Question: prepare the adjusting entries that are made help needed question above The trial balances before and after adjustment for Cullumber Company at the end of

help needed question above

help needed question above

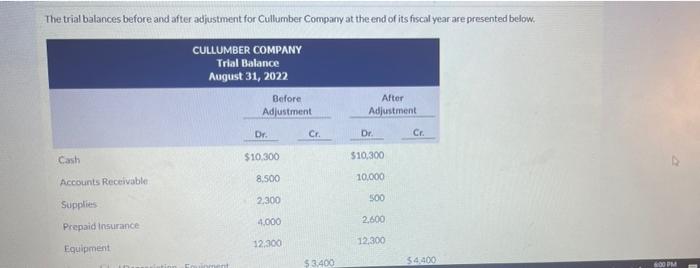

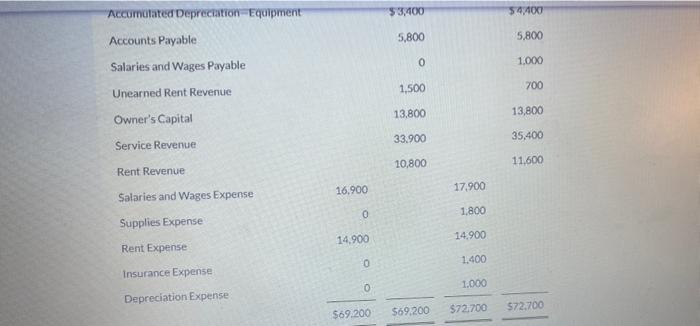

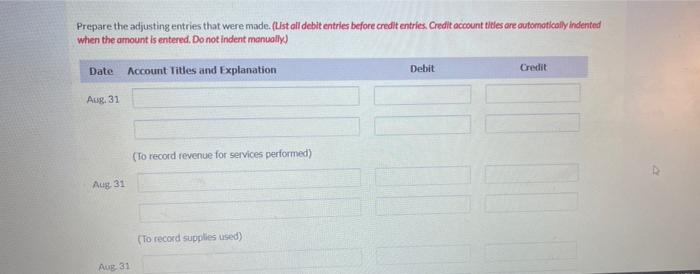

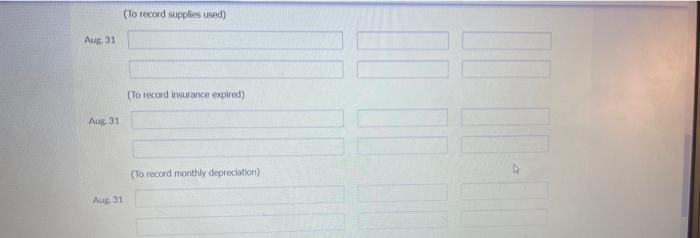

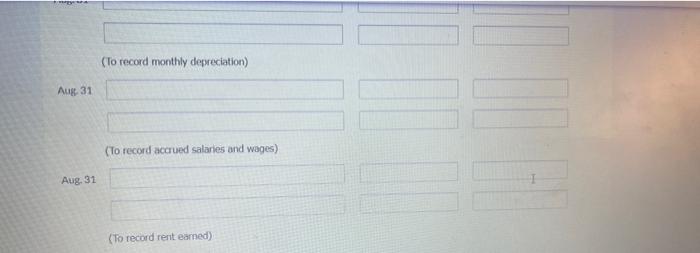

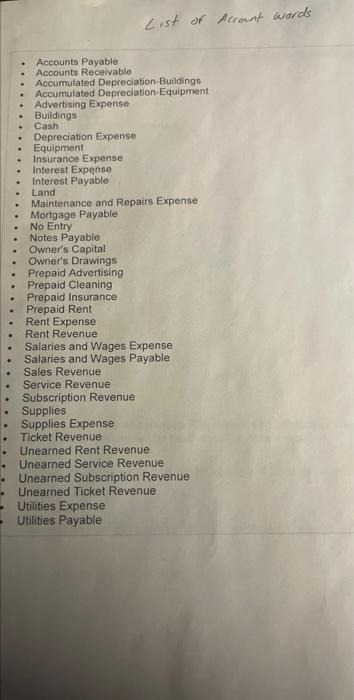

The trial balances before and after adjustment for Cullumber Company at the end of its fiscal year are presented below. CULLUMBER COMPANY Trial Balance August 31, 2022 Before Adjustment After Adjustment Dr. Cr Dr. Cr. $10.300 Cashi $10,300 Accounts Receivable 8.500 10,000 2.300 500 Supplies Prepaid Insurance 4.000 2,600 Equipment 12.300 12.300 $3.400 54.400 $3,400 54700 Accumulated Depreciation Equipment Accounts Payable 5,800 5,800 0 Salaries and Wages Payable 1.000 1,500 700 13,800 13,800 Unearned Rent Revenue Owner's Capital Service Revenue 33.900 35,400 10.800 11.600 Rent Revenue 16.900 17.900 Salaries and Wages Expense 0 1.800 Supplies Expense 14.900 14.900 Rent Expense 0 1.400 Insurance Expense 0 1.000 Depreciation Expense $69.200 $69.200 $722700 $72,700 Prepare the adjusting entries that were made (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 31 (To record revenue for services performed) Aug 31 (To record supplies used) Aug 31 (To record supplies used) Aug 31 (To record insurance expired) Aug 31 (To record monthly depreciation) Aug. 31 (To record monthly depreciation) Aug 31 (To record accrued salaries and wages) Aug. 31 (To record rent earned) List of Account words . . - . Accounts Payablo Accounts Receivable Accumulated Depreciation Buildings Accumulated Depreciation Equipment Advertising Expense Buildings Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Land Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Advertising Prepaid Cleaning Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Subscription Revenue Supplies Supplies Expense Ticket Revenue Unearned Rent Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue Utilities Expense Utilities Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts