Question: prepare journal entries View Policies Current Attempt in Progress The following transactions were recorded by an inexperienced bookkeeper during the months of June and July

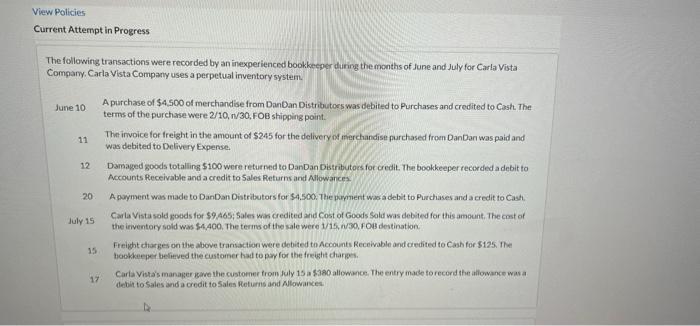

View Policies Current Attempt in Progress The following transactions were recorded by an inexperienced bookkeeper during the months of June and July for Carla Vista Company. Carla Vista Company uses a perpetual inventory system June 10 11 12 20 A purchase of $4.500 of merchandise from Dan Dan Distributors was debited to purchases and credited to Cash. The terms of the purchase were 2/10, 1/30, FOB shipping point The invoice for freight in the amount of $245 for the delivery of merchandise purchased from DanDon was paid and was debited to Delivery Expense. Damaped goods totalling 5100 wore returned to DanDan Distributors for credit. The bookkeeper recorded a debit to Accounts Receivable and a credit to Sales Returns and Allowances Apayment was made to Dan Dan Distributors for $4.500. The pupment was a debit to Purchases and a credit to Cash. Carla Vista solet goods for $9.465 Salles was credited and cost of Goods Sold was dobited for this amount, The cost of the inventory sold was $4,400. The terms of the sale were 1/15.6/30, FOB destination Freight charges on the above transaction were debited to Accounts Receivable and credited to Cash for $125. T hookkeeper believed the customer had to pay for the freight charges Carla Vista's manager gave the customer from July 15 a $380 allowance. The entry made to record the allowance was a debit to Sales and a credit to Sales Returns and Allowances July 15 15 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts