Question: prepare journal entry Using the information from question 15 along with the following: The employer payroll taxes for Cowboy Company include FICA taxes, federal unemployment

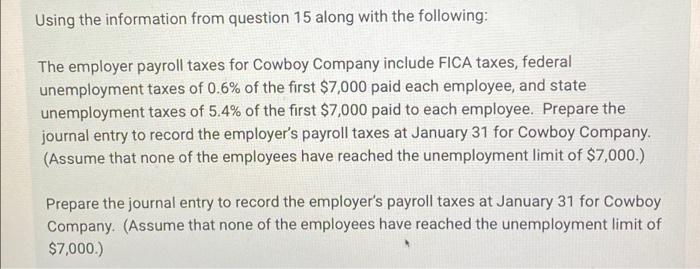

Using the information from question 15 along with the following: The employer payroll taxes for Cowboy Company include FICA taxes, federal unemployment taxes of 0.6% of the first $7,000 paid each employee, and state unemployment taxes of 5.4% of the first $7,000 paid to each employee. Prepare the journal entry to record the employer's payroll taxes at January 31 for Cowboy Company. (Assume that none of the employees have reached the unemployment limit of $7,000.) Prepare the journal entry to record the employer's payroll taxes at January 31 for Cowboy Company. (Assume that none of the employees have reached the unemployment limit of $7,000.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts