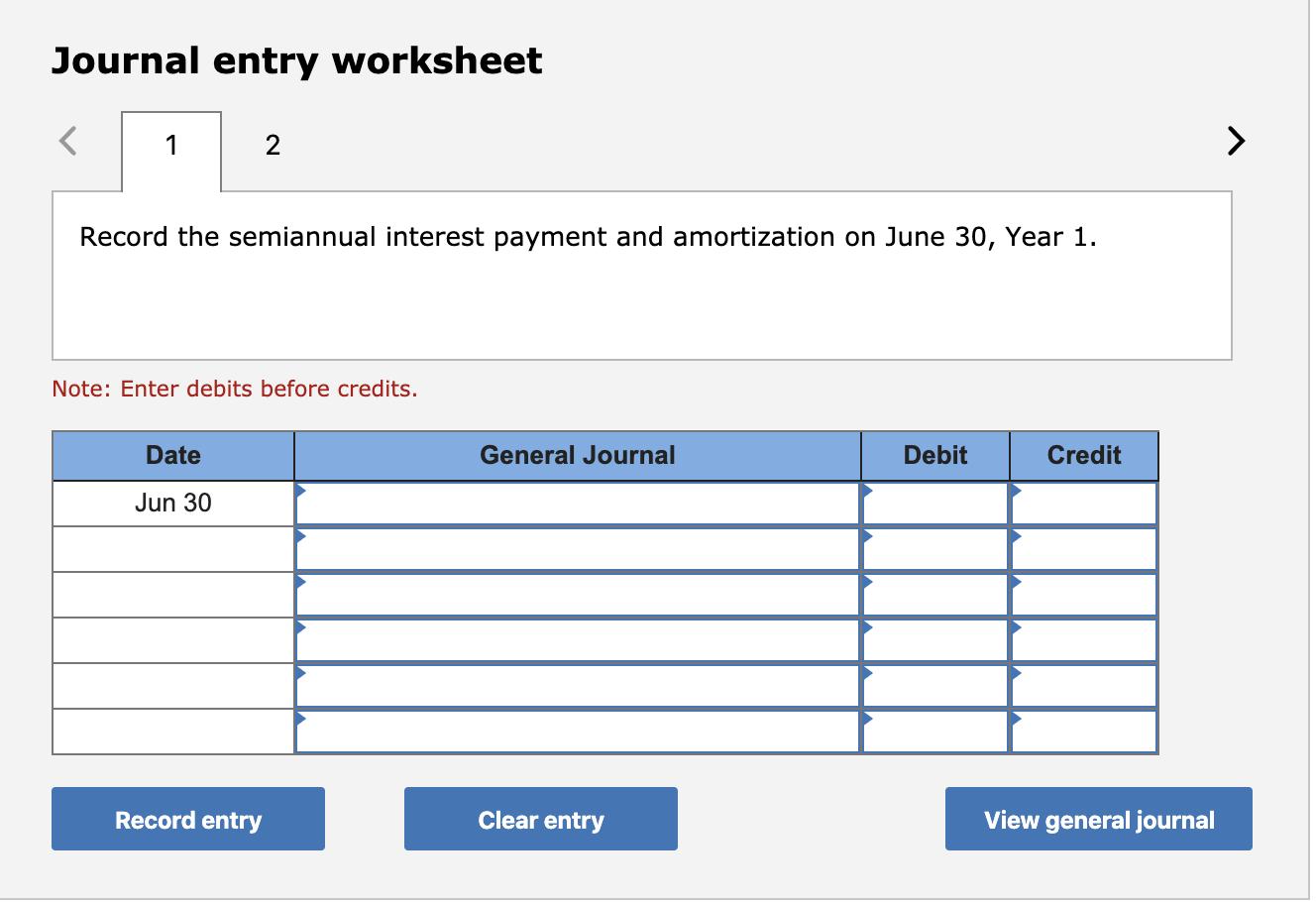

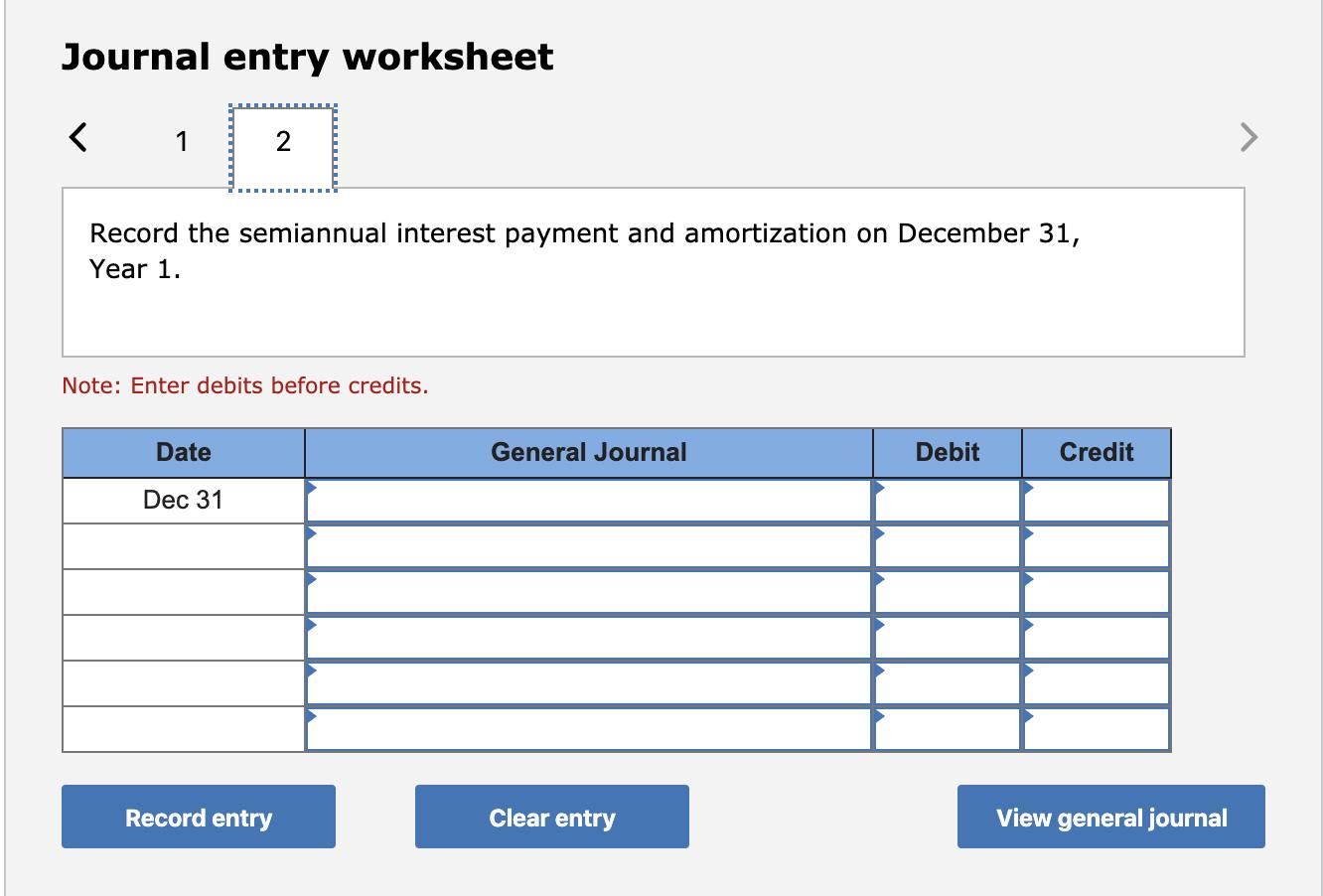

1(b). Prepare journal entries to record the first and second interest payments on June 30, Year 1, and December 31, Year 1.

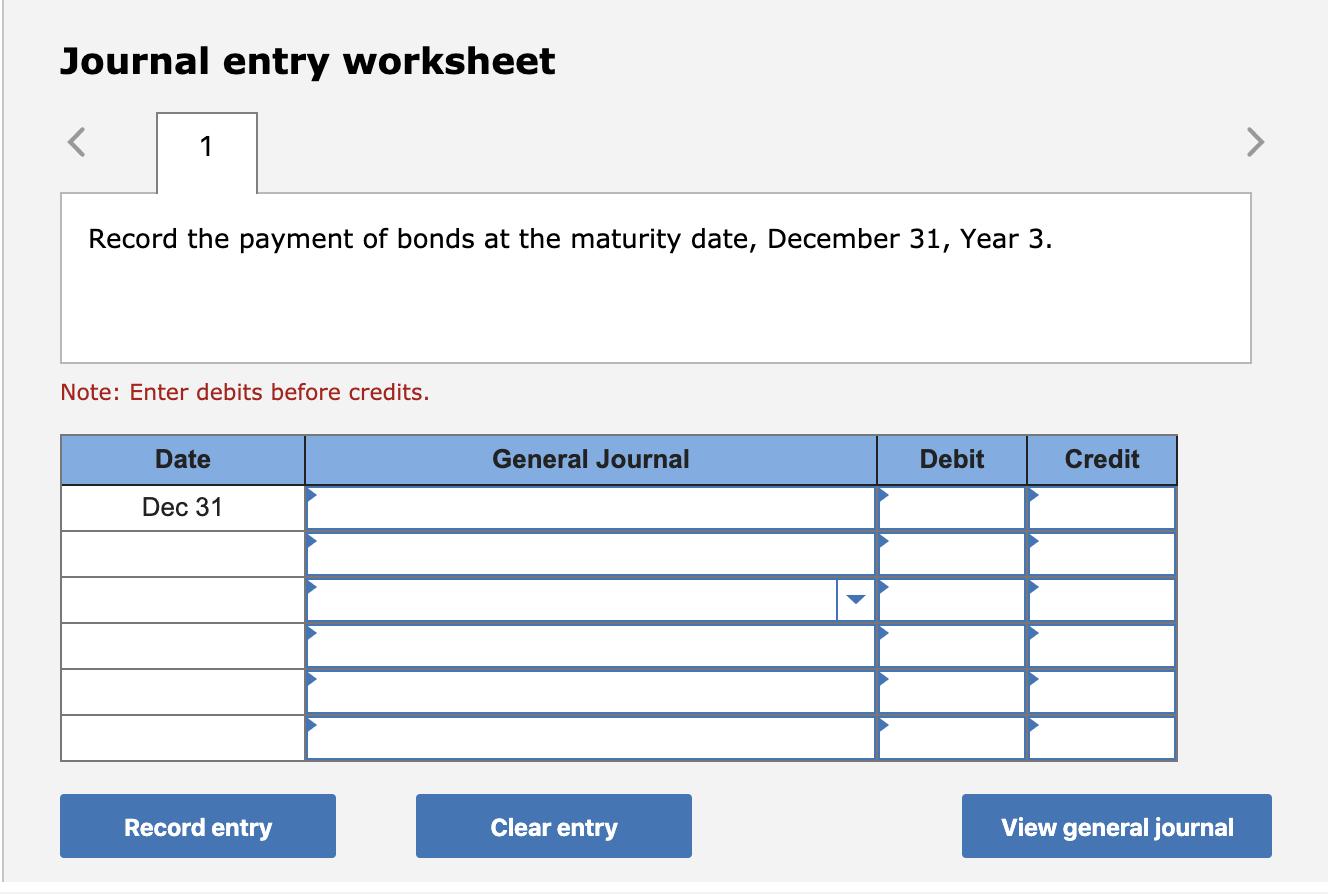

1(c). Prepare journal entries to record the maturity of the bonds on December 31, Year 3.

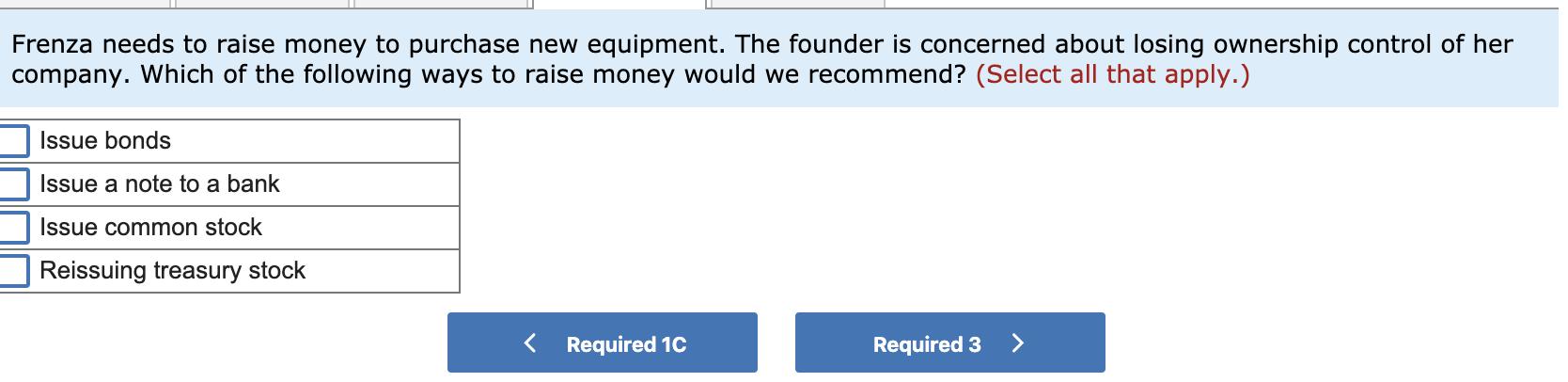

2. Frenza needs to raise money to purchase new equipment. The founder is concerned about losing ownership control of her company. Which of the following ways to raise money would we recommend?

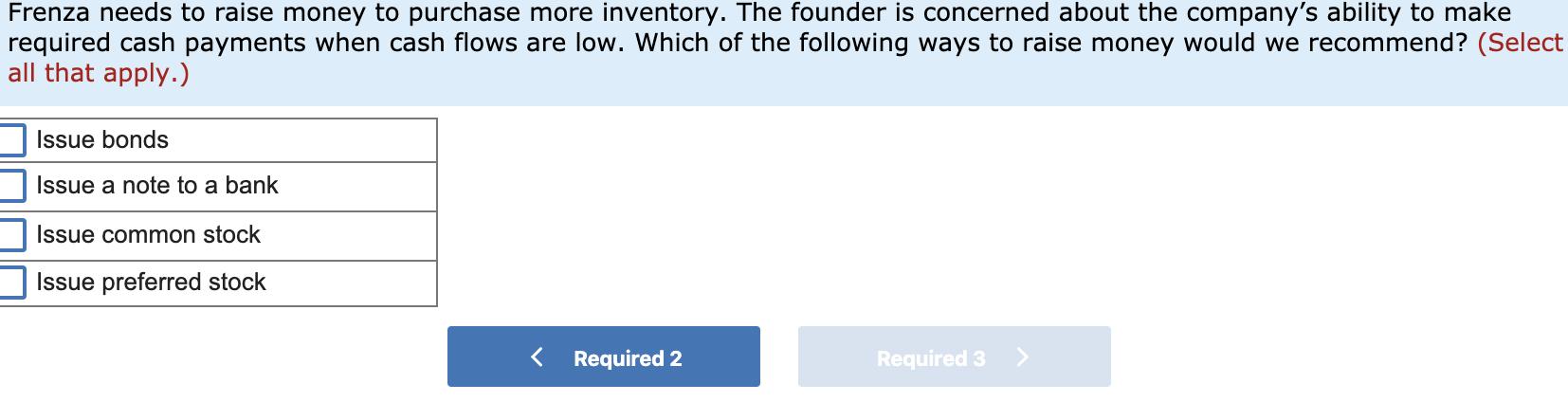

3. Frenza needs to raise money to purchase more inventory. The founder is concerned about the company’s ability to make required cash payments when cash flows are low. Which of the following ways to raise money would we recommend?

options for the journal entries are:

options for the journal entries are:

accounts payable, accounts receivable, accumulated depreciation, bond interest expense, bond interest payable, bonds payable, cash, common stock, contributed capital in excess of par value, depreciation expense, discount on bonds payable, gain on retirement of bonds payable, interest payable, lease liability, leased asset, loss on retirement of bonds payable, premium on bonds payable, the premium on bonds payable, rental expense

Fundamental Accounting Principles

ISBN: 978-0078110870

20th Edition

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta