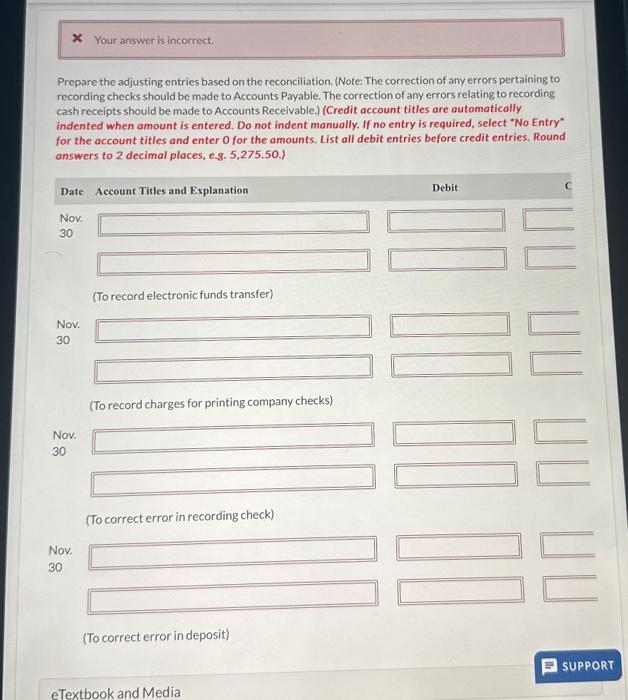

Question: Prepare the adjusting entries based on the reconciliation. (Note: The correction of any errors pertaining to recording checks should be made to Accounts Payable. The

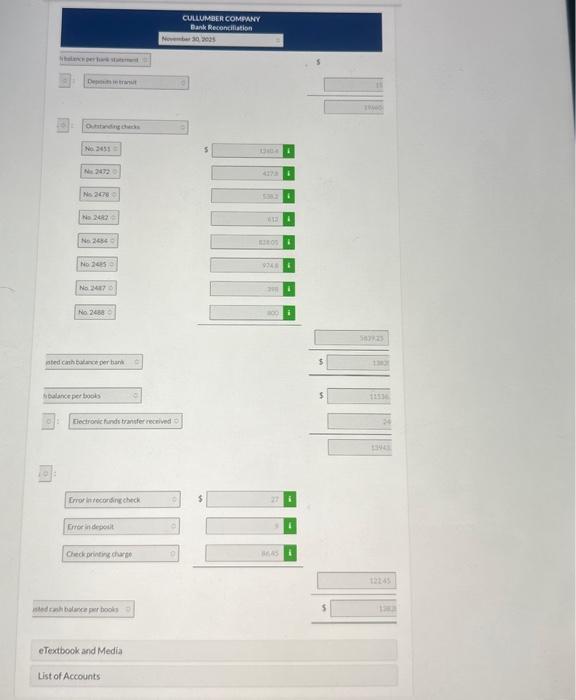

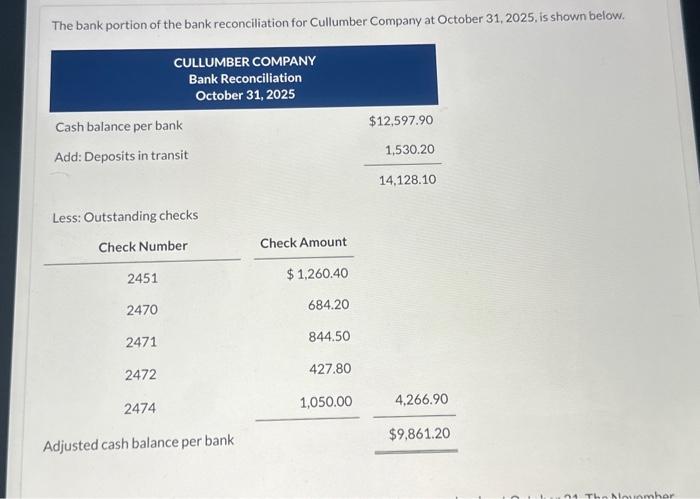

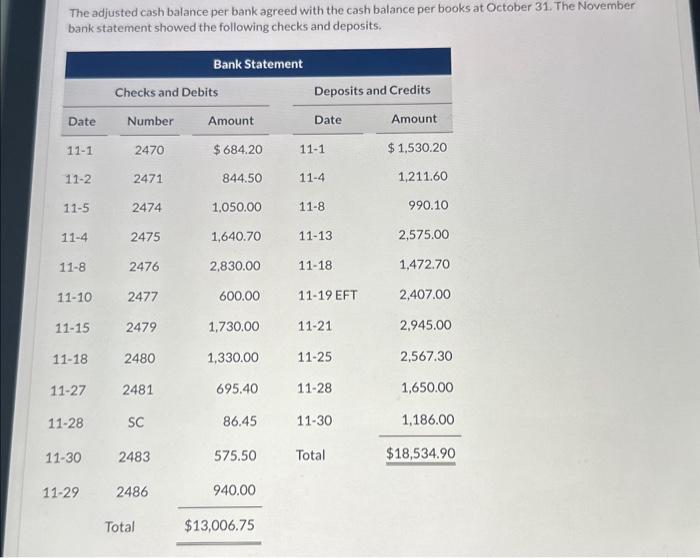

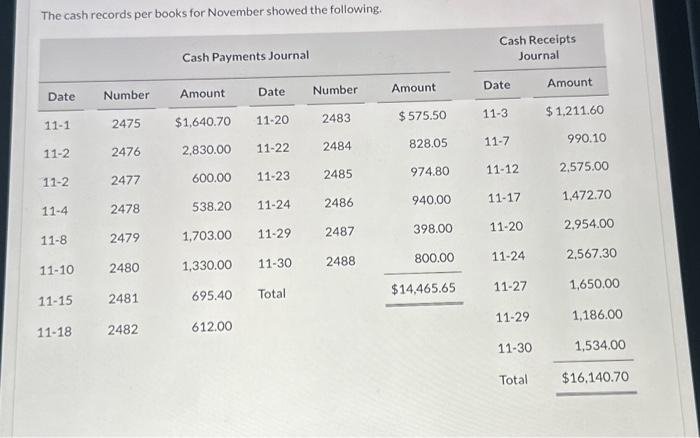

Prepare the adjusting entries based on the reconciliation. (Note: The correction of any errors pertaining to recording checks should be made to Accounts Payable. The correction of any errors relating to recording cash receipts should be made to Accounts Receivable) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. List all debit entries before credit entries. Round answers to 2 decimal places, e.8. 5,275.50.) The bank portion of the bank reconciliation for Cullumber Company at October 31,2025, is shown below. The adjusted cash balance per bank agreed with the cash balance per books at October 31 . The November bank statement showed the following checks and deposits. The cash records per books for November showed the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts