Question: Prepare NPV analysis in an Excel spreadsheet using the assumptions provided by Roberts and Kelly. You will need to determine the net anticipated cash flows

- Prepare NPV analysis in an Excel spreadsheet using the assumptions provided by Roberts and Kelly.

You will need to determine the net anticipated cash flows for the Hideaway to complete this

anal.

- Given there could be uncertainty surrounding the assumptions, prepare sensitivity analysis on your calculation for Option 2 (full investment) by changing 2 of the assumptions. Include a note explaining what assumption you adjusted and why. Include it in the same workbook and title the

worksheet "Sensitivity"

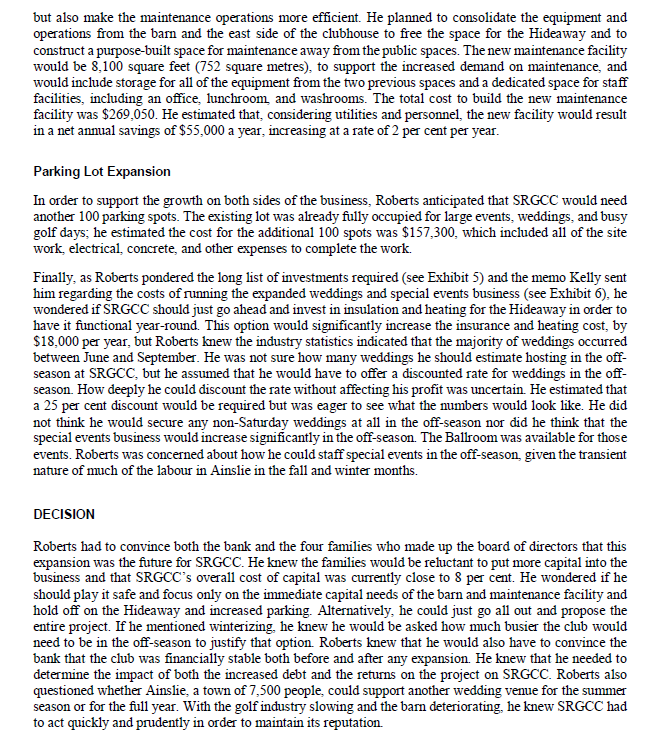

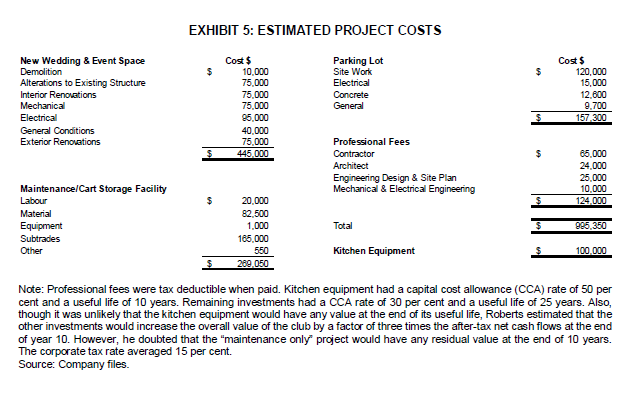

\f\fEXHIBIT 5: MEMO FROM ANNE KELLY RE COSTING To: Jordan Roberts General Manager From: Anne Kelly, Director of Special Events Re: The Hideaway Projected (lists Hi Jordan. I've spoken with my team and here's what we're thinking. Based on our current weddings held in the Ballroom, we're comlortable with my original estimate that 65 per cent of all functions will be sitdown meals and the remaining oocktail functions I know we've estimated our capacity as 210 and 250, respectively, for these two types ol events, and I certainly see our events almost always at capacity in the Ballroom cunenliy. I think we're okay estimating full capacity. By the way, we've included some projected revenues for other events. Just a reminder that these events typicdly are rental inoorne onlythat is, we don't provide any food or alcohol at those events. As you know, it's much more expensive to serve a lull med. I've checked with the chef and, based on our current offerings, Ithinkwe can estimate using our current full meal oost of$25 per person. Cocktails and appetizers are, of course, lees expensive, and | th'nk we're safe to say $8.00 there per person. I would assume a rate of increase of 2 per cent on these costssimilar to our expected pricing increases And just a reminder that we shouldn't have to factor in alcohol as we permit our clients to bring in their own wine, beer, and spirits. Based on howwe currently stalfthe Bdlroom events, I estimate that we'll need 14 serving staff members per event. I typically have the staff here for setup through to teardow'n, which usually means a 12hour shift. Cunent hourly rates are, on average, $15.50, but we should count on a 2 per cent increase on this rate. Plus, lknmv the Ontario government has been talking about increasing minimum hourly rates I'm not sure howthat will impact all ofthe business here at SRGCC. I'm assuming we'll see increases in our insurance and utilities bills with this expansion. Without heal, we'll just be paying tor power, and so I'm guessing that the utility bill increase will befairly minor, say $15,000. Insurancel asked our broker. She's suggested we think about $25,000 {total} as a likely increase for both property and liability coverage. Both of these will likely increase at a 2 per cent rate as well. I'm alm thinking that we'll need to increase our supplies of linens, oerernony chairs, etc. in orderto have enough inventory on hand for the extra functions. I think we should count on spending $10,000 on these sorts of supplies. Finally, between myself and our manager of weddings and events we think we can manage the extra workload, though I believe the Hideaway will take up 410 per cent ofour manager's time. Her current total compensation is $65,000, asyou know. This is exciting! Let me know if I've nissed anything. Anne Source: arm by case writers. The Hideaway Roberts and Kelly named the converted maintenance facility-the potential new venue space-the Hideaway to differentiate it from the existing Ballroom In order to operate both spaces at the same time, Roberts knew they needed to expand the existing kitchen and create access from the kitchen to both spaces and purchase an additional $100,000 in kitchen equipment. Further, a grand entrance to the space was needed as well as outdoor space for cocktail receptions overlooking the golf course. Other renovations to the current space included washroom additions, a bridal suite, and a generator to provide back-up power for both the Ballroom and the Hideaway (see Exhibit 4). Roberts estimated that the renovations to transform the maintenance facility into the Hideaway would be $445,000. To keep the renovation and operating costs of the space lower and to add to the industrial feel, the Hideaway renovations would not include insulating or heating the space for winter use. Therefore, Roberts and Kelly planned to host weddings in the space during the peak wedding season and the warmer months-from May through to October. Estimated sales per wedding would be slightly higher than the current averages for the Ballroom at $13,500 for Saturday weddings and $10,500 for Sunday to Friday weddings, as the Hideaway would have a capacity of 210 guests for a seated meal or 250 guests for a standing cocktail reception; the Ballroom had a capacity of 180 guests seated and 200 standing. Kelly estimated that 65 per cent of the weddings and special events would be seated meals and the remaining 35 per cent standing cocktail receptions. Kelly predicted that, in 2017, the Hideaway would host 15 Saturday weddings, at $13,500 each, and another three weddings on other days of the week, at $10,500 each. Since the Ballroom was already nearly sold out for prime dates in the 2017 wedding season, Kelly was confident the club could achieve this projection based on the waiting list and number of potential clients who had already been turned away. By the second year of operating both spaces, Kelly projected the Hideaway would host 18 Saturday and five non-Saturday weddings. Finally, in 2019, the Hideaway would host the full capacity of 21 Saturday weddings and another seven non-Saturday weddings. Each year, Kelly planned to increase the price per wedding by 2 per cent. In addition to weddings, Kelly estimated other opportunities to rent out the space would generate an additional $15,000 in revenue in 2017, $25,000 in 2018, and $35,000 in 2019. Again, she estimated a steady increase thereafter of 2 per cent. Kelly also recognized that, to deliver two weddings at the same time, the number of kitchen and wait staff would have to increase significantly, and both wedding timelines would have to be perfectly aligned to keep the kitchens running smoothly. Staffing the now-double wedding operation would be a challenge in such a small town. She expected to be able to hire temporary foreign workers to help with the kitchen and service requirements of the peak season. However, Kelly and Roberts would have to research how this process worked and consult with the board about this plan. New Maintenance Facility Roberts knew that if the current maintenance space were to be converted into a wedding venue, the club would be short on room for its maintenance work. SRGCC had two separate spaces for maintenance facilities and storage. The east side of the clubhouse was primarily used for summer operations such as golf carts and off-season storage of equipment. The second space was an aging barn that was used for off-season storage and seasonal material storage such as fertilizer, mulch, lawn tractors, and bunker rakes. The barn was well beyond its useful life and needed to be replaced; Roberts felt this might be the optimal time to review how to make the best use of a capital outlay to not only house maintenance activities and equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts