Question: prepare Payroll Journal Entries please I have the solution . I will attach along with solution if needed . PAYROLL FINAL PROBLEM 1.) Employee Name:

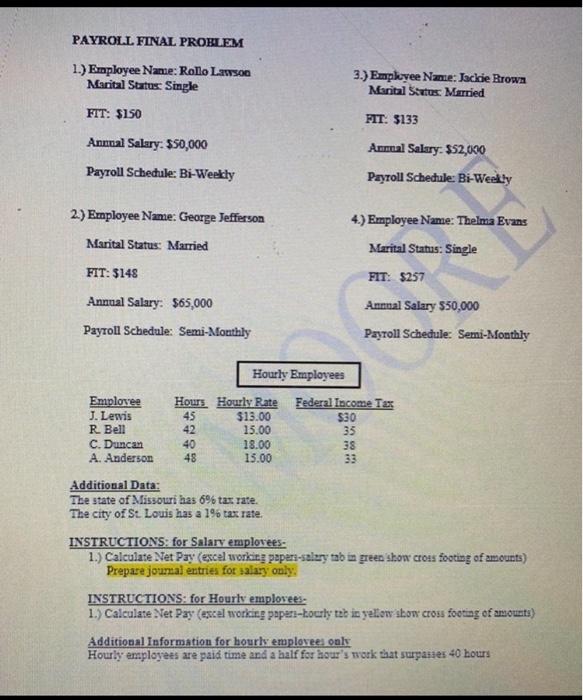

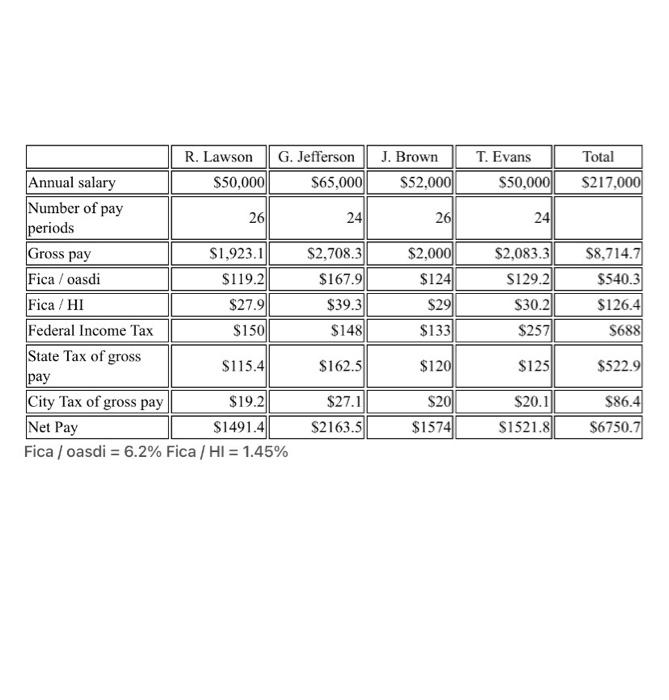

PAYROLL FINAL PROBLEM 1.) Employee Name: Rolo Lawson Marital Status: Single 3.) Employee Nante: Jackie Brown Marital Sextus: Married FTT: $150 PIT. $133 Annual Salary: $50,000 Annual Salary: $52,000 Payroll Schedule: Bi-Weekly Payroll Schedule: Bi-Weekly 2.) Employee Name: George Jefferson Marital Status: Married FIT: $148 4.) Employee Name: Thelma Evans Marital Status: Single FIT: $257 Annual Salary 550,000 Payroll Schedule: Semi-Monthly Annual Salary: $65,000 Payroll Schedule: Semi-Monthly Hourly Employees Employee J. Lewis R Bell C. Duncan A. Anderson Hours Hourly Rate 45 $13.00 42 15.00 40 18.00 48 15.00 Federal Income Tax $30 35 38 33 Additional Data: The state of Missouri has 6% tax rate. The city of St Louis has a 19 tax rate. INSTRUCTIONS: for Salary emplovees- 1.) Calculate Net Pay (excel working Papers-salary tab in green show cross footing of amounts) Prepare journal entries for salary only INSTRUCTIONS: for Hourly employees 1.) Calculate Net Pay (excel working Papers-kourly tab in yellow show cross footing of amounts) Additional Information for hourly emplovees only Hourly employees are paid time and a half for hour's work that surpasses 40 hours J. Brown $52,000 T. Evans $50,000 Total $217,000 26 24 Gross pay $2,000 $124 R. Lawson G. Jefferson Annual salary $50,000 $65,000 Number of pay 26 24 periods $1,923.1 $2,708.3 Fica/oasdi $119.2 $167.9 Fica/HI $27.9 $39.3 Federal Income Tax $150 $148 State Tax of gross $115.4 $162.5 pay City Tax of gross pay $19.20 $27.1 $1491.4 S2163.5 Fica / oasdi = 6.2% Fica / HI = 1.45% $2,083.3 S129.2 $30.2 $257 $8,714.7 $540.3 $126.4 $688 $29 $133 $120 $125 $522.9 $20 $20.1 S1521.8 $86.4 $6750.7 Net Pay $1574 PAYROLL FINAL PROBLEM 1.) Employee Name: Rolo Lawson Marital Status: Single 3.) Employee Nante: Jackie Brown Marital Sextus: Married FTT: $150 PIT. $133 Annual Salary: $50,000 Annual Salary: $52,000 Payroll Schedule: Bi-Weekly Payroll Schedule: Bi-Weekly 2.) Employee Name: George Jefferson Marital Status: Married FIT: $148 4.) Employee Name: Thelma Evans Marital Status: Single FIT: $257 Annual Salary 550,000 Payroll Schedule: Semi-Monthly Annual Salary: $65,000 Payroll Schedule: Semi-Monthly Hourly Employees Employee J. Lewis R Bell C. Duncan A. Anderson Hours Hourly Rate 45 $13.00 42 15.00 40 18.00 48 15.00 Federal Income Tax $30 35 38 33 Additional Data: The state of Missouri has 6% tax rate. The city of St Louis has a 19 tax rate. INSTRUCTIONS: for Salary emplovees- 1.) Calculate Net Pay (excel working Papers-salary tab in green show cross footing of amounts) Prepare journal entries for salary only INSTRUCTIONS: for Hourly employees 1.) Calculate Net Pay (excel working Papers-kourly tab in yellow show cross footing of amounts) Additional Information for hourly emplovees only Hourly employees are paid time and a half for hour's work that surpasses 40 hours J. Brown $52,000 T. Evans $50,000 Total $217,000 26 24 Gross pay $2,000 $124 R. Lawson G. Jefferson Annual salary $50,000 $65,000 Number of pay 26 24 periods $1,923.1 $2,708.3 Fica/oasdi $119.2 $167.9 Fica/HI $27.9 $39.3 Federal Income Tax $150 $148 State Tax of gross $115.4 $162.5 pay City Tax of gross pay $19.20 $27.1 $1491.4 S2163.5 Fica / oasdi = 6.2% Fica / HI = 1.45% $2,083.3 S129.2 $30.2 $257 $8,714.7 $540.3 $126.4 $688 $29 $133 $120 $125 $522.9 $20 $20.1 S1521.8 $86.4 $6750.7 Net Pay $1574

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts